[ad_1]

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Nato has accused Moscow of escalating its war on Ukraine after Kremlin allies in occupied territories announced referendums to join Russia and the country’s parliament approved legislation that clears the way for military mobilisation.

Four Moscow-controlled regions in Ukraine will hold votes this week, a step that the Kremlin has resisted to date and which western powers and Kyiv immediately denounced as a sham.

Russia’s Duma also passed a law on Tuesday to increase penalties for desertion and evasion of conscription in the event of mobilisation, a further sign of Moscow’s hardening stance.

On Tuesday, US secretary of state Antony Blinken called the referendums “the sign of Russian failure”. “If these referenda proceed, and if Russia purports to annex Ukrainian territory, the United States will never, never recognise it,” he said during the UN General Assembly in New York.

Jens Stoltenberg, secretary-general of Nato, decried the referendums as “a further escalation” of the war. “Sham referendums have no legitimacy and do not change the nature of Russia’s war of aggression against Ukraine,” he said.

Thanks for reading FirstFT Asia. Share feedback on today’s newsletter at firstft@ft.com. — Emily

Five more stories in the news

1. China EV maker targets Hong Kong’s biggest IPO of 2022 Electric vehicle maker Zhejiang Leapmotor Technology is seeking to raise as much as $1bn in what would be Hong Kong’s largest initial public offering this year, in the latest test of investor appetite for China’s fast-growing EV market.

2. Ecuador reaches debt restructuring deal with China The government of centre-right president Guillermo Lasso said it had reached a $1.4bn deal with two Chinese banks to extend the maturity on loans and reduce interest rates and amortisation. China has been Ecuador’s most important financial partner for the past decade, beginning under leftist former president Rafael Correa, who was in office from 2007-2017.

3. Investors in Trump media Spac scramble for better terms Donald Trump and the backers of a blank-cheque company that plan to take his Truth Social media business public are pushing to renegotiate a $1bn financing package with investors ahead of a crucial deadline for the deal.

-

Related news: Chamath Palihapitiya, one of the big boosters of special purpose acquisition companies, has thrown in the towel, returning $1.5bn to investors after failing to find targets.

4. Private equity may become a ‘pyramid scheme’, warns Danish pension fund Mikkel Svenstrup, chief investment officer at ATP, compared the private equity industry to a pyramid scheme, warning buyout groups are increasingly selling companies to themselves and to peers on a scale that “is not good business”.

5. Number of super-rich individuals swells by a fifth The ranks of the super-rich swelled in 2021, with the number of people worth over $100mn increasing by 21 per cent to 84,500, according to the latest Credit Suisse Global wealth report.

The day ahead

Cardinal Zen faces trial in Hong Kong After the start of the trial, originally set for Monday, was delayed after the judge contracted Covid-19, Cardinal Joseph Zen Ze-kiun and five well-known members of the Democratic Front are due to appear in a court today, accused of failing to properly register a humanitarian fund for which they were administrators.

US interest rate decision The Federal Open Market Committee is expected to announce today that it will raise interest rates by at least 0.75 percentage points for the third time in a row as it tries to hit the brakes on the overheating US economy.

UK business secretary announces support scheme Jacob Rees-Mogg is expected to share details of a business support scheme for companies on Wednesday, ahead of chancellor Kwasi Kwarteng’s “mini-Budget” on Friday.

What else we’re reading

Hong Kong pins hopes on rugby sevens to rejuvenate city Hong Kong is betting on November’s return of the rowdy rugby sevens tournament to restore the Asian financial centre’s fortunes as the city’s leader said he would “actively study” relaxing a hotel quarantine requirement that has frustrated businesses and residents of the territory since 2020.

Indonesia’s unexpected success story As sharply rising US interest rates add to economic problems in the developing world, Indonesia appears unruffled, and its economy is prospering. Yet even as investors pile in, some worry about the sustainability of Indonesia’s newfound stability, particularly its politics.

Europe ditches negative rates as inflation surges The era of negative interest rates in Europe is set to end this week when Switzerland’s central bankers leave Japan as the sole proponent of one of the most controversial economic experiments of recent times. After more than a decade, the policy ultimately fell short of hopes that it would quickly vanquish the threat of deflation and revive growth.

‘Magic numbers’ are clouding the climate debate Climate change has become an existential crisis of notable exactitude, its parameters mapped out by precise temperature rises, thresholds, deadlines and “tipping points” of no return. But some scientists say climate messaging needs a fundamental reset to make it more accurate and relevant to our lives.

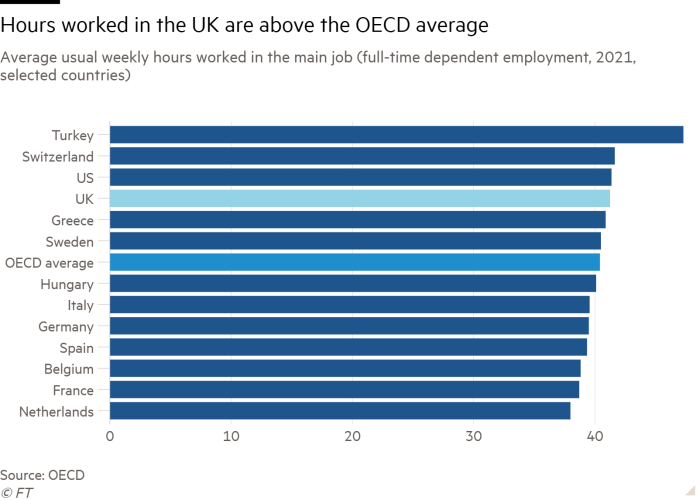

Are the British the worst idlers in the world? In the 2012 book Britannia Unchained, five Conservative MPs argued: “Once they enter the workplace, the British are among the worst idlers in the world.” Given that two of the book’s authors were Prime Minister Liz Truss and chancellor Kwasi Kwarteng, Sarah O’Connor says it is worth asking: is there any truth to it?

Style

Baseball caps are back, but what about in the office? Even in our casualised, post-lockdown world, workplace hats may be a step too far, writes Teo van den Broeke.

Recommended newsletters for you

Disrupted Times — Documenting the changes in business and the economy between Covid and conflict. Sign up here

Asset Management — Sign up here for the inside story of the movers and shakers behind a multitrillion-dollar industry

[ad_2]

Source link