[ad_1]

Bitcoin miners have historically sold BTC as they produced it to cover operating costs. But over the past couple of years a “HODL” strategy has permeated the industry as participants have opted to pay off expenses with debt instead.

Miners racked up much bitcoin- and equipment-backed financing to raise a combined $4 billion in capital for daily expenditures as bids to keep increasing bitcoin treasuries rose in the industry.

While that strategy worked fine during the 2020-2021 bull market, when the bitcoin price was increasing and capital was easier to raise, over-leveraged miners have come under extreme pressure this quarter as the cryptocurrency lost over 70% of its U.S. dollar value.

Consequently, with current macroeconomic conditions impairing companies’ abilities to raise capital and a bleeding bitcoin price, many public miners saw themselves with no other option than to give up on their HODL mentality.

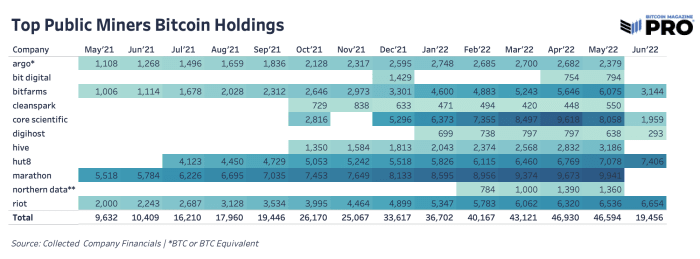

In May, most public miners started selling considerable amounts of bitcoin to pay off debt or recurring costs, and the trend has apparently not died off. While some have sold only periodically their mined BTC since then, others have opted to part ways with some of the coins they had put in the balance sheet in previous months.

In June, Riot Blockchain sold 300 BTC, while CleanSpark sold 328. Core Scientific, however, went a bit further and dumped 78.6% of its bitcoin holdings for $167 million, which it said “were primarily used for payments for ASIC servers, capital investments in additional data center capacity and scheduled repayment of debt.” The firm added that it will “continue to sell self-mined bitcoins to pay operating expenses, fund growth, retire debt and maintain liquidity.” Bitfarms also sold a considerable chunk of its holdings – over 3,000 BTC – last month. Meanwhile, Marathon Digital Holdings and HUT 8 remain depositing monthly bitcoin production into custody.

Marathon: To HODL Or Not To HODL

Marathon has been able to keep holding its bitcoin so far partly because of its operations structure. Contrary to some other big miners, the firm doesn’t seek to vertically integrate; rather, it outsources most of its operations while retaining ownership of its miners, which incurs costs only when the machines are online and hashing.

“I don’t have to worry about land leases, buying transformers, buying containers, building buildings, paying deposits to the energy providers, et cetera. What we do is we contract with a hosting provider with a fixed price,” Marathon CEO Fred Thiel told Bitcoin Magazine.

“So our model means that in times like this, we can literally just sit on our miners and, if we have to, operate at a very low cost,” he continued. “Because we’re not having to prefund these big CapEx [capital expense] investments. So it gives us an advantage in this current market situation.”

While this lean structure has allowed Marathon, which is the largest bitcoin holder among public bitcoin miners, to forgo selling bitcoin thus far, the company could soon start selling some of its produced BTC, Thiel suggested.

The executive explained that while the company currently is one of the very few miners who haven’t sold bitcoin amid a broader market slump, future market conditions might lead to a change in the company’s strategy.

“If bitcoin remains at these levels, it could be prudent for us to at least sell bitcoin as we’re mining it, enough to cover the current expenses,” Thiel said. “We’re currently not looking at necessarily selling our stockpile of bitcoin, but again, if it makes sense for us to do that from a capital perspective, then we would.”

Thiel highlighted that different price action by bitcoin will incur different actions from Marathon as the company seeks to navigate the current market; the executive hinted at three possible scenarios.

“If the situation remains status quo with the bitcoin price bouncing between $18,000 and $22,000, there’s one strategy. If bitcoin drops below that, there’s another strategy. And if bitcoin goes above that, there’s a third strategy,” Thield said, declining to provide more details.

“I prefer just not to go deeper than say that there may come conditions where we would sell the bitcoin as we mine it to cover operating expenses, and there may come a point where we would sell some of our stockpiling to cover CapEx if we needed to.”

While a sustained period of time in current levels could require Marathon to sell its monthly production, as Thiel explained, the firm would only be pressured to sell its accumulated BTC and risk losing its status as the largest public miner bitcoin holder if price began ticking lower. On the other hand, a rally would allow Marathon’s HODL strategy to remain intact.

“It’s just my personal belief that bitcoin is gonna grind along at these levels until something changes in the macro environment and people are willing to invest in risk-on assets again,” Thiel theoreticized.

“And that may come in the latter part of this year or next year, who knows at this point? It’s really going to be very dependent on the Federal Reserve and the degree to which we enter into recession and the economy, right?”

[ad_2]

Source link