[ad_1]

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Ford plans to scale back future investments in China, as the US carmaker’s chief executive warned there was “no guarantee” western carmakers could win against local electric vehicle rivals.

The company will “put less capital at risk” by focusing on commercial vehicles such as delivery vans, and will instead use the market as a “listening post” to help it better understand battery technology, Jim Farley told the Financial Times.

“If you just reinvest in a new cycle of EVs in China, there is no guarantee, or no data, that would suggest the western companies win,” Farley said.

Ford’s decision echoes warnings from Nissan last week that the rapid pace of production of Chinese carmakers was piling pressure on international manufacturers as they struggle to compete for market share.

Competition is also heating up between China’s domestic manufacturers, which have been aggressively cutting prices since late last year as demand softened and the government cut back on subsidies. Some project their number will shrink from about 200 to between five and 10 in the coming years.

More than a quarter of all cars sold in China last year were electric vehicles, but experts have said only EV makers with economies of scale and enough financial firepower will remain standing in the years ahead.

Here’s what else I’m keeping tabs on today:

-

Debt ceiling: President Joe Biden plans to meet Congressional leaders today in a further effort to advance a possible agreement on the government’s borrowing limit and avoid an unprecedented national default.

-

Bank failures: The House Financial Services Committee holds its semi-annual hearing on supervision and regulation and today’s session will probably have a strong focus on the recent failures of several regional US banks.

-

Retail sales: Economy watchers will be looking for clues on the mood of the consumer in this morning’s data. Retail sales are expected to have risen 0.8 per cent in April following a 0.6 per cent drop in March.

-

Fedspeak: The Atlanta Fed’s Financial Markets Conference continues, with Dallas Fed president Lorie Logan taking part in a policy session on ‘Mitigating risks and preserving financial stability in an appropriately restrictive policy environment’. Tonight’s keynote address will include discussion from the presidents of the Atlanta and Chicago Feds.

-

Home Depot: Investors will keep a close eye on the hardware retailer’s results for any clues on the health of the property market and the US consumer more broadly. Home Depot’s revenues are expected to dip fractionally from a year ago to almost $38.3bn.

Five more top stories

1. China’s industrial output and consumer spending have fallen short of expectations, fuelling doubts over the strength of the country’s rebound after it dismantled its zero-Covid policy. Youth unemployment hit a record while a key measure of investment also lagged estimates, casting a shadow over the outlook for the world’s second-largest economy.

2. Janet Yellen warned the stand-off over the debt ceiling had resulted in a jump in government borrowing costs, as the Treasury secretary doubled down on predictions the US risks running out of cash as early as June 1.

3. The EU should crack down on India reselling Russian oil as refined fuels, including diesel, into Europe, the bloc’s high representative for foreign policy said. Josep Borrell told the FT that Brussels was aware that Indian refiners were buying large volumes of Russian crude oil before processing it into fuels for sale in Europe.

4. Norway’s $1.4tn oil fund will step up its use of shareholder proposals to send messages on environmental, social and governance topics to US companies. The world’s largest sovereign wealth fund filed shareholder proposals on climate for the first time this year at four US companies and said it considered the trial a success.

5. Record levels of share buybacks are attracting complaints from prominent investors concerned that the practice is boosting executive bonuses but providing only limited benefits to shareholders. The world’s 1,200 biggest public companies collectively bought back a record $1.3tn of their own shares last year, triple the level of a decade ago.

News in-depth

As Europe’s central bank pushes ahead with the development of an electronic currency, conspiracy theories are swirling, with some fearing the state will use it to track and control citizens’ spending. While many politicians hope a digital euro can be launched in as little as three years’ time, they are struggling to communicate convincing arguments for the project, with opponents arguing it is a solution seeking a problem.

We’re also reading . . .

-

AI and mobile devices: The race is on to bring the technology behind ChatGPT to the smartphone in your pocket. The latest moves in AI could transform mobile communications and computing far faster than seemed likely just months ago.

-

Turkish election: Author Dimitar Bechev says a tougher line on opponents and more economic challenges may follow if president Recep Tayyip Erdoğan wins the May 28 run-off race.

-

Fiscal rules: How do countries break free from the “doom loop” of stalling economic growth and expanding safety nets? Andy Haldane suggests rethinking the fiscal rules shaping government investment decisions.

Don’t miss this episode of the FT Talent podcast to hear chief economist Martin Wolf discuss how he built his career.

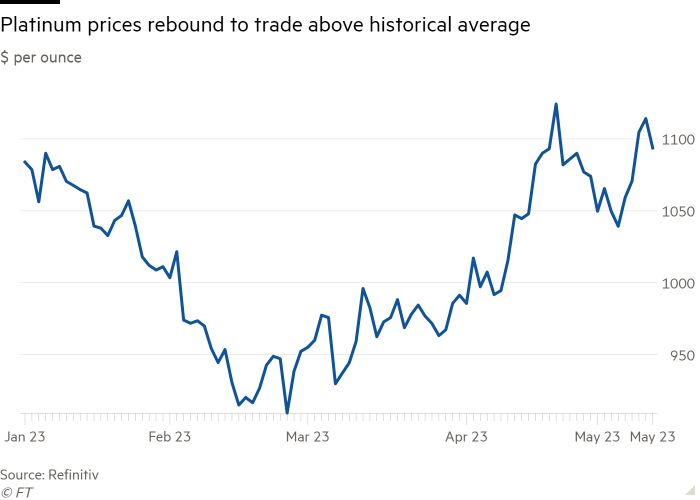

Chart of the day

This year the platinum market is expected to chalk up its largest deficit since records began in the 1970s as supply falters in South Africa and China’s industrial expansion powers ahead. The deficit marks a stark reversal from bumper oversupply in the previous two years when car production was hit by semiconductor shortages.

Take a break from the news

This fascinating FT essay delves into the art-filled London home of former Queen frontman Freddie Mercury as its contents come up for auction.

Additional contributions by Emily Goldberg

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link