[ad_1]

Wingtra’s drones are used to perform surveying missions by organizations around the world, including NASA and the Army Corps of Engineers. Now the startup is mapping out a new expansion strategy after landing $22 million in Series B funding, which it will use to improve its current tech and add new features. “Our product roadmap is high confidential, but let’s say our high-level vision looking a decade or so forth is to take people out of the loop and have a completely automated data collection, processing and analysis,” co-founder and CEO Maximillion Boosfeld told TechCrunch.

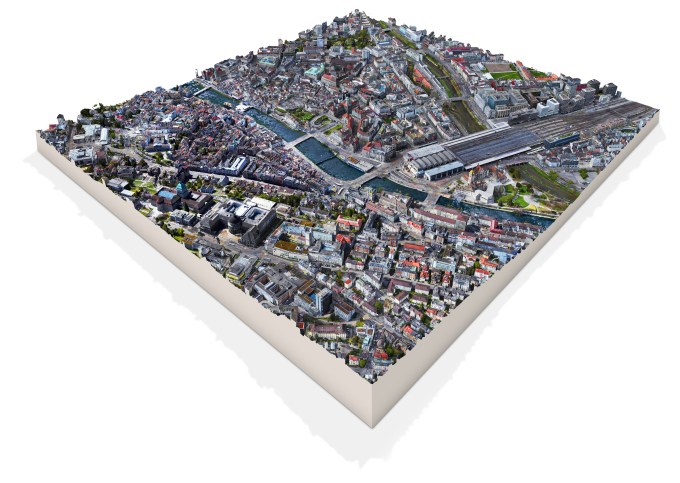

Based in Zurich, Switzerland, with offices in Fort Lauderdale and Zagreb and nearly 200 employees, Wingtra says it is the world’s largest producer of commercial vertical take-off and landing (VTOL) drones. It makes mapping drones, develops software for fully autonomous flights and the WingtraPilot app, which collects and processes aerial survey data. Wingtra drones are used by surveyors in a wide range of industries, including construction, mining, environmental monitoring, agriculture, urban planning and land management.

Out of the images collected with the WingtraOne drone

Investors in Wingtra’s Series B in aerial mobility fund DiamondStream Partners, EquityPitcher Ventures, Verve Ventures, Ace & Company, the European Innovation Council Fund (EIC Fund), Ace & Company and Spring Mountain Capital Founder John L. Steffens.

The genesis of Wingtra came together in 2014 when Boosfeld, Basil Weibel, Elias Kleimann and Sebastian Verling started working on a thesis paper while studying at ETH Zurich’s Autonomous Systems Lab. The paper proposed a design for a small unmanned aerial vehicle that could take off and land vertically like a helicopter, but transition to a fixed-wing mode for long-range flight.

While still working on their thesis, the four registered Wingtra as a company to develop and commercialize the tech. They got accepted into the Wyss Zurich accelerator program, an incubator for commercializing scientific breakthroughs from ETH Zurich and the University of Zurich. During their time in the program, the Wingtra One, a professional mapping and surveying UAV, was developed.

Wingtra’s flagship drone is now the WingtraOne VTOL commercial drone, which it says is used by hundreds of businesses and organizations in 96 countries, including, NASA, Texas A&M University, The Ohio State University, CEMEX, Rio Tinto, Army Corps of Engineers and Kenya Red Cross. In total, WingtraOnes make more than 100,000 flights each year, and has mapped 18 million acres of land and sea.

The startup’s second generation drone, released in 2021, is called the WingtraOne Gen II and creates survey grade 2D and 3D maps with RGB cameras. Wingtra says that a single flight covering over 100 hectares can be digitized at 0.5 in/px, or up to 30 times faster and 90% cheaper than terrestrial surveying.

The three main industries Wingtra sells to are construction and industry, urban planning and land development and mining.

Boosfeld told TechCrunch that the biggest challenge of managing such large assets is is the availability of up-to-date, accurate and affordable data. Lack of data leads to inefficiencies, high costs and preventable CO2 emissions. But terrestrial surveying is labor intensive and can be dangerous, such as in the case of large construction sites, and impossible to do without risking lives and fines when there are natural disasters like landslides.

Wingtra dones are meant to be operational under all those conditions, and make asset management more efficient and sustainable at scale. The startup says they are capable of collecting survey-grade data up to 30 times faster than other surveying methods, including other drones or terrestrial tools, and need minimal training to operate because of the WingtraPilot app’s simple operations system and automated route planning.

One example of an organization that uses Wingtra drones to make collecting surveying data more efficient is the Alabama Department of Transportation (ALDOT), which uses them to oversee the upkeep and maintenance of the state’s roadway infrastructure. The ALDOT flies drones over construction projects each business day of the week and uses data collected to help with things like making sure erosion control measures, including silt fences, are installed properly.

Another example of how Wingtra is used is the Red Cross in Kenya, which deployed the startup’s drones and software to manage a major locust invasion. Data gathered using Wingtra was able to track the migration of locust swarms, crop damage and ultimately make decisions about how to mitigate the invasion.

In terms of competition, Wingtra’s best-known rivals are eBee from AgEagle and DJI’s Phantom 4 RTK and M300. Boosfeld says eBee is the first drone that paved the way for accessible industry level drone photogrammetry. Both lead the survey and mapping fields for different reasons—eBee X is a well-industrialized and reliable fixed-wing survey and mapping drone, while WingtraOne offers VTOL combination with top-grade image quality for coverage. But their key differentiation is their take-off and landing technology, said Boosfield.

WingtraOne’s VTOL lets it lift off and touch down like a multicopter, before transitioning to fixed-wing to cover wide areas. On the other hand, the eBee X is a traditional fixed wing drone that requires hand launching and lands on its belly, which Boosfield explains means operators need to make sure launches and landings happen with wide clearance and on terrain that is dry and soft enough to support it. He added that higher-end aerial mapping cameras are heavy and fixed-wing drones like eBee X cannot support their weight. “Currently, only VTOL drones can offer image resolution of 42MP, which translates to better accuracy, and ultimately more reliable map reconstruction,” he said.

As for the Phantom 4 RTK, Boosfield said even though it is marketed as a survey and mapping drone, it doesn’t have much in common with the WingtraOne. Unlike WingtraOne, Phantom 4 RTK is a typical multirotor, which means it behaves in air like a a helicopter. This difference means the WingtraOne is capable of the much broader coverage demanded by most mapping projects, while multirotors like Phantom 4 RTK cover relatively limited areas.

DJI’s M300 is a large multirotor that Boosfield says is a good drone for inspection, search and rescue and other medium-range applications, but is less efficient than dedicated mappying systems. For example, even though it is bigger than the Phantom 4, it is still a multirotor that relies exclusively on sizable batteries to lift it.

Wingtra also doesn’t have to deal with the political issues that DJI does in the U.S. market, where it is blacklisted by the U.S. Defense Department because of alleged ties to the Chinese military.

In a statement about the investment, DiamondStream Partners’ Dean Donovan said, “We are very excited about partnering with Wingtra. The product’s simplicity of use, its high reliability engineering, and the company’s global network of value-added resellers and service providers have positioned it to expand its leadership in the $83+ Billion mapping segment of the aerial intelligence market globally. We look forward to helping the company in the United States and Latin America, which will be increasingly important geographies as Wingtra continues to expand.”

[ad_2]

Source link