[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

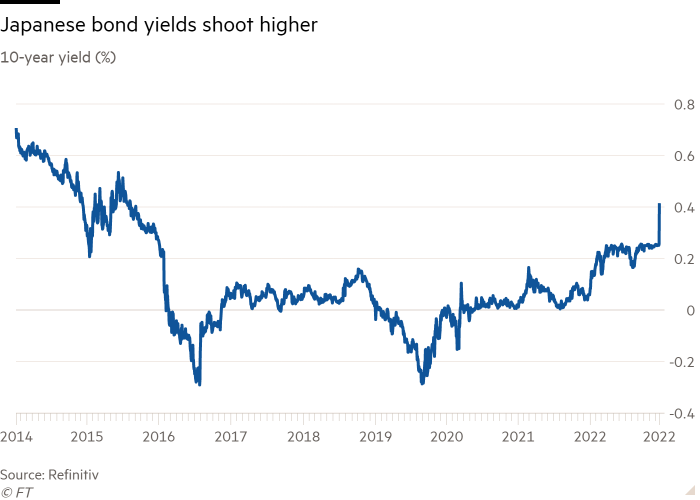

Good morning. The Bank of Japan stunned markets yesterday with a surprise change to its controversial yield curve control policy (YCC), triggering big swings in the currency, bond and equity markets.

The BoJ is the last of the world’s key central banks to stick to an ultra-loose monetary policy and government bond purchases to stimulate growth.

But like elsewhere in the world, inflation in Japan has risen sharply this year. Core inflation — which excludes volatile food prices — has exceeded the BoJ’s 2 per cent target for seven consecutive months, hitting a 40-year high of 3.6 per cent in October.

Japan’s increasingly extreme outlier status has contributed to a huge fall in the yen this year as markets have priced in the differential with the rate-tightening US Federal Reserve.

The central bank said yesterday it would allow 10-year bond yields to fluctuate by plus or minus 0.5 per cent, instead of the previous 0.25 per cent. It kept overnight interest rates at minus 0.1 per cent.

The move triggered a sell-off in global government bond markets. The yield on the 10-year Japanese government bond rose to 0.47 per cent, its highest since 2015. The US 10-year Treasury yield rose 0.11 percentage points to 3.69 per cent while the equivalent UK gilt yield increased by a similar margin to 3.6 per cent.

The yen jumped more than 4 per cent to about ¥131.2 against the US dollar while the Topix equity index fell 1.5 per cent.

Outgoing BoJ governor Haruhiko Kuroda denied that the policy change amounted to a tightening of monetary policy. He said the change was meant to address increased volatility in global financial markets and improve the functioning of Japan’s bond markets.

The BoJ’s efforts to defend its yield curve targets have contributed to a sustained reduction in market liquidity in the Japanese government bonds market, leading to what some analysts have described as “dysfunction”.

The central bank now owns more than half of outstanding government bonds, compared with 11.5 per cent when Kuroda became governor in March 2013.

Mansoor Mohi-uddin, chief economist at Bank of Singapore, said the announcement indicated the BoJ was considering a broader exit from its YCC policy, likening it to the 1989 decision to raise interest rates that led to decades of deflation.

Join FT Live at Davos for a number of in-person and digital events alongside the World Economic Forum Annual Meeting January 16 through January 20. The sessions will gather leaders in policy, business and finance to share insights into the big issues being debated and the solutions that may pave the way to renewed growth, stability and resilience. View the events and register for free here.

Five more stories in the news

1. Putin says war in Ukraine is becoming ‘extremely complicated’ As his invasion nears the 10-month mark, Putin called the situation in Ukraine “extremely complicated”. This is the second time this month he has admitted that the war in Ukraine — which he originally thought would take less than a week — is set to go on for a long time.

2. China’s media promise ‘normalcy by spring’ China’s relaxation of zero-Covid policies is being accompanied by an abrupt shift in official rhetoric on the virus. Now, the country’s state media is seeking to portray an “exit wave” of coronavirus cases sweeping the country as part of a pre-planned strategy.

3. FTX is hoping to claw back SBF’s political donations Crypto exchange FTX is trying to recoup millions of dollars in political donations made by Sam Bankman-Fried in order to pay back creditors. Some recipients are already seeking to return money, and the company’s new management says it will take legal action to get back cash that’s not voluntarily returned.

4. Union chief resigns in EU-Qatar bribery scandal Luca Visentini, the secretary-general of the International Trade Union Confederation, has resigned less than one month after taking office. He admitted late on Monday to taking thousands of euros in cash from former MEP Pier Antonio Panzeri. Panzeri is at the centre of a corruption scandal in which Qatar and Morocco allegedly sought to influence EU lawmakers through bribes.

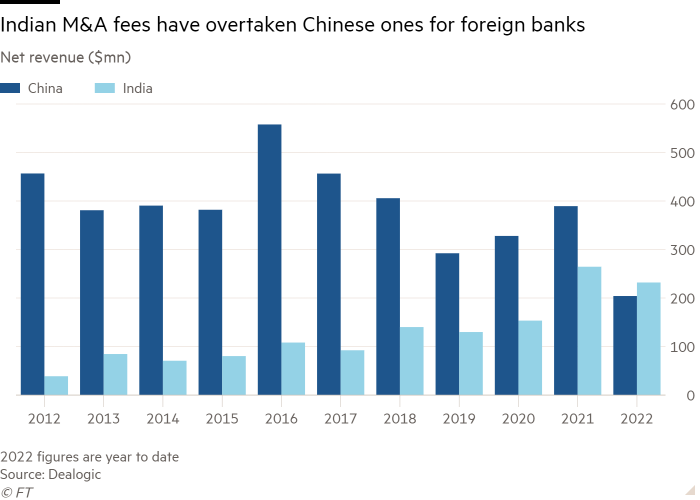

5. India overtakes China in M&A fees for western banks The world’s largest investment banks will earn more dealmaking fees in India this year than in China for the first time. The milestone is indicative of a broader shift by western finance to diversify away from a decoupling Chinese economy.

The day ahead

Ambulance workers strike in the UK More than 1,600 Unite union members at the West Midlands, North West and North East ambulance service trusts will walk out over pay. Also, ambulance staff across most of England and Wales will strike over pay as part of a co-ordinated walkout by the three main ambulance unions Unison, GMB and Unite.

Economic indicators Canada will publish its November consumer price index (CPI) inflation figures. Germany releases the GfK consumer confidence survey. The UK will have its November public sector finances data today, and the US its Conference Board December consumer confidence figures

Corporate results Carnival posts its Q4 results and Rite Aid its Q3 results today. Bunzl will also have a trading update — the provider of hard hats, beard guards and disposable cutlery is expected to confirm a good end to its financial year with good revenue growth, supported by numerous acquisitions announced over the past 12 months.

What else we’re reading

The great green office crunch Buildings account for 39 per cent of global energy-related carbon emissions, and new environmental regulations to tackle the problem are kicking in at the worst possible time. Acres of office space around the world, worth hundreds of billions, are now at risk of redundancy.

Private equity moves into hospital ERs For a private equity industry that has made billions of dollars by assembling car washes, dentists’ offices, and local businesses into efficiently run national chains, a “roll up” of hospital emergency rooms seemed like a sound plan. But the titans of finance had not reckoned on the backlash from doctors.

Billionaire Oleg Deripaska’s Sochi hotel complex seized A Russian court has ordered the seizure of the $1bn Imeretinskiy hotel complex and marina owned by billionaire Oleg Deripaska after the Kremlin asked the oligarch to stop criticising the war, the FT has been told by people familiar with the matter.

Silicon Valley start-ups race for debt deals in funding crunch A sharp decline in venture capital dealmaking and a closed market for initial public offerings have resulted in a funding crunch for many private technology companies, leading start-ups that have traditionally relied on deep-pocketed Silicon Valley investors to turn to alternative financing deals.

3M to end ‘forever chemicals’ production as pressure builds The manufacturing conglomerate has said it will phase out Pfas — chemicals used in products such as mobile phones and non-stick pans — by the end of 2025, citing pressure from regulators and investors over the accumulation of the long-lived substances in the environment. The transition is estimated to cost the company up to $2.3bn.

Best pop albums of 2022

Pop critic Ludovic Hunter-Tilney picks his 10 favourite albums of the year.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link