[ad_1]

This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday

Trade Secrets comes to you from Washington today, where I am standing in for Alan. As we head into next week, all ears are open for word from the working group set up by the US and EU to try and head off the massive green trade war they’re barrelling towards. Charted waters today looks at the reinvigorated debate over Brexit and its consequences for UK economic growth.

The road to resolving discord over Inflation Reduction Act

To recap: the US passed its enormous package of tax credits intended to boost domestic green energy industries, with a “made in America” flavour. Extra credits are awarded for electric vehicles that are made in the US, and more again for cars that cut China and other “foreign entities of concern” out of the supply chain.

But the law has come under attack, not just from the EU and other US trade allies, but from some US companies too.

The EU, for its part, has lodged a series of complaints, not just against the electric vehicle tax credit, but on credits linked to renewable energy, sustainable aviation fuel, clean hydrogen and clean electricity. It has accused the US of discriminatory trade practices, and fretted that potential European investment will be lured away to the US by lucrative tax breaks and subsidies.

Elsewhere, lobbying is being done by US companies resistant to unwinding their global supply chains.

What can be done? Altering the letter of the law is tricky. Taking flagship, vote-winning legislation that has attracted global kudos back to Congress for amendments isn’t on the menu of options open to the Biden administration.

All eyes now are on the slightly-less-sexy implementation process being spearheaded by the US Treasury and Internal Revenue Service. The imaginations of lawyers and trade lobbyists are going into overdrive thinking up creative reinterpretations and definitions of some of the legislative text’s key phrases and clauses.

To take a slightly amusing (but seriously being mooted) example — the legislation awards credits for electric cars built using batteries with minerals mined from a country with whom the US has a “free trade agreement”.

Well, some lawyers argue that the lack of capital letters here means this might not mean a Free Trade Agreement — that is, a partner country with whom the US has a Congressionally approved trade deal, but could indicate a looser affiliation. Say, perhaps, the US’s “mini deal” with Japan — could that be included? Or, more optimistically, perhaps it could refer to all twenty countries party to the WTO’s Agreement on Government Procurement (GPA)?

The GPA is essentially how non-US companies skirt Washington’s Buy American public procurement rules — the US issues waivers to GPA members, so as not to break international law. Other lawyers will tell you that when establishing who has a trade deal with the US, it’s ridiculous to look at anything other than the US’s tariff schedule, and then it becomes obvious.

Then there’s “final assembly” — you’ll find lobbyists and diplomats in Washington wondering how much of the assembly needs to really be done in the US to allow an EV to qualify for a tax credit.

Also up for debate in the Inflation Reduction Act is what constitutes a “foreign entity of concern”. This is defined in other pieces of US law to indicate China, Russia, North Korea and Russia. Notably, among the carmakers, Ford is on the record as lobbying for any US-owned subsidiary to be excluded when it comes to the IRA provisions. Others want to define precisely a portion of control over a US company that a “foreign entity of concern” can have.

On that topic, some autos, including Ford, Stellantis and Volkswagen are pushing for the creation of a “de minimis” threshold when it comes to critical mineral content in car batteries. Rather than having “any” material from a foreign entity of concern disqualify a car from the full tax credits, they want a small amount of Chinese content to be still allowed. Volkswagen has suggested setting it at 10 per cent.

There are two slightly separate issues here; first. companies fighting to create the maximum flexibility possible for their supply chains and manufacturing operations. Second, US allied governments fighting to protect what they say is the level playing field for globally traded goods such as EVs and clean energy tech.

For the carmakers, some softening of the law or changing of the timeline might help ultimately move them towards the US administration’s ultimate goal of decoupling its green tech supply chains from China.

But it is hard to see, among all these options — and there are other issues being consulted on — where a solution that would satisfy the EU’s central argument that the IRA will prefer US-made goods over EU-made ones could be found.

As Sam Fleming and Andy Bounds report, EU trade ministers have said they want concrete solutions by December 5, when the US and EU will hold the next session of their regular trade and technology council. The European Commission has suggested that it could take the issue to the WTO if the talks between Brussels and Washington fail to bear fruit. Whereas the bloc is appealing to the WTO rule book and invoking the rules-based trading system — the US is moving towards a post-WTO world.

Alan Beattie writes a Trade Secrets column for FT.com every Thursday. Click here to read the latest, and visit ft.com/trade-secrets to see all his columns and previous newsletters.

Charted waters

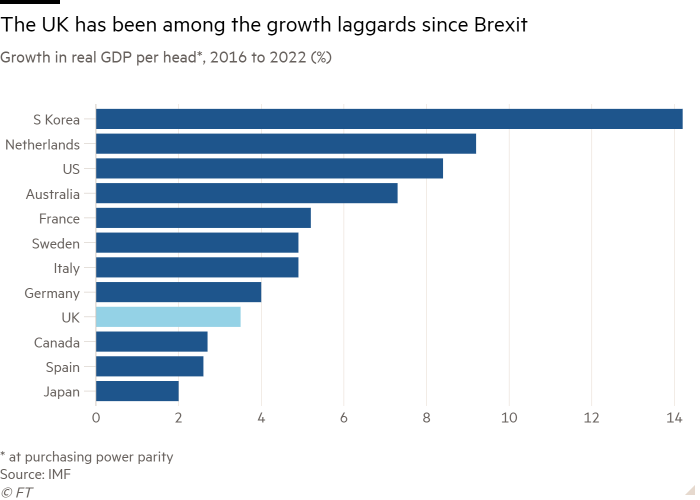

The debate over the future shape of Brexit reared its head last week, after UK prime minister Rishi Sunak was forced to deny reports that Britain might seek a deeper, Swiss-style deal with its European partners.

But the resurfacing of comments about the UK’s trading arrangements has simply underlined that this story will run and run. Businesses have urged ministers to boost trade with the EU and dump legislation that could introduce further uncertainty at a time of soaring inflation. The Office for Budget Responsibility noted this month that the “latest evidence suggests that Brexit has had a significant adverse impact on UK trade . . . and will result in the UK’s trade intensity being 15 per cent lower in the long run than if the UK had remained in the EU”.

As Martin Wolf writes in his column, there is no use in pursuing renewed membership. “Trying to alter the main features of the current unhappy relationship is pointless. But that cannot justify making things even worse” (Georgina Quach).

Trade links

-

Singapore is well-positioned to play both sides of decoupling, writes Leo Lewis in his column. The city state has a ringside seat for the shifting investment patterns caused by US-China tensions.

-

The US wants to thwart China in its aim of producing advanced semiconductors, bearing the shorthand definition of 3-14 nanometre (nm) process technology. The distinctions may sound minimal, but the stakes are huge. The scrap over chips is a proxy for a wider geopolitical confrontation between an old and a new superpower, as this Lex in-depth piece explains.

-

The potential unravelling of the old order in the global oil market will reach a defining moment over the next week when Europe starts to block Russian seaborne crude from the continent — one of the strongest responses yet to Vladimir Putin’s brutal invasion of Ukraine. Derek Brower in New York and David Sheppard in London assess the politics of this plan in their deep dive.

-

The future is digital, and nowhere more so than in trade, writes Rana Foroohar in her column. This is good news — it is crucial that ideas and data flow across borders. But the danger for policymakers is that information has a tendency to be monopolised.

[ad_2]

Source link