[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

-

The EU has put a last-minute deal on the table at the COP27 conference over a fund to support countries most vulnerable to climate change. Get the latest at our Climate Capital hub.

-

Billionaire Masayoshi Son personally owes SoftBank close to $5bn because of growing losses on its technology bets. The founder of the Japanese conglomerate has also lost his stake in the group’s second Vision Fund.

-

A fresh wave of employees have quit Twitter after owner Elon Musk’s insistence they should commit to an “extremely hardcore” working culture.

For up-to-the-minute news updates, visit our live blog

Good evening,

“Awful for households, awful for businesses, awful for society as a whole, and awful, electorally, for the government.”

That was FT columnist Stephen Bush’s verdict on the biggest drop in UK household income since the 1950s, as detailed by the Office for Budget Responsibility yesterday alongside chancellor Jeremy Hunt’s Autumn Statement.

Think-tanks and others weighed in today with more criticism of Hunt’s package of £30bn in spending cuts and £25bn in tax rises, which he hopes will stabilise the economy after the spectacular crash-and-burn of his Tory predecessors just last month.

The Institute for Fiscal Studies said Britain was entering a “new era” of higher taxation and public sector austerity because of its failure to create economic growth.

IFS director Paul Johnson said it was “a grim place to be”, with “high borrowing, high debt, high tax and yet a lot of public services feeling under strain”. Or, as FT chief economics commentator Martin Wolf put it, Hunt offered no jam today and no jam tomorrow.

The Resolution Foundation focused on the OBR forecasts showing that average wages would not regain 2008 levels until 2027. Such a prolonged stagnation has not been experienced in the UK since the 1820s, according to figures calculated by the FT.

Although Hunt hit back at charges that he was targeting middle-earners, there were more signs today of the pressure on household finances as Nationwide, the UK’s largest building society, warned of an increase in bad loans.

Political reaction from all sides was less than complimentary. The right criticised the tax rises, while others bemoaned the failure to mention Brexit — an “economic own goal” as the IFS’ Johnson put it — as a key source of the UK’s troubles. Mark Littlewood, director of the Institute of Economic Affairs, said the statement was a “recipe for managed decline”, rather than a plan for prosperity.

While business groups welcomed the decision to provide relief on business rates, the Federation of Small Businesses said investment would be hit by Hunt’s tax raids, arguing that his plans were “high on stealth creation and low on wealth creation”. Experts warned that the new stealth taxes on capital gains and dividends risked holding back UK entrepreneurs and could prompt them to sell. There were harsh words too from the tech and science communities on the decision to scale back R&D tax credits.

The chancellor can however take some comfort that there was no wildly adverse reaction from financial markets this time around and can take credit for restoring the country’s fiscal credibility, the FT editorial board said.

Now that the UK government has steadied the economic ship, the FT editorial board added, “it must develop a serious and credible plan to get Britain’s economy growing again. If it fails to do so, it will jettison whatever slim hope it may retain of winning the next election and leave Britain facing years of painful austerity and stagnation.”

Last word of today goes to the IFS’ Johnson: “We are . . . reaping the costs of a long-term failure to grow the economy, the effects of population ageing, and high levels of past borrowing. The truth is, we just got a lot poorer. We are in for a long, hard, unpleasant journey.”

Essential links:

Need to know: UK and Europe economy

UK retail sales grew a better than expected 0.6 per cent in October but remain below pre-pandemic levels, with the longer-term trend still heading downwards.

Read the story of how G20 leaders managed to cobble together support for a (qualified) condemnation of Russia’s war in Ukraine. French president Emmanuel Macron told the FT that China’s ability to pressure Russia was proving “extremely useful”.

Russia’s economy shrank 4 per cent in the third quarter because of the effect of western sanctions, sending the country into recession. The country’s central bank expects a drop of 3 to 3.5 per cent for the year.

Ireland, aka “Europe’s Silicon Valley”, has enjoyed many economic benefits from its decades-long focus on global IT, but the possible bursting of the tech bubble leaves the government needing to rebalance.

Need to know: Global economy

Republicans are back in control of the US House of Representatives, albeit by a tiny margin, after the final midterm election results dribbled in.

The newly-sworn in Iraqi government of Mohammed Shia al-Sudani is reeling from the “heist of the century” after $2.5bn was allegedly spirited away from tax authorities.

Peru’s new finance minister — the country has had almost as many as the UK this year — admitted that the country’s rolling dysfunction was putting off investors. Chile, Colombia and now Brazil have followed Peru in electing new leftwing presidents. Listen to Latin America editor Michael Stott explain the changing nature of the region’s political map.

The World Cup finally kicks off this weekend in Qatar. Is there an ethical case for watching what many believe is a highly unethical event? And how will fans cope without a beer? Whatever you decide, our experts have all bases covered, on and off the pitch.

Here’s our film on the likely legacy of the tournament.

Need to know: business

UK ministers blocked the sale of Newport Wafer Fab, Britain’s biggest chipmaker, to Chinese-owned Nexperia. The acquisition was halted under new powers the government has to limit transactions involving strategic national assets.

Britain also has a difficult decision to make on its space industry after uncertainty over continued participation in the EU’s Copernicus Earth observation programme, as well as the €95bn Horizon research fund.

Our Big Read considers whether cultural and operational issues at digital bank Revolut could hinder its acceptance by UK and European regulators.

The chemicals and agribusiness sector is one of the hardest hit by the disruption caused by the war in Ukraine. Read more in our special report: Chemicals and Manufacturing.

Yuji Naka, a celebrated Japanese video game programmer and co-creator of Sonic the Hedgehog, has been arrested over an alleged insider dealing scam.

Science round-up

China’s doctors warned they were not ready for a potential Covid “exit wave” as restrictions ease, with too much effort going into containment rather than building robust defences. Confusion reigns in Guangzhou where local officials are trying to interpret Beijing’s relaxation of rules while handling a record Covid outbreak.

UK Covid infections have fallen to their lowest level in seven weeks.

America’s space race with China intensified as Nasa successfully launched Artemis, the first mission to the moon in half a century. Artemis aims to be the launch pad for sending humans to Mars.

A global decline in sperm counts is accelerating after levels fell by more than half between 1973 and 2018, according to new research.

Simple invention has the power to change the world, says columnist Tim Harford. So why did we not hear more about Dr Dilip Mahalanabis’ rehydration treatment for cholera?

Covid cases and vaccinations

Total global cases: 630mn

Get the latest worldwide picture with our vaccine tracker

Some good news

University of Edinburgh scientists have discovered that parasites from the ancient disease leprosy have the potential to regenerate livers.

Something for the weekend

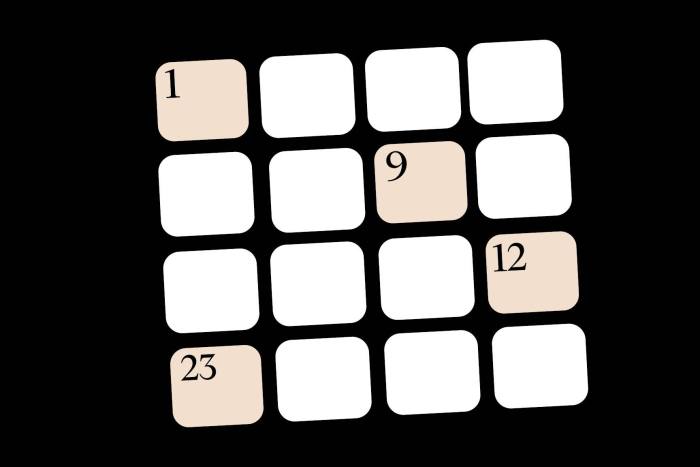

The FT Weekend interactive crossword will be published here on Saturday, but in the meantime why not have a go with today’s cryptic crossword.

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link