[ad_1]

Receive free World updates

We’ll send you a myFT Daily Digest email rounding up the latest World news every morning.

Our top scoop today is on SoftBank-owned Arm, which is in talks to bring in Nvidia as an anchor investor as part of the UK chip designer’s plans to list in New York as soon as September.

Nvidia is one of several existing Arm partners, including Intel, that the UK-based company is hoping will take a long-term stake at the initial public offering stage, according to several people briefed on the talks.

The prospective investors are still negotiating with Arm over its valuation. One person familiar with the discussions said Nvidia wanted to come in at a share price that would put Arm’s total value at $35bn to $40bn, while Arm wants to be closer to $80bn.

Nvidia, the world’s most valuable semiconductor company, was forced last year to abandon its planned $66bn acquisition of Arm after the deal was challenged by regulators.

Arm and Nvidia declined to comment. A person close to the situation said the talks had not been concluded and might not lead to an investment.

Here’s what else I’m keeping tabs on today:

-

Central banks: The US Federal Reserve publishes its Beige Book on economic conditions, the Bank of England releases its financial stability report and the Bank of Canada is expected to raise interest rates again in its decision today.

-

Inflation data: Russia, Spain and the US have their consumer price indices for last month.

-

Nato: On the military alliance summit’s second day, the G7 plans to announce a multilateral security agreement for Ukraine and US president Joe Biden travels to Finland.

-

UK water crisis: A parliamentary select committee is set to question water industry executives this morning.

Five more top stories

1. Exclusive: JPMorgan is hiring dozens of bankers globally to capitalise on Silicon Valley Bank’s collapse, adding to its teams catering to start-ups and venture capital-backed companies. Hires in the UK and the US include three former SVB executives, with the bank also planning to expand in its Asia offices. Read more on how JPMorgan is filling the gap left by SVB.

2. A US federal court ruling has helped Microsoft move closer to its purchase of Activision Blizzard after a judge dismissed the Federal Trade Commission’s attempt to block the $75bn deal. The UK’s competition watchdog, which initially rejected the acquisition, signalled it was open to discussing changes to the deal that would address its concerns.

3. Exclusive: EY China has refused to pay fees owed to its global headquarters for more than a year in a dispute over IT services. The Chinese arm says the services cannot be fully used after Beijing tightened data security rules, according to people familiar with the matter. Read more on the tussle between EY’s global bosses and its semi-independent member firms in China.

4. New York-listed Assured Guaranty has more than $10bn of exposure to troubled UK water utilities which are labouring under £60bn of debt. If companies such as Thames Water and Southern Water default or fail to make interest repayments, the US insurance company could end up having to pay out to lenders.

5. UK chancellor Jeremy Hunt has ordered ministers to find more than £2bn of savings to fund 6 per cent public sector pay rises this year, arguing that borrowing more money to fund the rises will fuel inflation. Hunt is expected to agree on a strategy with Prime Minister Rishi Sunak this week. Here’s why some in Whitehall are already warning against the spending cuts.

The Big Read

Four decades after Ronald Reagan rejected large-scale US government intervention in the economy, Joe Biden is embracing it wholeheartedly with a raft of subsidies for domestic producers in strategic sectors, in the hope of creating hundreds of thousands of new jobs. Will the president’s policies transform the American economy in a way that is durable and have a tangible impact that resonates with voters?

We’re also reading . . .

-

UK pensions: The flurry of consultations after the chancellor’s Mansion House speech does not inspire confidence in the pension system’s future, writes Helen Thomas.

-

Turkey looks west: Backing Sweden’s Nato bid was a strategic move by President Recep Tayyip Erdoğan to ease tensions and unblock trade.

-

Ukraine and Nato: The military alliance’s caution over admitting Kyiv risks emboldening Moscow, writes the FT’s editorial board.

-

‘Gender-washing’: Japan’s financial regulators warn that regional banks are prone to inflating diversity figures due to legal ambiguity over women’s leadership roles.

Chart of the day

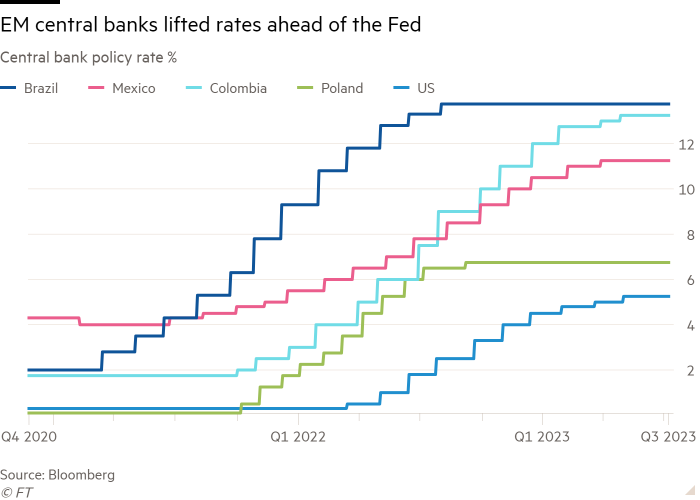

Investors have been buying up local currency bonds issued by emerging economies in a bet that policymakers there have done a better job of battling inflation than their developed market counterparts, with the gap in government borrowing costs between the two markets falling to its lowest level in 16 years.

Take a break from the news

After a long and vexed rebirth, the once-legendary London seafood restaurant Manzi’s is back. The FT’s Ajesh Patalay got a first taste of the extensive menu, which includes a large selection of crustacea among the starters.

Additional contributions by Emily Goldberg, Gordon Smith and Benjamin Wilhelm

[ad_2]

Source link