[ad_1]

US jobs growth rose at an unexpectedly rapid clip in October, defying expectations for a larger slowdown as the historically tight labour market again showed resilience in the face of the Federal Reserve’s aggressive efforts to curb demand.

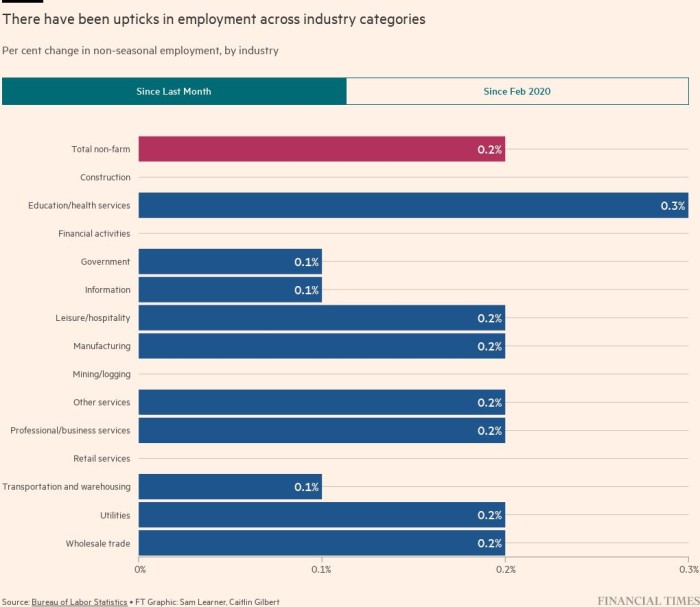

The economy added 261,000 positions last month, according to data released by the Bureau of Labor Statistics on Friday, more than consensus forecasts of 200,000. The figure was down from an upwardly revised 315,000 in September and 292,000 in August. On average this year, the economy has added 407,000 jobs each month, compared with a monthly increase of 562,000 in 2021.

Despite these gains, the unemployment rate ticked up to 3.7 per cent, just above its pre-pandemic low.

The red-hot labour market has long been a source of discomfort for the Fed as the US central bank seeks to restrain economic growth in order to bring decades-high inflation under control. Acute worker shortages have helped to drive up wages as employers seek to fill positions, helping to stoke inflation.

Fed chair Jay Powell described the labour market as “overheated” on Wednesday at a press conference following the central bank’s decision to lift the federal funds rate by 0.75 percentage points for the fourth time in a row. Citing recently released data that showed both labour costs steadying and job vacancies unexpectedly climbing, he warned he does not “see the case for real softening yet”.

Fuelling October’s jobs gain was a rise in employment across the healthcare industry, professional and technical services and manufacturing. The number of leisure and hospitality jobs also swelled by 35,000. Construction and retail were among the sectors to report no monthly increase in positions.

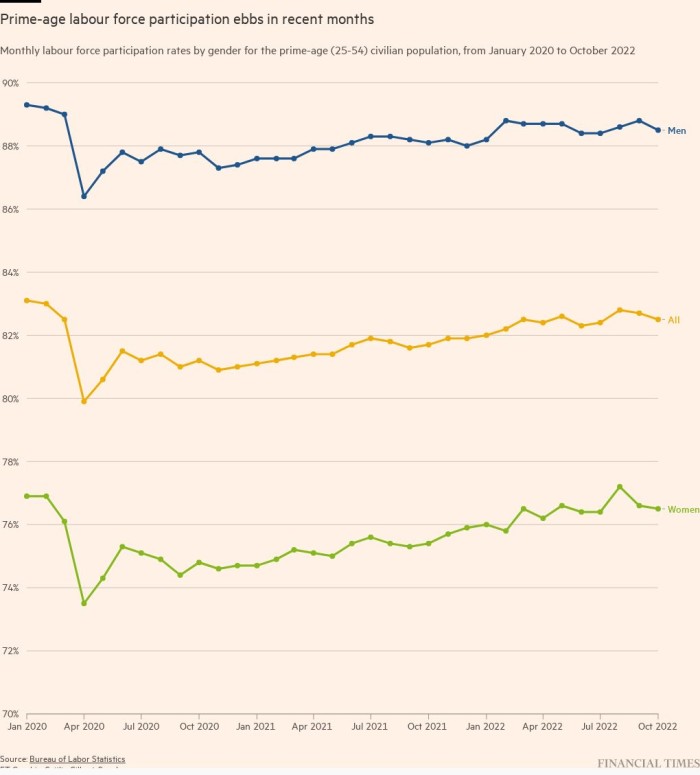

The share of Americans either employed or seeking a job — known as the labour force participation rate — again failed to improve in October, steadying at 62.2 per cent. Average hourly earnings rose 0.4 per cent, more than expected and an acceleration from September’s increase. The annual pace steadied at 4.7 per cent.

“You’re still looking at very strong wage growth and stubbornly low supply, so the Fed still very much has an inflation problem on its hands,” said Sarah House, senior economist at Wells Fargo. “We’re not seeing the easy way out of this inflation, which is more labour supply.”

Powell on Wednesday cautioned that wages were “flattening out” at a level that is “well above” what would be consistent with inflation returning to the Fed’s 2 per cent target. Despite evidence that the economy is not cooling as rapidly as expected, the chair this week signalled the Fed would consider reducing the pace at which it is raising interest rates. That potential change could come either as soon as the December meeting or one after that, given not only how far rates have risen this year but also the lagged effect of policy changes on the real economy.

The potential course adjustment from the US central bank comes after it pushed the fed funds rate to a range of between 3.75 per cent and 4 per cent, a level that will more forcefully curb activity.

Powell made clear that a slower pace will not mean an easing up of the fight against inflation, however, he did warn that the policy rate would reach higher levels than expected. Following the latest jobs report, markets have now priced in fed funds rate peaking above 5 per cent next year.

A higher so-called terminal rate further reduces the odds the Fed can avoid tipping the economy into a recession, economists warn, with the unemployment rate likely to rise above 5 per cent.

“For now they have a sole priority and that is bringing inflation down,” said Bob Michele, the head of fixed income, currencies and commodities at JPMorgan Asset Management. He added that Powell on Wednesday had tried to “tell the market that they weren’t going to pivot or pause [because] they are still concerned about inflation.

US government debt, which has dropped in value this year alongside the Fed’s policy actions, initially came under another bout of selling pressure on Friday, but retraced much of that move. The yield on the 10-year Treasury — a benchmark used to set borrowing costs for consumers, businesses and other governments across the globe — was up 0.03 percentage points to 4.15 per cent. Yields rise when a bond’s price falls.

The S&P 500 was up 1.3 per cent shortly after the opening bell.

“Payroll growth isn’t slowing fast enough and wages aren’t slowing as quickly as August and September data initially suggested,” Thomas Simons, an economist with Jefferies, said. “This keeps another 75 basis point hike on the table for the December [Fed] meeting, though obviously we have lots more data between now and then.”

[ad_2]

Source link