[ad_1]

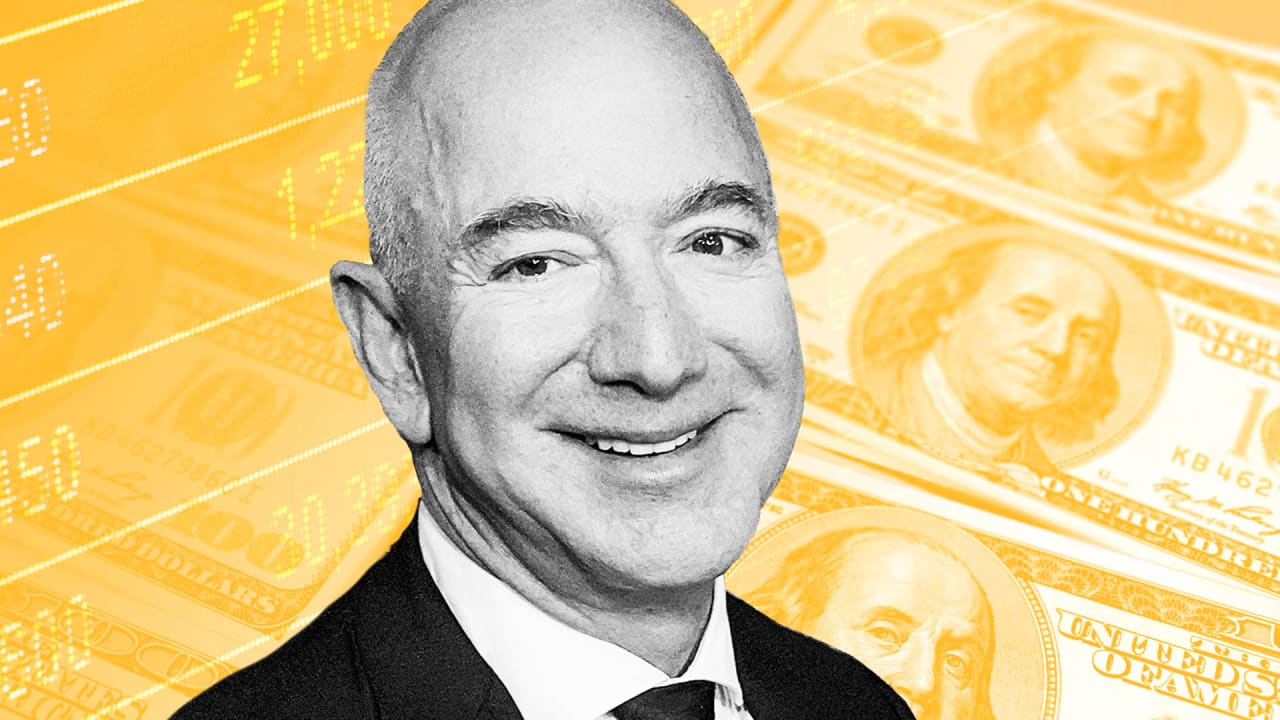

Billionaire Jeff Bezos claimed over the holiday weekend that President Joe Biden doesn’t know how inflation works.

Criticizing a tweet in which the president demanded that Big Oil bring down the price at the pump to reflect the cost paid for the product, the Amazon founder called Biden’s statement “either straight ahead misdirection or a deep misunderstanding of basic market dynamics.”

The Bezos-Biden Twitter exchange prompted a response from UC Berkeley’s Robert Reich, former U.S. Labor Secretary, who tweeted that “Bezos should know that a major reason prices are rising is that hugely profitable corporations have been using inflation as a cover to raise prices on consumers.”

The debate over whether companies are unnecessarily increasing prices in the post-lockdown economy has been ongoing. Late last year, Biden accused companies like meat processors of price gouging, pushing the Agriculture Department to investigate large meatpackers that control a sizable chunk of the poultry and pork markets to determine if they were underpaying farms but hiking prices during the pandemic. Those companies tripled their profits during that time.

Supply-chain shortages are real, and labor costs and manufacturing material costs have indeed increased over the last year. Some observers, such as a recent op-ed in the Wall Street Journal, blame rising prices on “newly empowered workers” who are increasingly unionizing. But corporate profit margins have outpaced wage gains in the last two years, including inflationary months. The Commerce Department’s Bureau of Economic Analysis found that labor costs grew 7% between 2020 and 2021, but corporate profits after tax grew by 14%.

Price hikes have come following pent-up consumer demand after the first year of the pandemic, global goods shortages, ongoing lockdowns in China, and Putin’s war in Ukraine, wrote Reich in his July 5 economic and political newsletter. “But the corporate price hikes often exceed these higher costs,” says Reich.

In fact, there’s a widening difference between what corporations pay for those costs and the prices they charge customers. A June paper by Mike Konczal and Niko Lusiani, directors at the economic think tank Roosevelt Institute, found that markups and profits skyrocketed in 2021 to their highest recorded level since the 1950s. U.S. companies increased their markups and profits in 2021 at the fastest annual pace since 1955.

Lusiani and Konczal found that corporations are raising prices because they have market power, and customers believe the hikes are justified because of rising costs.

In terms of Big Oil, gas prices hit the highest in 14 years, while ExxonMobil’s profits more than doubled and Chevron’s quadrupled in the first quarter of 2022. The price of crude oil has fallen to $15 a barrel, but prices at the pump haven’t budged.

Bezos’s Amazon has also been rising prices in the wake of inflation, and yet Amazon’s profits nearly doubled in the fourth quarter of last year. It also announced in February that it would boost the annual price of its Prime membership by 17% to $139, up from $119. The company cited higher wages and increased transportation costs for the increase. But the company has increased the price of its Prime membership every four years since 2014.

[ad_2]

Source link