[ad_1]

Stay informed with free updates

Simply sign up to the World myFT Digest — delivered directly to your inbox.

Good morning.

The US Federal Reserve held interest rates at a 22-year high for the second time in a row yesterday but kept open the possibility of further monetary tightening amid mounting evidence that the US economy remained strong.

After 11 increases since March 2022, the benchmark federal funds rate is now between 5.25 per cent and 5.5 per cent.

Strong economic data, including a robust labour market and consumer spending that drove faster than expected gross domestic product growth in the third quarter, may have left the central bank with more work to do to meet its inflation target, Fed chair Jay Powell indicated after the meeting.

“We are committed to achieving a stance of monetary policy that is sufficiently restrictive to bring down inflation to 2 per cent over time and we’re not confident yet that we have achieved such a stance,” he said.

But the central bank could afford to proceed “carefully” with future decisions, Powell said, amid signs that past rate rises were having an effect on the economy. Here are more details on yesterday’s unanimous decision.

For the latest on central banks and their fight against inflation, premium subscribers can sign up to our Central Banks newsletter by Chris Giles here, or upgrade your subscription here.

Here’s what else I’m keeping tabs on today:

-

UK interest rate decision: The Bank of England is likely to follow the Fed in holding rates at their highest levels since before the 2008 financial crisis.

-

AI summit: Tech billionaire Elon Musk and UK prime minister Rishi Sunak are set to do an interview together this evening.

-

Results: Apple, Bombardier, BT Group, Eli Lilly, Ferrari, Fox, Hugo Boss, Starbucks, S&P Global, Moderna, Prudential Financial and Shell are among those reporting. See our Week Ahead newsletter for the full list.

-

Markets closed: Several markets across South America are closed for All Souls’ Day or Day of the Dead, including in Brazil and Mexico.

Five more top stories

1. Joe Biden has called for a “pause” in fighting in Gaza in order to help free hostages held by Hamas. The US president was speaking at an event where he was interrupted by an audience member who urged him to back a ceasefire, which the White House has resisted since the war began. Here’s more from Biden’s remarks yesterday.

2. Exclusive: Lloyds Banking Group has rebuffed the latest £1bn offer by the Barclay family to reclaim the Telegraph in an attempt to reassure bidders in an auction for the British newspaper group. Bidders have been concerned by the family’s repeated offers to take back control by paying down much of the debt owed to Lloyds. Read the full story.

3. The US has upstaged Rishi Sunak with plans to set up its own institute to police artificial intelligence, announcing it on the day the UK prime minister hosted his global AI safety summit at Bletchley Park in England. The move came despite Britain’s own plans to set up a similar body, though UK officials played down any divergence with Washington.

-

AI pledge: The US, UK and China are among 28 countries that agreed to work together to ensure AI is used in a “human-centric, trustworthy and responsible” way, in the first global commitment of its kind.

-

Microsoft: The tech giant has made the technology behind ChatGPT available as a standard feature in its Microsoft 365 suite of productivity apps.

4. Exclusive: China’s biggest memory-chip maker has had to raise billions of dollars in new capital after burning through $7bn in funding over the past year trying to adapt to Washington’s restrictions on its business. Yangtze Memory Technologies was added to a trade blacklist last December and banned from procuring US tools to make chips. Here are more details on its fundraising round.

5. Exclusive: Europe’s CVC Capital Partners has postponed plans to float until next year because of market uncertainty, according to two people with direct knowledge of the decision. The delay to the buyout group’s plans to list in Amsterdam extends a two-year saga over whether it will follow rivals on to the public markets. Here’s more on the move.

Join us online today to discuss if corporate companies or private equity firms have the dealmaking advantage and the future of M&A in a volatile economic environment. Register here.

The Big Read

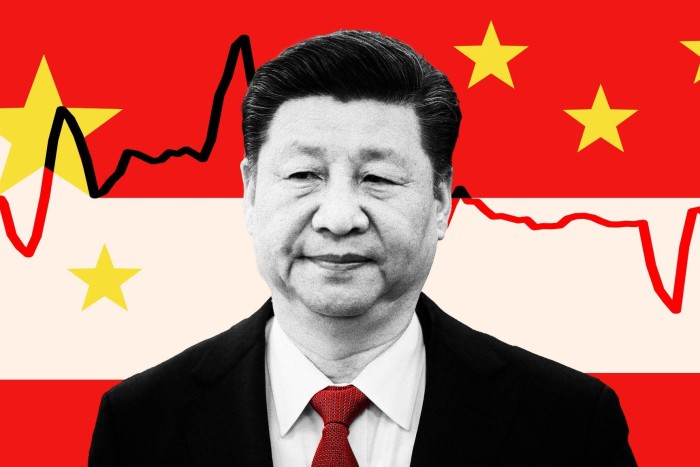

China’s Communist party used to allow its people abundant economic opportunity in exchange for heavy restrictions on their political freedom. But President Xi Jinping’s promise of “common prosperity” is starting to fade as the country’s economy falters. Graduates are struggling to find jobs, the middle class has lost money to a property meltdown and the rich are reeling from Beijing’s crackdowns on different sectors. A once optimistic society is worrying about its future as China’s social contract breaks down.

We’re also reading . . .

-

War in Ukraine: The country is rushing to bolster its energy infrastructure ahead of winter as a renewed Russian aerial campaign starts to home in on Ukraine’s power stations.

-

Goldman Sachs: Will chief David Solomon’s big bet on the bank’s newly merged asset and wealth management unit help him close its valuation gap — and keep his job?

-

Vladimir Putin: Russia’s president unnerved his foes and friends with nuclear threats, but he has since toned down his rhetoric. Here’s why.

-

‘Album culture’: Labour’s row over the Israel-Hamas war shows the increasing difficulty of choosing “singles” in politics and policies, an unwelcome development, writes Robert Shrimsley.

Chart of the day

UK income inequality has narrowed since the pandemic as a rising minimum wage and a surge in hiring have boosted earnings for some of the lowest-paid employees, according to data released yesterday. Wage growth was strongest in occupations such as caring, leisure and other services.

Take a break from the news

“I still dress like a teen — though it’s probably not doing my career any favours,” writes the FT’s Annachiara Biondi. The 33-year-old millennial explains in this essay why she’ll continue to embrace her graphic T-shirts, crop tops and battered Vans even if others view it as a sign of immaturity.

Additional contributions from Benjamin Wilhelm and Gordon Smith

[ad_2]

Source link