[ad_1]

For a rapid valuation climb, think, ‘What’s the highest risk right now, and how do I remove it?’

You’ve likely heard of pre-seed, seed, Series A, Series B and so on and so forth. These labels often aren’t super helpful because they aren’t clearly defined — we’ve seen very small Series A rounds and enormous pre-seed rounds. The defining characteristic of each round isn’t as much about how much money is changing hands as it is about how much risk is in the company.

On your startup’s journey, there are two dynamics at play at once. By deeply understanding them — and the connection between them — you’ll be able to make a lot more sense of your fundraising journey and how to think about each part of your startup pathway as you evolve and develop.

In general, in broad lines, the funding rounds tend to go as follows:

- The 4 Fs: Founders, Friends, Family, Fools: This is the first money going into the company, usually just enough to start proving out some of the core tech or business dynamics. Here, the company is trying to build an MVP. In these rounds, you’ll often find angel investors of various degrees of sophistication.

- Pre-seed: Confusingly, this is often the same as the above, except done by an institutional investor (i.e., a family office or a VC firm focusing on the earliest stages of companies). This is usually not a “priced round” — the company doesn’t have a formal valuation, but the money raised is on a convertible or SAFE note. At this stage, companies are typically not yet generating revenue.

- Seed: This is usually institutional investors investing larger amounts of money into a company that has started proving some of its dynamics. The startup will have some aspect of its business up and running and may have some test customers, a beta product, a concierge MVP, etc. It won’t have a growth engine (in other words, it won’t yet have a repeatable way of attracting and retaining customers). The company is working on active product development and looking for product-market fit. Sometimes this round is priced (i.e., investors negotiate a valuation of the company), or it may be unpriced.

- Series A: This is the first “growth round” a company raises. It will usually have a product in the market delivering value to customers and is on its way to having a reliable, predictable way of pouring money into customer acquisition. The company may be about to enter new markets, broaden its product offering or go after a new customer segment. A Series A round is almost always “priced,” giving the company a formal valuation.

- Series B and beyond: At Series B, a company is usually off to the races in earnest. It has customers, revenue and a stable product or two. From Series B onward, you have Series C, D, E, etc. The rounds and the company get bigger. The final rounds are typically preparing a company for going into the black (being profitable), going public through an IPO or both.

For each of the rounds, a company becomes more and more valuable partially because it is getting an increasingly mature product and more revenue as it figures out its growth mechanics and business model. Along the way, the company evolves in another way, as well: The risk goes down.

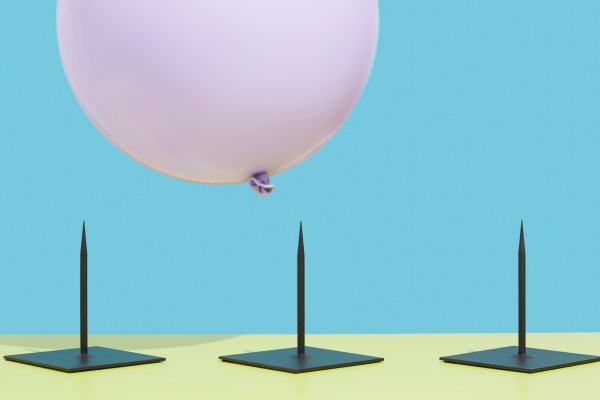

That final piece is crucial in how you think about your fundraising journey. Your risk doesn’t go down as your company becomes more valuable. The company becomes more valuable as it reduces its risk. You can use this to your advantage by designing your fundraising rounds to explicitly de-risk the “scariest” things about your company.

Let’s take a closer look at where risk appears in a startup and what you can do as a founder to remove as much risk as possible at each stage of your company’s existence.

Where is the risk in your company?

Risk comes in many shapes and forms. When your company is at the idea stage, you may get together with some co-founders who have excellent founder-market fit. You have identified that there is a problem in the market. Your early potential customer interviews all agree that this is a problem worth solving and that someone is — in theory — willing to pay money to have this problem solved. The first question is: Is it even possible to solve this problem?

[ad_2]

Source link