[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

EU member states have warned Brussels against giving Ukraine an unrealistic expectation of rapidly joining the bloc, ahead of a summit in Kyiv where Volodymyr Zelenskyy is pressing for progress on accession and reconstruction.

Zelenskyy is due to host his EU counterparts Ursula von der Leyen and Charles Michel this week and is expected to lobby for the country’s EU membership, the use of frozen Russian assets to fund Ukraine’s reconstruction and a legal mechanism to prosecute Russians for war crimes.

Senior diplomats from EU capitals are concerned that unfeasible Ukrainian expectations — including EU accession by 2026 — have been encouraged rather than tempered by Brussels’ top officials.

“No political leader wants to be on the wrong side of history . . . Nobody wants to be blamed for not doing enough,” said one senior EU diplomat. “So they tell them it’s all possible.”

In response to Russia’s invasion last February, the EU scrambled to support Ukraine through military, humanitarian and financial packages, including sanctions against Russia that have hit the bloc’s own economies.

The EU also took the unprecedented step of making Ukraine an official membership candidate, despite the country falling short of the standard requirements.

Five more stories in the news

1. YouTube Shorts takes on TikTok YouTube will today introduce a revenue sharing scheme on Shorts, its short-form clips offering. The division of Google parent Alphabet will allow content creators to take a cut of advertising profits from their videos in a bid to lure them away from fast-growing rival TikTok, as the social media platforms battle for younger users.

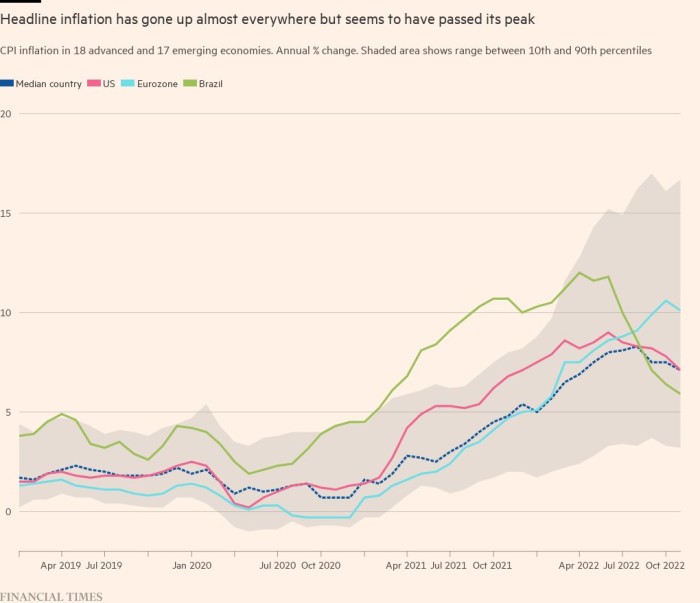

2. Eurozone mortgage demand falls Demand for housing loans in the eurozone fell at a net percentage of minus 74 per cent, the fastest pace on record. The figure from the European Central Bank was the lowest since records began in 2003 and a decline from minus 42 in the previous quarter, mainly driven by interest rates, lower consumer confidence and deteriorating housing market prospects.

3. Sunak faces crunch decision on N Ireland UK prime minister Rishi Sunak is facing a big test of his authority as a deal to resolve post-Brexit trade disputes in Northern Ireland takes shape. Sunak will have to sell the deal to pro-UK unionist politicians in the region and Eurosceptic Tory MPs.

4. US and India launch new tech and defence initiatives New technology, space and defence initiatives between the two countries reflect an effort to counter China in the Indo-Pacific, wean New Delhi off its reliance on Russia for weapons and boost India’s homegrown technology capacity.

5. Gautam Adani pulls off $2.4bn share sale The Indian billionaire has completed a $2.4bn equity sale despite a short-seller report alleging fraud and stock manipulation at his industrial empire. The share sale at Adani Enterprises, the magnate’s flagship group, became a test of investor faith after Hindenburg Research last week alleged financial misconduct across Adani Group.

-

Under scrutiny: Adani Group has doubled borrowing to $30bn in the past four years, raising questions about whether it is overleveraged.

The day ahead

Federal Reserve meeting The Fed ends a two-day meeting where it is expected to raise interest rates by a quarter percentage point.

UK strikes Hundreds of thousands of teachers, train drivers and civil servants will join the biggest day of strike action in the UK since 2011, which is expected to cause widespread disruption across England and Wales.

Economic data The EU has the December unemployment rate and flash consumer inflation figures for January. S&P Global publishes the manufacturing purchasing managers’ indices for Brazil, Canada, the eurozone, France, Germany, Italy, Spain, the UK and US.

Corporate results Sports betting company Entain, commodity trader Glencore, GSK, Meta, Netgear, Novartis, Novo Nordisk, Orsted, Peloton, Virgin Money and Vodafone report.

What else we’re reading

Is the IMF right about the UK economy? The fund consigned Britain to the economic doghouse yesterday when it singled out the UK as the only leading economy likely to contract this year. Is the forecast correct? And if so, why is the UK economy growing so slowly, and what can be done about it?

Arming Ukraine is stretching the US defence industry The Javelin anti-tank missile and the Himar rocket launcher, both built by American defence companies, have helped change the course of the war in Ukraine. But the sheer quantity of munitions required has exposed supply chain vulnerabilities, detailed mapping by the Financial Times demonstrates.

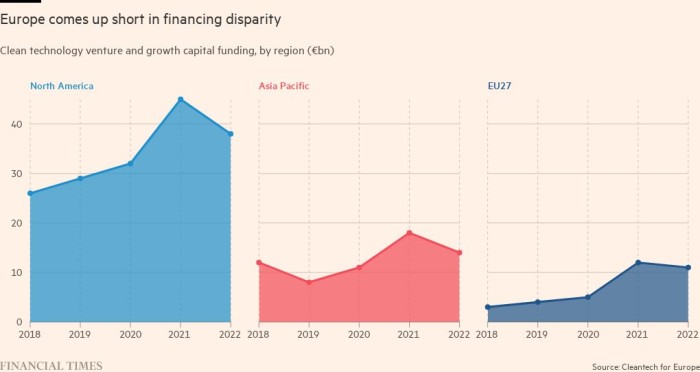

Can the EU keep up with the US on green subsidies? The huge incentives in the Inflation Reduction Act are provoking a debate in Europe with ramifications for the entire single market. As the US and China pour hundreds of billions of dollars into green industries through state funding, some say the EU should go the same way. Others argue more fundamental problems need to be addressed.

How the UAE’s biggest lender pursued StanChart After news leaked last month that First Abu Dhabi Bank wanted to buy Standard Chartered, the UAE’s biggest lender quickly said it was no longer evaluating an offer. But several people close to the lender say the deal could be revived after a cooling-off period ends in July.

Saudi Arabia’s ambitious tourist push Saudi Arabia wants to lure 100mn visitors annually by the end of the decade. Despite its ambitions, there are doubts about whether the deeply conservative kingdom, where alcohol is forbidden and unmarried couples theoretically face prosecution, can compete with the party vibe of Dubai or the mix of beaches and history in Egypt.

Take a break from the news

In the medieval mountain town of Mestia, Georgia, a team of guides is opening up a new frontier for adventure-seeking skiers. In this story, complete with impressive photos, Simon Usborne explores the deep snow and delicious dumplings that the region has to offer.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link