[ad_1]

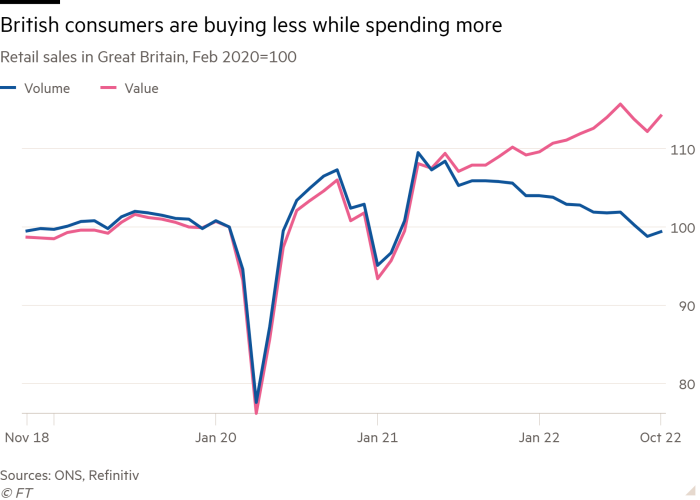

British retail sales grew more than expected in October, rebounding after an extra bank holiday in September kept stores shut, but were below pre-pandemic levels reflecting the impact of surging prices.

The volume of retail sales in Great Britain grew 0.6 per cent last month compared with the previous month, according to data published by the Office for National Statistics on Friday.

The figure was double the 0.3 per cent forecast by economists polled by Reuters and followed a revised down 1.5 per cent fall in the previous month when sales were affected by the additional bank holiday for the Queen’s funeral.

However, sales volumes fell 2.4 per cent in the three months to October compared with the previous three months, reflecting the impact of surging prices and continuing the downward trend since the summer of 2021.

ONS director of economic statistics Darren Morgan said: “Retail sales increased in October, although this is likely a rebound effect after weak sales last month as many retailers closed or operated differently on the extra bank holiday for the Queen’s funeral.”

He added: “Looking at the broader picture, retail sales continue their downward trend seen since summer 2021 and are below where they were pre-pandemic.”

In October, the quantity of goods sold was 0.6 per cent below February 2020 levels, before the pandemic, even as shoppers spent 14.2 per cent more, laying bare the hit that inflation has dealt to household spending power.

Separate data published on Friday by research company GfK showed that UK consumer confidence rose marginally to minus 44 in November from a 48-year low of minus 49 in November.

But the uptick was “likely to reflect nothing more than a collective sigh of relief as a new prime minister takes charge following the alarming fiscal antics we saw in September,” said Joe Staton, client strategy director at GfK.

He added that “household budgets remain shrouded in massive uncertainty with fresh jumps in food prices, energy still uncomfortably expensive, the prospect of new interest rate rises pressurising mortgage and rent payments, potential future hikes in council tax and squeezed real pay.”

The figures come the day after the Office for Budget Responsibility forecast that UK living standards would fall the most since records began in the 1950s in 2022-23. The UK fiscal watchdog, which published its forecast alongside the Autumn Statement, calculated that over the next two years, the UK household disposable income will wipe out the previous eight years’ growth.

[ad_2]

Source link