[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning and as business leaders and policymakers gather for the first day of the World Economic Forum in the Swiss ski resort of Davos there is a warning that the world’s biggest companies are facing multibillion-dollar writedowns on recent acquisitions.

US media and healthcare companies are among those to have slashed the value of business units in the past few months, and accountants at valuation service Stout are warning that more cuts could be imminent as the annual reporting season gets under way.

An era of high interest rates, rising inflation, geopolitical uncertainty and climate chaos is undermining business confidence around the globe. In a recent column, the academic Adam Tooze said the world was facing a “polycrisis”.

Gideon Rachman, the FT’s foreign affairs commentator, wrote yesterday that “the fear haunting the WEF is that a long period of peace, prosperity and global economic integration could be coming to a close — just as it did in 1914”.

-

FT Live: The FT will be at Davos covering the news but also hosting a series of in-person and digital events with leaders in policymaking, business and finance. View the events and register for free.

Five more stories in the news

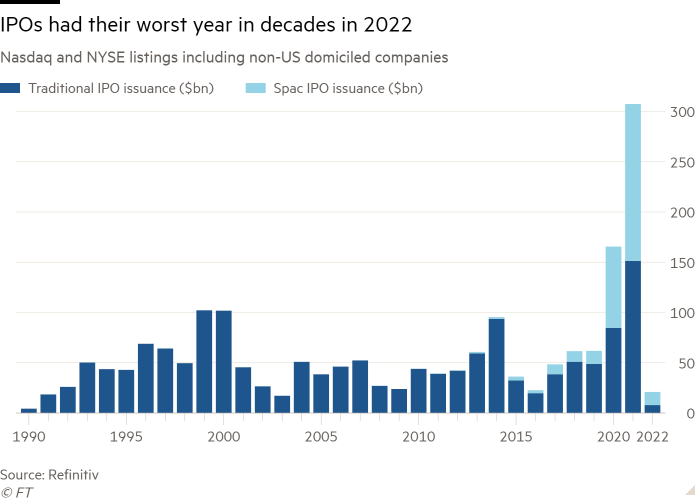

1. US companies turn to convertible bonds December was the busiest month of 2022 for convertible issuance by deal count, according to Refinitiv data, after an otherwise “dead” year. Extreme volatility and rising interest rates made last year the worst year for traditional stock market listings in the US since 1990. But debt that includes an equity component has seen a pickup in activity.

2. US cracks down on private equity securitisation vehicles Regulators are cracking down on a type of investment vehicle used by the private equity industry over fears that rating agencies are downplaying the dangers of the products and exposing insurers to under-appreciated risks. The vehicle, known as “collateralised fund obligations”, echo the “collateralised debt obligations” that played a central role in the 2008 financial crisis. Private capital correspondent Kaye Wiggins explains.

3. Taiwan presidential contender sparks US concerns over China tensions Taiwan’s ruling Democratic Progressive party yesterday elected Lai Ching-te, a man virtually unknown outside his country, to be its chair and likely next leader ahead of an election in 2024. Lai, described as a “deep green” or someone with radical pro-independence leanings, is expected to face Hou Yu-ih, the popular mayor of the country’s largest municipality and a member of the more China-friendly opposition party.

4. Bayer shuns ‘innovation unfriendly’ Europe The German pharmaceutical company has said it is shifting the focus of its drugs business to the US and away from Europe, where governments are making “big mistakes” in how they manage health budgets. Stefan Oelrich, head of Bayer’s drugs business, told the Financial Times that policies such as a medicines levy in the UK and similar schemes in Germany were dissuading investment.

5. Ford to rely less on Volkswagen The US automaker is poised to cut its dependence on Volkswagen technology for its next generation of electric cars in Europe, unravelling a core part of the alliance formed by the rivals two years ago. Ford is preparing to launch vehicles this year and next using VW-sourced batteries, but expects to use an in-house system from 2025.

The day ahead

N Ireland trade talks UK foreign secretary James Cleverly holds talks with European Commission vice-president Maroš Šefčovič on the Northern Ireland protocol after a tentative breakthrough last week.

Military drills in Belarus Belarus and Russia begin joint aviation drills of air divisions as part of the countries’ regional grouping of troops.

Martin Luther King Day Banks, stock markets and Congress will be closed in the US today as the country observes a national holiday to honour civil rights activist Martin Luther King Jr.

China’s GDP China’s National Bureau of Statistics will tomorrow release what is expected to be another set of disappointing economic growth figures. Here are five things to look out for.

What else we’re reading

What the end of the US shale revolution would mean for the world Fracking catapulted the US to the top of the energy hierarchy, especially after Russia cut natural gas shipments to Europe and western sanctions targeted Moscow’s oil. But higher costs, labour shortages, low yields and a lack of reinvestment threaten that position.

The Xi nobody saw coming When Xi Jinping consolidated his hold on China’s communist party at its five-yearly congress in October, the last thing anyone expected from the strongman president entering his 11th year in power was a sudden about face. Yet within weeks, Xi’s government had reversed its efforts to control Covid-19, Big Tech companies, the property market and more. The 180-degree turn raises doubts about everything the world thought it knew about Xi, argues Ruchir Sharma.

Enron, Madoff and FTX: New York’s Belfer family The wealthy American oil dynasty was a client of fraudster Bernard Madoff and lost billions in the demise of Enron. Now, it has been embroiled in the collapse of FTX, according to court documents, showing just how far the crypto exchange founder Sam Bankman-Fried penetrated the US elite in his drive to attract investment.

The Henry Mance Interview Tyler Cowen has become a cult figure among a hyper-intellectual elite bent on self-improvement. The eclectic economist champions markets and big business and his latest venture is an online university. “My personal ambition is to be the individual who has done the most to teach the world economics, broadly construed,” he tells Henry.

The lure of Singapore, ‘Asia’s Switzerland’ Chinese wealth is moving into Singapore as individuals and companies view it as an attractive vessel to navigate through US-China tensions, skittish financial markets and a possible global recession. But can the city-state maintain its neutrality?

Take a break from the news

Beaches, baths, spinning and spas — here are five feel-good destinations for 2023.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link