[ad_1]

Bitcoin’s price is down roughly 70% from its latest all-time high, and the mining sector is feeling the full weight of the ongoing bear market. Lots of fear, uncertainty and doubt (FUD) often spread far and wide about miners during bear markets, but the data about how these operators are affected and behave in this environment is simple. This article outlines six key data sets that illustrate the effects of the bear market on bitcoin miners and their operations.

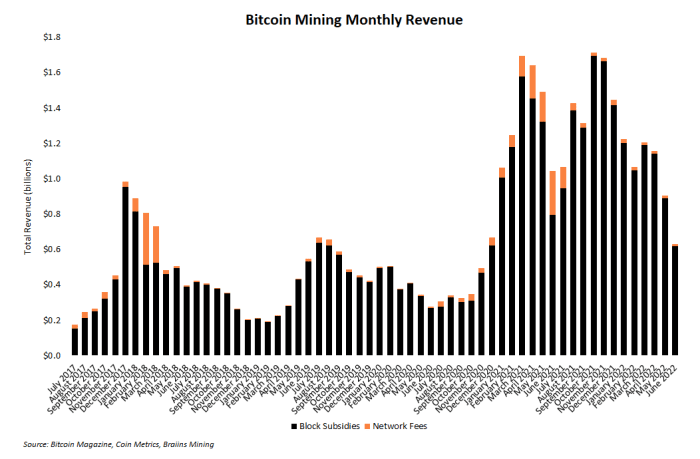

Monthly dollar-denominated revenue is a hallmark metric that signals the state of the mining sector. In bearish market conditions, miners expect revenue to drop, and the below bar chart illustrates this is exactly what is happening. Primarily this metric is falling because of a cheaper bitcoin price quoted in dollars. In fact, monthly mining revenue in June is set to record its lowest level in 18 months. From August 2021 to April 2022, moreover, miners enjoyed a comfortable nine-month streak of at least $1 billion in total sector-wide revenue. May ended that streak, and revenue continues dropping in June.

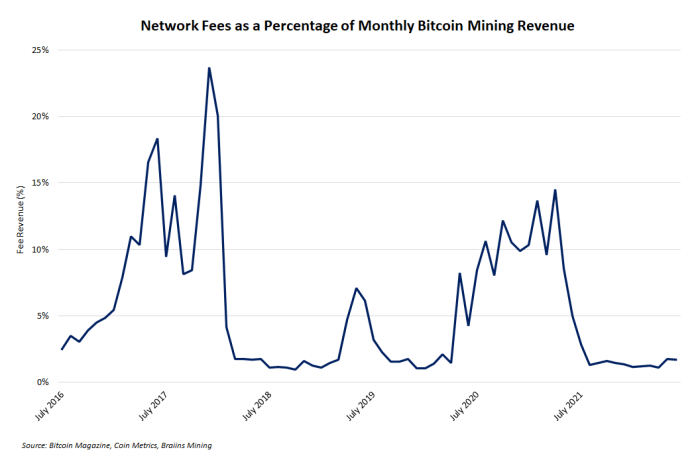

Digging deeper into mining revenue, transaction fees are an important (and hotly debated) category of revenue. Many bitcoin advocates and critics alike argue that a strong fee market is critical for Bitcoin’s long-term success. And during bullish market conditions, fees generally represent a significant percentage of monthly mining revenue. But bear markets historically obliterate this revenue stream, and the current market conditions are no exception. From August 2021 to May 2022, fees represented roughly 10% to 15% of monthly revenue — but since August, that number has hovered around 1 percent. In fact, since August, fees have not represented more than 2% of monthly mining revenue as shown in the line chart below.

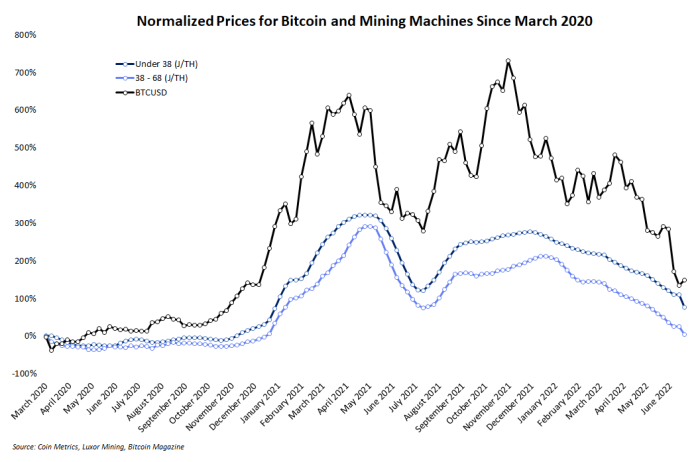

Mining machines have a very strong positive correlation to the price of bitcoin, and bear markets often cause prices for these machines to drop precipitously. There are several causes for this relationship, including repricing based on current revenue produced per machine and some basic psychological factors unique to the mining sector. Curiously, machine prices tend to lag behind bitcoin when the market sells off, and the below line chart illustrates this dynamic. Year-to-date, prices for mining machines across various levels of efficiency and profitability have dropped by 50% to 60% at the time of writing. If bitcoin’s price continues to dip, the mining hardware market will surely follow.

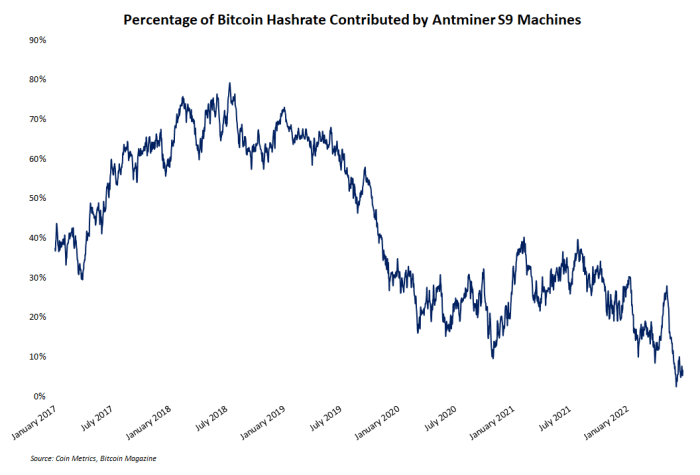

Not only are hardware prices dropping, but older machines are being squeezed out of the market altogether as economically rational miners are forced to power down less efficient hardware to avoid mining bitcoin at a price higher than the market is willing to pay for it. This effect is most clearly seen in the share of hash rate contributed by Antminer S9s, an old generation of machine developed by Bitmain. Compared to a 35% share of hashrate coming from these machines one year ago, S9s now contribute barely 5% of total hashrate, according to Coin Metrics data shown in the chart below. “At these BTC prices, the S9 once again looks like scrap metal,” said Coin Metrics analyst Parker Merritt.

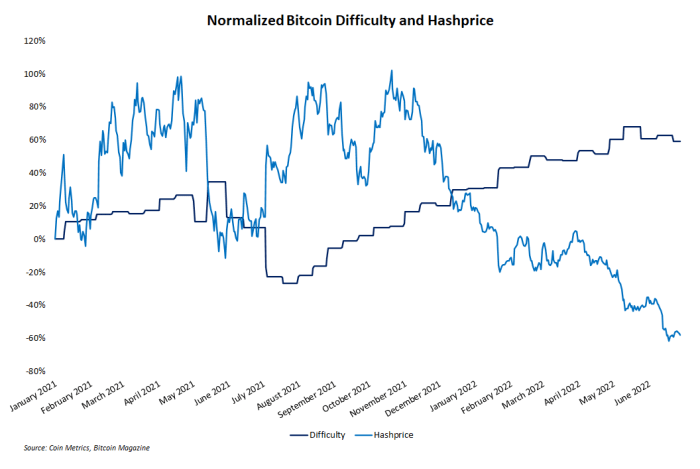

The most precise metric for tracking mining revenue is hash price, which measures the dollar-denominated revenue per unit of hashing power energized per second per day. This metric often fluctuates independent of price, and it can go down even when the price of bitcoin goes up. The chart below shows growth in mining difficulty and plummeting hash price since early 2022. In fact, late June saw hash price drop below $0.10 for the first time since late October 2020. Yet another symptom of bearish market conditions making life more difficult and less profitable in the mining sector.

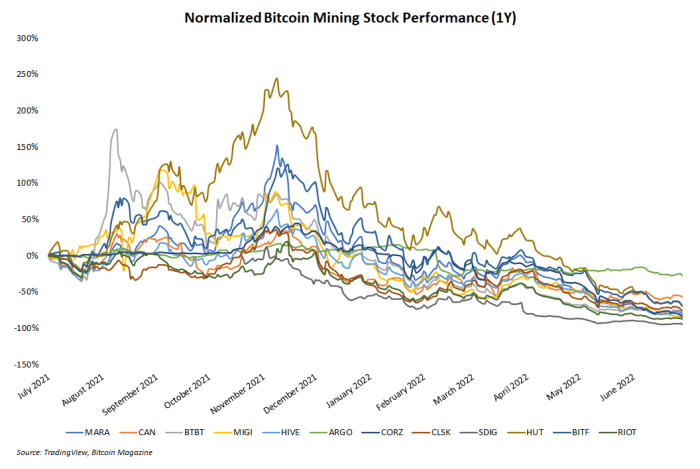

Collapsing share prices for publicly traded mining companies is probably the strongest signal of current market conditions. For all the reasons mentioned above, most mining companies are holding significantly devalued physically mining assets, operating with tightening profit margins and earning a much cheaper digital asset as bitcoin’s price drops. But mining stocks also tend to act as a high-beta play to bitcoin’s price, so when the bitcoin price moves either up or down, prices for shares of mining companies experience even larger moves in the same direction.

The line chart below shows the normalized one-year performance of a dozen different mining companies that trade on the Nasdaq. Almost every company is down at least 60% over that period, at the time of writing, with the worst performer — Stronghold Digital Mining — down 94%. Times are tough for bitcoin miners … and their shareholders.

In bearish conditions, the bitcoin markets often look to miners to gauge whether sentiment is stabilizing or worsening. Miners selling coins, unplugging machines, or liquidating hardware are all signs that, yes, conditions are bad. But ultimately all this data follows the price of bitcoin instead of affecting the price of bitcoin. So, when any of the above data sets will improve is an open question — it depends on when the bitcoin market levels out or turns bullish. Until then, miners continue operating according to their existing plans for surviving another long bear market.

This is a guest post by Zack Voell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link