[ad_1]

Receive free World updates

We’ll send you a myFT Daily Digest email rounding up the latest World news every morning.

NatWest chief executive Alison Rose has resigned after she admitted to inaccurately briefing a BBC journalist about the closure of Nigel Farage’s bank account.

Rose will leave with immediate effect, the bank said in a statement this morning. Paul Thwaite, chief executive of the bank’s commercial and institutional business, will take over for 12 months while NatWest searches for a permanent replacement.

Her resignation comes after Downing Street and the Treasury raised concerns about revelations that she had been the source of an inaccurate report about the personal finances of the former UK Independence party leader.

The departure of the head of one of the UK’s largest banks follows a high-profile row between Farage and the lender, whose biggest shareholder has been the UK government since a taxpayer bailout at the height of the 2008 financial crisis.

Farage, a presenter on GB News, said on Twitter last month that “the establishment” was trying to “force” him out of the UK by closing his bank accounts.

Here’s what else I’m keeping tabs on today:

-

US interest rates: The Federal Reserve is expected to raise rates by a quarter of a percentage point today. The S&P 500 reached its highest level in more than a year yesterday ahead of the meeting.

-

Results: Earnings season rolls on with reports from Airbus, Banco Santander, British American Tobacco, Carrefour, Danone, Deutsche Bank, GSK, Lloyds Banking Group, Meta, Rio Tinto and UniCredit. See our Week Ahead newsletter for the full list.

What do you think of the row over Farage’s bank accounts? Let us know at firstft@ft.com

Five more top stories

1. British billionaire Joe Lewis has been charged over multiple alleged instances of insider trading, US prosecutors said yesterday. The property investor and Tottenham Hotspur owner has been charged with 19 counts, including securities fraud and conspiracy to commit securities fraud and make false statements. Read the full story.

2. Russia has criticised western countries for pressing African leaders to skip a summit in St Petersburg this week. Less than half as many dignitaries are making the trip as when the Kremlin last staged the event in 2019. The reduced guest list is a blow to Vladimir Putin’s efforts to rally support amid the war in Ukraine. Here’s who will and will not be attending.

-

Related: The UK government has “underplayed and underestimated” Russia’s Wagner paramilitary group and the “security implications of its significant expansion”, said a cross-party committee of MPs.

3. Exclusive: Qatar’s sovereign wealth fund is in talks to buy a 1 per cent stake in Mukesh Ambani’s retail unit, weighing a $1bn investment in the Indian billionaire’s Reliance Retail Ventures. The Qatar Investment Authority follows other oil-rich Gulf state funds in looking towards Asia and specifically India.

4. Microsoft and Google parent Alphabet reported greater resilience than expected in their core businesses in the second quarter. Both companies pointed to higher spending in the coming quarters as they build out the data centres needed to support an expected boom in demand for new generative AI services. Here’s more from this week’s Big Tech results.

5. London’s mayor has asked for more money from the Conservative central government to fund a more generous scrappage scheme for owners of older cars caught by his plans to expand a clean air zone. Sadiq Khan faces mounting political pressure after his scheme was blamed for Labour’s failure in the Uxbridge by-election. Here’s why he says the plan deserves more money.

The Big Read

On January 15, Republican caucus-goers in Iowa will fire the starting gun on the US presidential primary process. Florida governor Ron DeSantis and nearly all his party’s other candidates are betting on the Midwestern state as they pursue the same goal: halting the seemingly inevitable march by former president Donald Trump to the party’s nomination in 2024.

We’re also reading and watching . . .

Chart of the day

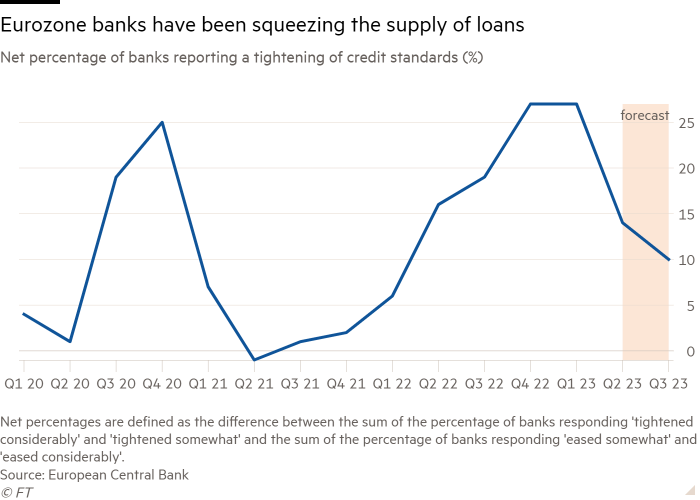

Eurozone banks have reported a sharp fall in demand for business loans to its lowest level on record, bolstering calls for the European Central Bank to abandon hints of further interest rate rises after its meeting this week.

Take a break from the news

The marketplace is awash with wireless earbuds at every price point, but these ones don’t play music. The QuietOn earbuds provide glorious silence in the most unobtrusive way possible, making them perfect for bedtime or long-haul flights. This week’s HTSI features these “sleep buds” and other essential gadgets.

Additional contributions by Benjamin Wilhelm, Darren Dodd and David Hindley

[ad_2]

Source link