[ad_1]

Receive free World updates

We’ll send you a myFT Daily Digest email rounding up the latest World news every morning.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning.

Today we have an exclusive interview with one of Russia’s richest men, who has expressed “surprise” at the country’s resilience after a war he thought would bankrupt the Kremlin.

Metals oligarch Oleg Deripaska told the Financial Times that Moscow had survived the effort to isolate its economy by developing new trade ties with the global south and increasing investment in domestic production.

The private sector, meanwhile, proved more robust than he had expected only months earlier. “I was surprised that private business would be so flexible. I was more or less sure that up to 30 per cent of the economy would collapse, but it was way less,” he said.

Russia was hit hard in the wake of the full-scale invasion but has since succeeded in avoiding G7 sanctions on the vast majority of its oil exports. The IMF has forecast Russia’s gross domestic product will grow by 1.5 per cent this year and 1.3 per cent in 2024.

“Yes, there is war spending and all this kind of subsidies and government support but still it’s a surprisingly low slowdown [ . . .] The private economy found its way to operate and to do so successfully,” said Deripaska. Here’s the full interview.

Here’s what else I’m keeping tabs on today:

-

Bank of England: Governor Andrew Bailey attends a meeting of the bank’s Financial Policy Committee to discuss risks to financial stability. Yesterday the BoE published the terms of reference for a sweeping review of its forecasting process, led by former US Federal Reserve chair Ben Bernanke.

-

UK politics: Ed Davey, leader of the Liberal Democrats, is expected to deliver a bullish closing speech to his party conference and promise to defeat the Tories in southern England at the polls. For more UK politics, sign up for our Inside Politics newsletter.

-

Results: Alliance Pharma, Barr, Card Factory, Close Brothers and Smiths Group report. Asos is expected to publish a trading update.

One more thing: We are launching a new central banks newsletter for premium subscribers. Chris Giles will use nearly 20 years of experience as the FT’s economics editor to provide weekly insights on interest rates and monetary policy. Sign up here.

Five more top stories

1. Exclusive: Scrapping the HS2 high-speed rail project will damage trust in Britain, the new US owners of Birmingham City football club have warned Rishi Sunak. The club’s chair wrote to the prime minister to warn that truncating HS2 would damage Birmingham’s economy and shake investor confidence. Here’s more from the letter seen by the FT.

-

Inheritance tax: The prime minister is exploring major changes to the highly divisive tax in a bid to boost the Conservative party’s standing ahead of polls.

-

Net zero U-turns: UK manufacturing groups have hit out at Sunak’s watering down of green targets, describing the move as “a huge setback” to the sector.

2. Exclusive: EY agreed to terminate a consulting contract and refund about £15mn to Santander’s UK business after failings in its anti-financial crime work for the bank, according to people with knowledge of the matter. The Big Four firm was one of several external advisers called on by Santander after its anti-money laundering systems drew regulators’ scrutiny. Here’s how the work “went badly wrong”.

3. Ken Griffin has joined investors led by Sir Paul Marshall to prepare a bid for the Telegraph Group ahead of an auction for the UK media company expected to start in the next few weeks. Griffin’s involvement is in a personal capacity, said a person familiar with the situation, and not linked to Citadel, the hedge fund he founded. Read the full story.

4. A drug by Merck has been linked to permanent “transmissible” Covid-19 mutations. Researchers found that mutations had increased after the US pharmaceutical group’s molnupiravir was introduced, especially in countries where the treatment was more widely used, raising concerns about the effectiveness of antiviral drugs to treat Covid-19.

5. Streaming will transform the video games industry just like Netflix revolutionised television and cinema, said Ubisoft’s chief executive. The French gaming company last month agreed to acquire streaming rights for Activision Blizzard’s portfolio of games as part of Microsoft’s bid to take over Activision. Read the FT’s full interview with Yves Guillemot.

The Big Read

Global regulators are raising alarm bells over a rapid build-up in hedge fund bets in the $25tn US Treasury market. The so-called basis trade involves playing two very similar debt prices against each other — selling futures and buying bonds — and extracting gains from the small gap between the two using borrowed money. Here’s how this could cause potentially serious problems.

We’re also reading . . .

Chart of the day

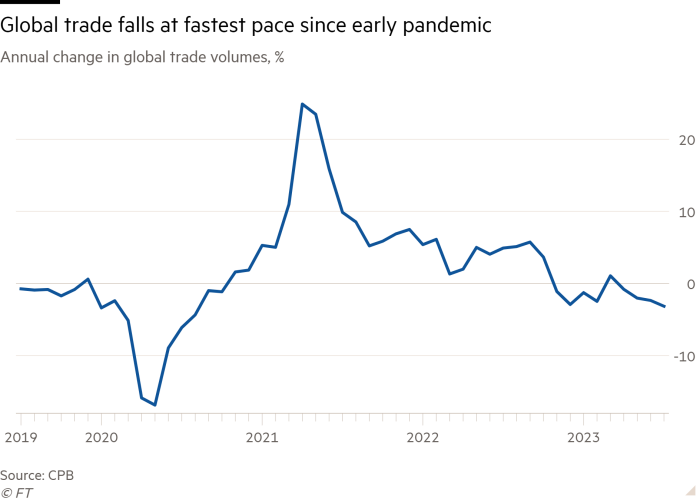

World trade volumes fell at their fastest annual pace for almost three years in July, according to closely watched figures that signal rising interest rates are beginning to affect global demand for goods.

Take a break from the news

The iPhone 15 Pro Max is lighter, boasts a 48-megapixel camera and has an exciting new button. But should you buy it? Rhodri Marsden reviews the latest model of Apple’s flagship smartphone.

Additional contributions from Benjamin Wilhelm and Gordon Smith

[ad_2]

Source link