[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

US defence secretary Lloyd Austin played down the significance of a potential Ukrainian retreat from the eastern city of Bakhmut, as Russia’s months-long offensive came closer to encircling the city.

-

US private equity group Silver Lake and one of Canada’s largest pension funds have offered $12.4bn to buy experience management software company Qualtrics, in what could be one of the largest buyouts of the year.

-

Boeing is joining forces with rival Airbus in the £1bn contest to replace Britain’s battlefield helicopter as concerns rise that the original in-service date of 2025 can no longer be met.

For up-to-the-minute news updates, visit our live blog

Good evening.

China is aiming for growth of just 5 per cent this year, its lowest target in more than three decades, as the world’s second-largest economy tries to bounce back from pandemic disruption.

The conservative figure, announced by outgoing premier Li Keqiang at the National People’s Congress, the annual rubber-stamp parliament which began yesterday, should be easy to hit as household consumption rebounds. But it is also further confirmation that the era of double-digit increases has come to an end.

Investors were clearly disappointed, with copper, oil and iron ore leading global commodity markets lower on the news.

It also took the gloss off last week’s data which showed manufacturing activity expanding at the fastest rate in a decade, with the country’s exporters on a major charm offensive at world trade fairs.

Chinese defence companies at least will be happy with the promise of military spending increasing by more than 7 per cent. Taiwan not so much.

Li also set a budget deficit target of 3 per cent of GDP, and pledged to create 12mn urban jobs and keep the unemployment rate at about 5.5 per cent. He also promised to expand market access for foreign investors and address ongoing problems in the country’s property sector.

Li’s boss, President Xi Jinping, China’s most powerful leader since Mao Zedong, is expected to use the Congress to announce sweeping, centralising changes to his administration, with loyalists taking charge of key portfolios such as finance and tech.

There was also acknowledgment from the platform that “many difficulties and challenges still confront us”.

These include slowdowns in the rest of the world weakening demand for Chinese goods, alongside “escalating” attempts “to suppress and contain China’s development”, a reference to US controls on semiconductor technology.

US chipmakers must now agree not to expand capacity in China for a decade to become eligible for new federal subsidies, while a new Congressional committee has been formed to investigate the “ideological, technological and military threat” of the Chinese Communist party. Just last week Washington added another two dozen Chinese groups to its trade blacklist, accusing them of assisting China’s military and surveillance tech exporters.

Hong Kong, meanwhile, is coming up against stiff competition from Singapore in the battle to remain Asia’s leading financial hub.

A lacklustre economic performance could also act as a brake on wider global recovery: the IMF is counting on China and India to account for half of global growth this year — with the US and euro area at just 10 per cent.

Need to know: UK and Europe economy

UK construction activity was better than expected in February, according to new PMI survey data that showed the highest growth rate in nine months as the outlook for commercial projects improved. On a more downbeat note, the government’s pledge to build 40 hospitals is looking ever more hollow as inflation eats in to the budget.

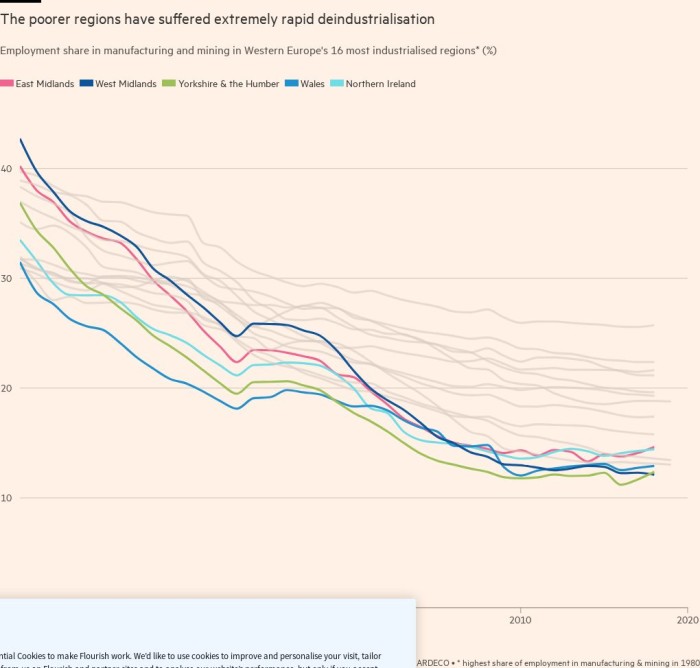

Chancellor Jeremy Hunt is set to use his March 15 Budget to give households more help with energy bills but economic forecasts suggest he will have little room for big giveaways. Chief economics commentator Martin Wolf says the challenge of “levelling up” of regional inequalities is even more difficult than widely thought.

European Central Bank chief Christine Lagarde warned that underlying price pressures would remain “sticky in the short term” and signalled that further interest rate rises were very likely as “inflation is a monster that we need to knock on the head”.

Estonia’s prime minister Kaja Kallas won a resounding victory in parliamentary elections, with her liberal Reform party taking 37 of 101 seats. The country of 1.3mn million people, which borders Russia, has been one of the EU’s most vocal supporters of Ukraine.

Need to know: Global economy

Columnist Rana Foroohar says the conventional wisdom that America leads on innovation and Europe on regulation has been reversed as the US tightens control over sectors such as tech, pharma and finance.

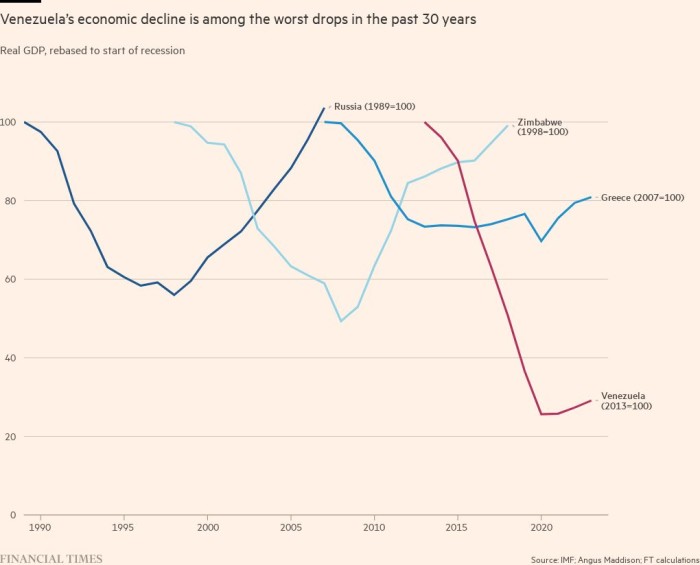

As Venezuelan leader Nicolás Maduro approaches his tenth anniversary as president, our Big Read explains how he remains very much in control, using both old-fashioned repression and more modern techniques such as AI-generated media content.

Need to know: business

The boss of BP’s US business insisted that the company was not cashing in on high oil prices and was sticking with its promised transition away from fossil fuels.

US-listed tech groups face a cash crunch after burning through billions from IPOs. As the proceeds from a period of frenzied dealmaking start to run low, many face a choice between expensive capital raises, cost cutting, or takeovers.

Business in Northern Ireland hailed last week’s Brexit trade deal with the EU, but for farmers in England, hope is fading fast for any kind of Brexit dividend.

The boss of Harrods said he was confident that the luxury department store would prosper in a downturn because “the rich get richer in a recession”. The remarks follow bullish reports from luxury companies such as Hermès and LVMH.

A new FT film documents the rise and fall of Sam Bankman-Fried’s FTX cryptocurrency exchange. “Regulators fell for it, venture capitalists fell for it, celebrities fell for it — everyone fell for the legend of Sam.”

The World of Work

How should companies carry out mass lay-offs without inflicting lasting damage on morale and future growth? US financial editor Brooke Masters says few companies appear to be trying to find creative ways to cut labour costs.

News that women now hold many more board seats in UK listed companies is welcome, but this means it will be become harder than ever to argue there are not enough with experience to be a chief executive or chair, says columnist Pilita Clarke.

Dilbert, the cartoon character who has chronicled cubicle culture since the 1990s, has been handed his pink slip. The strip has been dropped by US newspapers after its creator waded into a race controversy.

Some good news

A deal to protect the nearly 60 per cent of the world’s oceans that lie outside national boundaries has been agreed after nearly two decades of on-off negotiations. The High Seas Treaty was described by the UN as a “massive success for multilateralism and “an example of the transformation our world needs and the people we serve demand”.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link