[ad_1]

Four years ago, The Walt Disney Co. seized control of its streaming destiny. Instead of continuing to provide content to the likes of Netflix, it rounded up its storied brands—Disney itself, Marvel, Pixar, Star Wars, National Geographic—and folded them into a family-friendly video platform called Disney Plus. The result of intensive planning and investment, the service launched with great expectations and met them, signing up 10 million subscribers on its launch day. It reached 87 million in its first year, and had 164 million by the time it celebrated its second anniversary.

Months before Disney Plus’s debut, Disney had filled in another part of its streaming strategy when it acquired most of 21st Century Fox’s entertainment assets. The $71 billion acquisition gave it a controlling interest in Hulu, the venerable streaming service whose value proposition—something for everybody, including vast quantities of programming aimed at adults—complemented Disney Plus’s family focus. Last month, Disney announced plans to bring Hulu fully in-house by acquiring the remainder from Comcast’s NBCUniversal.

From the start, Disney Plus subscribers could opt for a package deal that also included Hulu (as well as ESPN Plus). This bundle offered a wealth of stuff, initially for the bargain price of $13 a month. Yet it didn’t represent a real unification of Disney’s streaming options. Disney Plus remained Disney Plus, Hulu remained Hulu, and subscribers had to traverse between two entirely different apps to watch everything they were paying for.

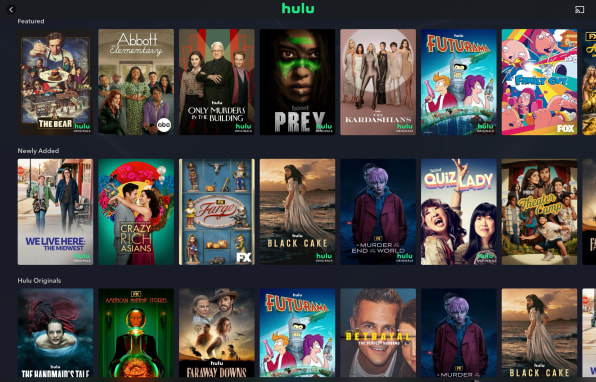

Now, with a new beta version of the Disney Plus app that launched this week, The Kardashians and Only Murders in the Building will coexist with Bambi and more variations on Star Wars than I can keep track of, all in one place. That’s because the beta incorporates nearly all of Hulu’s content into the Disney Plus interface. (A subset restricted by licensing agreements will remain absent, as will Hulu’s live TV service—and the stand-alone Hulu app isn’t going anywhere.)

For bundle subscribers, this integration means easier access to more entertainment options, including Hulu Originals as well as shows from a bevy of sources: broadcast networks, cable classics such as MTV and History, and beyond. But for Disney, making it possible required paying off years of the kind of technical debt that accumulates when you operate multiple services and often don’t have time to stop and think about their future.

“While the launch of this will be a simple Hulu button in the [Disney Plus] app, the complexity underneath to deliver that to you has [required] a lot of work,” says Aaron LaBerge, the president and CTO of Disney Entertainment & ESPN. “For example, the content libraries between Hulu and Disney Plus—over 70,000 pieces of content—were encoded differently. The playback output had different specifications. The metadata attached to each of those assets was different.”

By streamlining the process of putting video anywhere someone might want to watch it, Disney isn’t just making it possible for Hulu to have a home inside Disney Plus. It’s also making investments it hopes to benefit from for years to come, as maximizing the value of its myriad brands in a digital world grows only more essential.

Streaming realities

Since Disney Plus’s 2019 launch, the streaming landscape has shifted considerably—mostly away from its early unbridled optimism and toward hard-nosed economics. Like other major players, Disney has been making tough decisions: It’s trimmed its content investment, raised subscription prices, cut its subscriber goals, and begun cracking down on password sharing.

In the end, Disney Plus’s future rides on the basic question of whether a large and growing number of consumers feel they get enough out of it to justify the monthly cost, which currently ranges from $8 for the stand-alone ad-subsidized tier to $90 for a bundle offering ad-free Disney Plus, Hulu with Live TV, and ESPN Plus. Bringing Hulu into Disney Plus was an obvious way to help people watch even more of what they pay for, fulfilling Disney CEO Bob Iger’s mandate after his November 2022 return to better integrate the company’s experiences.

“We live in a world where people have multiple subscriptions,” says LaBerge. “They’re in Max, they’re in Netflix, they’re in Hulu, they’re in Disney Plus, they’re in Prime Video. And they don’t know what’s where. So we believe that for our content, putting it all in one place for you to easily find, applying personalization to recommend content you may like, and not having to send you into another app was really important.”

Disney’s yen for integration isn’t just about what consumers see. For years, it’s been working on the kind of behind-the-scenes integration necessary to make quicker progress on its most important initiatives. When I interviewed LaBerge for a 2016 story, he was ESPN’s CTO. In 2018, his responsibilities expanded to encompass all of Disney’s streaming efforts, a role he has maintained through further corporate restructuring. LaBerge remains based at ESPN’s campus in Bristol, Connecticut, which has evolved into an East Coast hub for Disney’s broader technical operations.

At a company with assets as numerous and far-flung as Disney’s, centralized oversight isn’t something that can be imposed overnight. In his office in Bristol, Michael Cupo, senior VP of business operations for Disney Entertainment & ESPN Technology, shows me a slide of a massive timeline laden with technology projects in progress or on the horizon. It name-checks Disney-owned properties (from Good Morning America to Latin America’s Star Plus, a rough Hulu equivalent) along with third-party names (Apple Vision Pro, IMAX) and several projects represented only by intriguing code names. Only this year, he acknowledges, has Disney reengineered itself enough to avoid getting bogged down by the sheer overload of competing interests.

And even then, it’s not easy. Do stakeholders throughout the company love the rigor it’s trying to bring to the process? No, Cupo says, they hate it: “Everyone wants their thing done, and it’s about us prioritizing the thing that’s most important to the business.” Presumably, they feel a little bit better about that prioritization when it’s their thing that rises to the top.

By the time integrating Hulu into Disney Plus was a priority, some of the necessary technology was already in place. Disney Plus, for instance, got parental controls last year, allowing it to accommodate such R-rated Marvel items as the Deadpool movies. Despite such progress, much remained to be done to bring two platforms with radically different histories into alignment, updating each one along the way. Hulu, which launched in October 2007, dated from streaming’s primordial age. It reflected many decisions made long ago by people no longer associated with the service, and sometimes lagged behind the current state of the streaming art.

“For example, in Hulu, a video asset has five pieces of art that describe the content,” explains LaBerge. “It’s the cover art, the poster art, small thumbnail, large thumbnail, etc. In Disney Plus, there are 27 pieces of art attached, which allows you to do a bunch of different creative things.”

Meanwhile, Disney Plus, though far more modern, was constrained by its founding goal of getting big fast, which had trumped longer-term concerns. “Any platform decisions that would have been made to stabilize or standardize or operationalize things, it was like, ‘We need to grow as quickly as possible,’” says Cupo. “What we’re doing now is going through and fixing those things.”

Indeed, Disney Plus’s original underpinnings were so inflexible that even rolling out price hikes had historically required allocating engineering resources. Now, according to Cupo, Disney has “actually built a platform so that, with a couple of button clicks—bang!—they can just go do it from a business perspective.”

Work in progress

The current incarnation of Disney Plus incorporating Hulu is labeled as a beta for a reason. There are some obvious affordances that Disney is still working on as it gets ready for the official release, scheduled for March 2024. For instance, it plans to build out full-blown hubs for the many content providers that make up Hulu, so subscribers can peruse what’s playing on FX or Nick Jr., for example. At first, only Disney Plus subscribers whose plans include Hulu will see that the Hulu content is there at all. Once the app leaves beta, the company plans to reveal it to non-Hulu subscribers, too—providing it with an opportunity to tout the benefits of upgrading their plans.

Beyond that, Disney hasn’t yet done anything to integrate the user profiles on Hulu and Disney Plus, which would allow subscribers to have one identity spanning both apps. For the moment, they’re as walled off from each other as if the two services in question were Netflix and Paramount Plus. “There’s no way for us to physically link two different profiles and their interactions without sending the user through some sort of wizard where we’ve got to be like, ‘Is this you, or is this you?’” says Jason Wong, Disney Entertainment & ESPN Technology’s senior VP of product management. “And we’re not looking to do that at this time.”

Still, even if there are some logical steps Disney might take to improve the Disney Plus-Hulu experience, it’s already implemented an array of technologies core to its high-level streaming ambitions. And when something offers the promise of a strategic edge, the company is particularly willing to commit to internal development rather than defaulting to off-the-shelf solutions.

Take advertising, for instance. An element of Hulu from the start, it came to Disney Plus in late 2022 with the addition of a basic ad-supported tier, which let Disney court subscribers who’d otherwise have been scared off by price increases. Adding ads to a service formerly devoid of them sounds inherently thorny. But LaBerge says Disney was able to pull it off in six months, because it had spent three and a half years building its own ad-serving platform, an effort that was bolstered by taking control of Hulu back in 2019.

When bundle subscribers search in Disney Plus, they’ll see Hulu shows (History of the World Part I, Drunk History) in results alongside Disney Plus offerings (Hamilton, Toy Story).

Earlier on, Disney, like many streamers, relied on Google and other outside specialists to serve its ads. But: “When you use a third-party ad platform, it’s kind of lowest common denominator in terms of functionality, because they have many different customers that they have to moderate,” says LaBerge. “Whereas there was a lot of bespoke work done in Hulu that we thought was advantageous.” By controlling its own platform, Disney can mix brand advertising it sells directly and ads it gets from programmatic networks “to maximize revenue for the company and relevance to the user, which is very hard to do,” says LaBerge.

Another fundamental upgrade relates to the various elements that make up a video stream—the content itself along with items such as maturity ratings, network bumpers, and preroll teasers. In the past, they all got burned into a single file and were part of it forever. Streaming the same content in a different context—say, in a country with a different rating system—required burning a new file. “It felt incredibly inefficient,” says Wong. “One of the things that we’ve now introduced with Hulu on Disney Plus as a technical platform improvement is the ability to dynamically stitch together videos in a seamless way so that all the discrete assets can be composited together.”

Even if some of what Disney has been implementing involves overdue renovations, it’s not a mere repair job. Instead, the company is creating building blocks it can apply throughout its portfolio. That includes streaming offerings that don’t even exist yet—such as an a-la-carte version of ESPN that includes all of its familiar cable-TV programming, a long-awaited service that Disney says will launch in 2025

“The veneer of those experiences might be slightly different based on the brands,” says LaBerge. “But the quality of the video you see, the seamlessness and pristine quality of the advertising, how we monetize that, how you log in with us, how we track what you’re doing so that we can personalize your experience—all that will be the same across every single touch point across The Walt Disney Company. Which is a massive competitive advantage.”

That still doesn’t guarantee success for Disney Plus, Hulu, and their present and future Disney stablemates. But in a business as fraught as streaming, execution is everything—and the technological details Disney has been obsessing over could be crucial.

[ad_2]

Source link