[ad_1]

Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning.

Talks at the COP28 summit in Dubai will be extended after a draft agreement triggered a backlash from countries that accused Saudi Arabia and other petrostates of thwarting efforts to tackle global warming.

The draft text, published last night by the UN climate body, dropped references to the phaseout of fossil fuels and instead set out a range of actions that countries “could” take to cut greenhouse gas emissions to net zero by 2050.

The talks were scheduled to end today but failure to secure a final text, which must be agreed by almost 200 countries present at the summit, mean they will now not conclude until tomorrow or Thursday, negotiators said.

Sultan al-Jaber, COP28 president and head of the Abu Dhabi National Oil Company, said after the release of the draft text: “We have made progress, but we still have a lot to do . . . I want you to develop the highest ambition on all items, including on fossil fuel language.”

If a text can be agreed to phase out fossil fuel use it would be a first for the world’s most important climate forum. Previously, only the phasedown of unabated coal use was referenced. Here’s the latest on the talks from reporters in Dubai.

Here’s what else I’m keeping tabs on today:

-

Inflation: The Bureau of Labor Statistics will publish the November consumer price index. It is expected to have fallen for the second consecutive month to an annualised rate of 3.1 per cent from 3.2 per cent in October.

-

US interest rates: The US Federal Reserve begins its final rate-setting meeting of the year. The central bank is expected to keep its main lending rate on hold at 5.25 to 5.5 per cent for the third meeting in a row.

-

Zelenskyy-Biden meeting: The US president will host his Ukrainian counterpart at a pivotal time in Ukraine’s fight against Russia.

Five more top stories

1. US officials have told the Financial Times that they expect Israel to switch tactics in their war against Hamas in January. The officials, speaking on condition of anonymity, said they would move away from the all-out ground offensive of the past two months to a more targeted pursuit of senior Hamas leaders and other high-value targets. Read the exclusive story from Felicia Schwartz.

2. China’s President Xi Jinping has lauded Beijing’s security and commercial ties with Vietnam, as he kicked off a state visit to a country that has become a critical global supply hub not only for western companies diversifying out of China, but also for Chinese manufacturers. Xi’s trip, the third to the country since he became general secretary of China’s Communist Party more than a decade ago, is also designed to counter Vietnam’s growing ties with the US.

3. German insurers, including Munich Re and Allianz, have amassed more than €3bn of exposure to the struggling property empire owned by real estate billionaire René Benko, according to documents reviewed by the FT. Signa Holding, the central company in the group that owns Selfridges in London and the Chrysler building in New York, filed for administration last month. Here’s more on the exposure of Signa’s lenders.

4. Exclusive: An Indian billionaire will pay £138mn in London’s most expensive home sale this year and the UK capital’s second most expensive home ever sold. “Vaccine prince” Adar Poonawalla will buy Aberconway House, a 25,000 sq ft Mayfair mansion near Hyde Park, through a UK subsidiary of his family’s Serum Institute of India. Here’s more on the sale.

5. Google has lost an antitrust lawsuit brought by Epic, the company behind popular video game Fortnite, which accused the search giant of suppressing competition in the Android app market to secure billions of dollars in profits from its Play Store. The verdict by a federal jury in San Francisco was returned after a weeks-long trial. Here’s what will happen next.

The Big Read

Industry figures say Kirkland & Ellis’s approach to business is more akin to a hedge fund or an investment bank than a law firm. A boom in private equity has meant bumper pay packages and rapid promotion for its partners, but as dealmaking slows, is the party over for the world’s most profitable law firm?

We’re also reading . . .

-

Israel-Hamas war: Rebuilding Gaza will require a long-term vision for Palestine, but the conditions for a two-state solution have worsened considerably in the past decades, writes Gideon Rachman.

-

Iran’s ‘first lady’: Wives of Iran’s past presidents were rarely seen in public, much less politics. But Jamileh-Sadat Alamolhoda has broken with tradition to speak to the FT.

-

‘I don’t want to be Venezuelan’: In the mineral-rich Essequibo region and across Guyana, the threat of annexation by Venezuela is stirring up both fear and nationalist sentiment.

Chart of the day

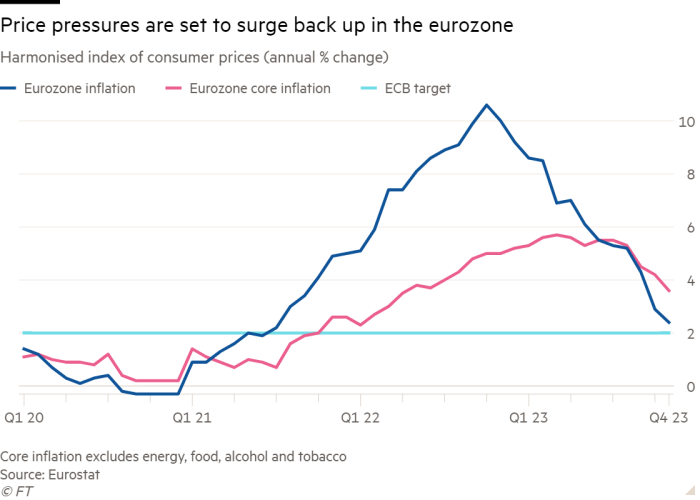

Is the market right in expecting a lowering of borrowing costs soon? What could prevent interest rate cuts in March? Martin Arnold answers questions that will be on policymakers’ minds when the European Central Bank meets on Thursday.

Take a break from the news

Home gadgets, including a TV that folds out at the touch of a button and a coffee machine that can save user preferences, are part of this guide to the ultimate luxury in home tech where money is no object.

Additional contributions from Tee Zhuo and Benjamin Wilhelm

[ad_2]

Source link