[ad_1]

Signs the US labour market is cooling have raised hopes that the worst inflation problem in decades is improving, but economists warn further action is still needed from the Federal Reserve to fully contain price pressures.

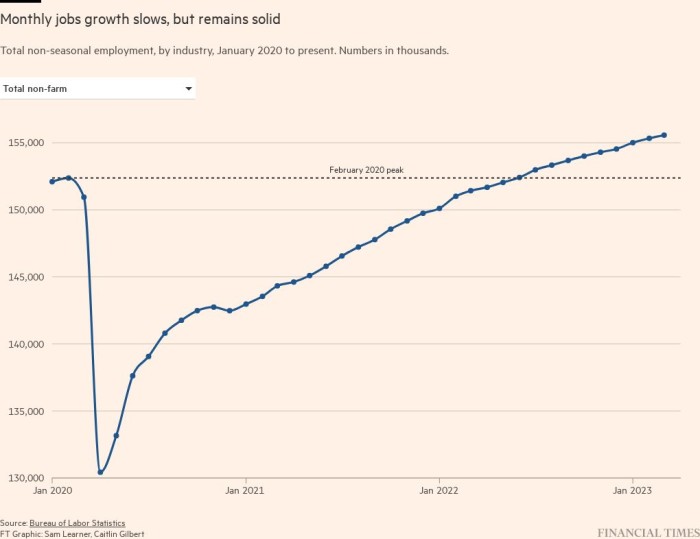

Data released on Friday bolstered the view that the world’s largest economy, while still resilient, is gradually losing some of its momentum. US jobs growth in March remained strong and the unemployment rate fell to a multi-decade low, but the latest figures show the pace of hiring is decelerating and wage growth easing.

Combined with data earlier this week, which also reflected dwindling demand for workers, economists say the slowdown that the US central bank has been trying to engineer since last year via sharply higher borrowing costs is under way.

Economists are still debating whether that steady progress will give way to a painful recession — especially if the Fed continues to raise interest rates as many economists expect, or the credit crunch associated with the recent banking turmoil is bigger than expected.

“What we’re looking at is an environment where the effects of Fed tightening and the efforts to slow the economy are beginning to take hold,” said Sarah House, senior economist at Wells Fargo. “While things seem to be slowing in an orderly way for now, we think we will see economic conditions weaken fairly sharply in the back half of the year.”

Friday’s data, which also showed that companies are pulling back both on workers’ hours as well as their use of temporary employees, capped a week of fresh evidence that economic activity is indeed moderating.

US jobless claims data, which tracks new applicants for unemployment aid, not only surpassed expectations on Thursday, but figures over the past 12 months were revised notably higher as part of an annual review by the Bureau of Labor Statistics. That suggests a weaker labour market than initially thought, economists say. Moreover, for the first time in two years, the number of job openings fell below 10mn, data out on Tuesday showed.

Separately, US manufacturing activity in March slumped to the lowest level in nearly three years.

According to fed funds futures markets, traders do expect the Fed to plough forward with another quarter-point rate rise in May, which would align with projections published by the central bank last month. Those showed most officials anticipate the federal funds rate peaking between 5 per cent to 5.25 per cent this year and for that level to be maintained at least until 2024. The benchmark policy rate currently hovers between 4.75 per cent to 5 per cent.

Praveen Korapaty, chief global rates strategist at Goldman Sachs, is among those to endorse another rate rise, noting that “nothing has collapsed” in the economy just yet.

“There’s deceleration, but we want that deceleration. You don’t want to be running the economy as hot as it’s been a couple of months ago,” he said. “I would have been somewhat more concerned if you did not see a cooling of the labour market because that would mean the Fed would have to do a bit more in terms of hikes.”

Although not his base case, Marc Giannoni, who formerly worked at the Fed’s regional banks in Dallas and New York, warned the central bank could implement an additional rate rise in June should the economic slowdown again stall.

“This labour market is just still incredibly resilient and incredibly strong,” said Giannoni, who is chief US economist at Barclays.

While Yelena Shulyatyeva, senior US economist at BNP Paribas, said this week’s data is “consistent” with a so-called soft landing — whereby the Fed tames inflation without outsized job losses — she warned that a mild recession is still the most likely outcome in the second half of the year.

Clouding the outlook is the extent to which the banking sector now pulls back on its lending activity in the aftermath of Silicon Valley Bank’s implosion, which last month forced the Fed and other government authorities to intervene to stem the panic.

Shulyatyeva, who expects one more rate move from the Fed next month, estimates the resulting tightening of financial conditions is roughly equivalent to half a percentage points’ worth of rises.

Additional reporting by Harriet Clarfelt in New York

[ad_2]

Source link