[ad_1]

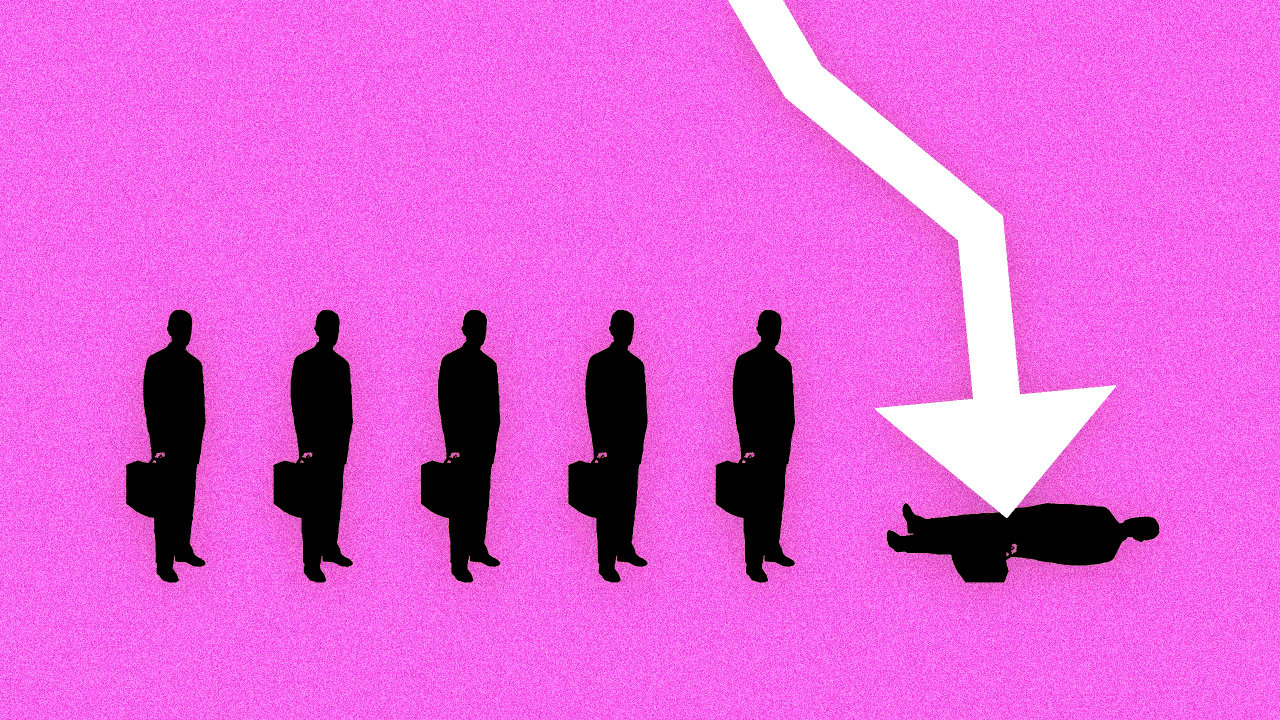

Several recent waves of high-profile layoffs are an uncomfortable reminder that many of us serve at the pleasure of the companies we work for. Whether you’ve been laid off, are hearing water-cooler whispers about reorganization, or simply want to be prepared, there are a number of steps you can take to ensure a job loss isn’t a catastrophe. Here’s how to survive—and even thrive—after a layoff.

Batten down the hatches

If you are still employed but worried about a layoff, there are several things you can do now to make your potential unemployment much easier to handle.

Know your rights

Layoffs can come suddenly and without warning, but depending on the size of your employer, that may be illegal. The Worker Adjustment and Retraining Notification (WARN) Act requires workplaces with more than 100 employees to provide no less than 60 calendar days’ advance written notice of a mass layoff. If your employer violates this rule, you may be eligible for back pay and benefits for up to 60 days.

Beef up your emergency fund

All the standard financial advice recommends having an emergency fund equal to three- to six-months’ worth of expenses in case of a job loss, which can sound impossible. It’s okay if you don’t have an emergency fund that can carry you for half a year but now is the best time to save as much of each paycheck as you can afford.

While you’re still employed is also a good time to find other potential sources of ready cash. Do you have items you can sell or services you can offer to help increase your savings? You can implement these strategies now or simply have them in your back pocket as an option after your layoff.

Go to the doctor

Unfortunately, losing your job often means losing your health insurance. Make the most of your medical coverage while you still have it. Quickly set up any needed appointments prior to the loss of coverage and ask if you can get advance prescription refills or switch to a three-month supply. You may also want to schedule appointments to get your teeth cleaned and get new glasses or contacts.

When the ax falls

Even if you know a layoff is likely, the reality of losing your job can be unexpectedly stressful. Keep a cool head and follow these steps to make the process as smooth as possible.

Take some time before signing

Reacting first and asking questions later may be a very human response to a layoff, but it leaves a lot to be desired in terms of negotiating your severance package. So if you have the option, try to wait at least 24 hours after receiving your notice before signing any official documents.

Depending on your age, your employer may be legally required to give you time to think. If you’re over the age of 40, federal law requires your company to give you 21 days to consider your severance agreement before signing—and the required time goes up to 45 days if the layoff is part of a group termination. There is no federal law requiring employers to the under-40 crowd that kind of time to consider, however.

No matter how much time you are able to take before signing, the waiting period will give you a chance to read through the all the layoff documentation provided by your employer. That will help you determine which questions to ask your human resources department as well as give you time to research comparable severance packages. Then you will be much more prepared for a meeting to negotiate your severance with your employer.

Negotiate your severance

Your workplace is under no legal requirement to offer you a severance package. But most companies provide some form of severance to protect themselves from any potential legal claims of wrongful termination. Your severance agreement will generally require you to agree to a confidentiality clause, a non-disparagement clause, and a non-solicitation clause, among other waivers. This means your severance package should be worth more than these potential rights.

Typically, employers offer one to two weeks’ salary for every year you have worked there, along with payment for unused PTO. But you don’t necessarily have to take the initial severance. Here are some of the benefits you might ask to increase your severance payout:

- Stock options

- Continued healthcare benefits

- Tuition reimbursement

- Career coaching

- Early and prorated payment of a performance-based bonus

- Company perks, such as laptop/phone, or gym membership

After the layoff

It’s natural to feel panicked about what will happen next, but these strategies will help you stretch your money and reduce your job-hunting time.

Budget the right way

Yes, you do need to reduce your expenses after a job loss. But instead of adopting austerity, cut your spending from easiest to hardest. Start by cutting the expenses you care about the least. These might include:

- Unused subscriptions: Take a few hours to comb through your statements and cancel all your unused subscriptions to immediately reduce your expenses without making any changes to your life.

- Services you won’t use as much while unemployed: Reduce your data plan, cut back on your monthly bus pass, or put your gym membership on hold.

- Monthly debt payments: Your creditors would generally prefer you to contact them if you are experiencing a financial hiccup rather than be forced to hound you after a missed payment. Call your lenders and ask for a payment pause or a reduction in your monthly payment.

Work your (social) network

One of the best ways to find new opportunities is via social media. Announcing your change in employment status online gives your network a chance to offer help and amplify your message. It also indicates to employers that you’re open to work.

Just mind your social media Ps & Qs. That means no bad-mouthing your old job or expressing bitterness, anger, or despair.

Getting back in touch with old friends and colleagues, online or IRL, can also help your job search and your mental health. You’ll have a chance to reconnect and put out more feelers into the world of work.

Take care of your biggest asset

Being unemployed can feel demoralizing. Don’t let yourself fall into unhealthy patterns that can exacerbate your stress. Exercising, socializing, and otherwise taking care of your mental and physical health should be a priority while your job searching.

Stick the landing

Getting laid off is no one’s idea of a good time, but it also doesn’t have to be a disaster. Planning ahead, doing your research, and making intentional financial choices can all help you get to the other side of a layoff in one piece.

Emily Guy Birken is a Milwaukee-based personal finance writer. Her books include The 5 Years Before You Retire, Choose Your Retirement, Making Social Security Work for You, and End Financial Stress Now.

[ad_2]

Source link