[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

More than 90,000 Hongkongers who have applied to move to the UK are being blocked from accessing as much as £2.2bn of pension assets, as activists accuse the city’s government of “punishing” those deemed “unpatriotic” following a political crackdown.

“It’s a blanket ban on British National (Overseas) holders accessing the property that is theirs,” said Sam Goodman, director of policy and advocacy at Hong Kong Watch, which released the figures today on the eve of a UK trip by financial services secretary Christopher Hui, the first ministerial-level Hong Kong official to visit Britain since 2019.

The UK’s BN(O) programme offered millions of Hong Kong residents a path to citizenship in the wake of a crackdown on pro-democracy protests in 2019. The move angered Chinese authorities, and in response, the Hong Kong government in 2021 said individuals could not use emigration under the UK scheme as a valid reason for early withdrawal of pension funds, effectively preventing immediate payouts.

Generally, former Hong Kong residents may reclaim their pension funds under the government’s Mandatory Provident Fund retirement saving system if they move abroad permanently. A number of banks, insurers and financial institutions offer pension funds under the system, including Manulife, Invesco, Fidelity and HSBC.

Here’s what else I’m watching today:

-

Andrew Bailey: The Bank of England governor is due to speak in Washington about the shifting risk landscape on the sidelines of the IMF/World Bank spring meetings.

-

Economic data: The US has its consumer price index for last month. Economists forecast annual inflation to have fallen to 5.2 per cent from 6 per cent in February.

-

Results: French luxury giant LVMH reports first-quarter revenue.

Inside Politics is holding a live panel discussion on April 19. Join Stephen Bush and other FT journalists and experts as they discuss next year’s UK general election. Sign up for the subscriber-only event here.

Five more top stories

1. EXCLUSIVE: EY has scrapped plans to break up its audit and consulting businesses, a split which would have represented the biggest shake-up to the accounting industry in more than two decades. Here’s how months of internal disagreement killed “Project Everest”.

2. EXCLUSIVE: Deutsche Bank is closing its remaining software technology centres in Russia, ending the German lender’s two decades of heavy reliance on Russian IT expertise in the wake of the country’s invasion of Ukraine. Read the full story here.

3. The IMF has warned of a “hard landing” for the global economy if inflation continues to push interest rates higher and said lower global energy and food prices could mask a darker reality. Here’s what else you should know from the fund’s World Economic Outlook.

4. The UK stock market is “not a very attractive place” for listed companies, the InterContinental Hotels chief has warned, in the latest sign of trouble for the London market. Keith Barr told the Financial Times that several shareholders have asked if the group has plans to shift its primary listing from the City to the US.

5. European aviation faces €820bn in extra costs to reach net zero emissions by 2050, according to industry estimates, with more than half to be spent on cleaner fuels not made from fossil fuels. Read more on the sector’s decarbonisation challenges.

The Big Read

Governments have promised to plant 633mn hectares of trees — an area larger than the Amazon rainforest — to help save the planet. While the goal is laudable, is it remotely plausible? In this visual essay, the FT explores the idea of reforestation and its effects on the land and people.

We’re also reading. . .

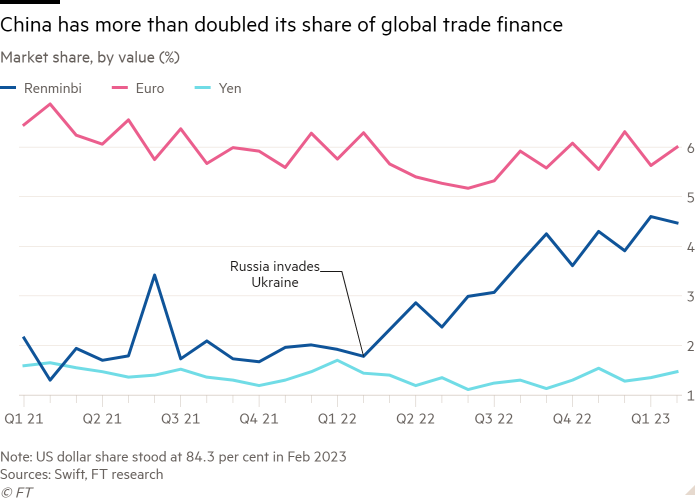

Chart of the day

The renminbi’s share of trade finance has more than doubled since the invasion of Ukraine, an FT analysis has found — a surge that analysts say reflects both greater use of China’s currency to facilitate trade with Russia and the rising cost of dollar financing.

Take a break from the news

We are seeing a gradual reimagining of where, when and how we work, writes Grace Lordan, associate professor at the London School of Economics, and much of that shift is coming from employees.

Additional contributions by Emily Goldberg and Vita Dadoo Lomeli

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link