[ad_1]

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

In Case You Missed It: Bitcoin Magazine Pro Special Edition Contagion Report

Early on July 6, 2022, it was announced that Voyager has filed for Chapter 11 bankruptcy.

Voyager Digital Commences Financial Restructuring Process to Maximize Value for All Stakeholders

This was following the announcement from the firm on June 22 that they had large exposure to Three Arrows Capital (3AC) in the form of unsecured loans.

“Voyager concurrently announced that its operating subsidiary, Voyager Digital, LLC, may issue a notice of default to Three Arrows Capital (“3AC”) for failure to repay its loan. Voyager’s exposure to 3AC consists of 15,250 BTC and $350 million USDC. The Company made an initial request for a repayment of $25 million USDC by June 24, 2022, and subsequently requested repayment of the entire balance of USDC and BTC by June 27, 2022. Neither of these amounts has been repaid, and failure by 3AC to repay either requested amount by these specified dates will constitute an event of default.” – Voyager Press Release

In our June 16 release, following the announced insolvency of 3AC, we speculated on the likelihood of Voyager exposure to 3AC in our issue, Fears Of Further Contagion.

“With the recent developments, rumors have been flying, with speculation that multiple crypto lending/borrowing desks have been hit from insolvency.

“While it is uncertain which firms may have experienced any balance sheet impairment, there is a large possibility of losses across firms in the industry, and it’s likely that we haven’t seen the dust settle.

“Shares of crypto custody/borrowing firm Invest Voyager ($VOYG) have fallen 33% over the past two days. The firm’s latest quarterly release showed that the company had lent $320 million to a Singapore-based entity (home of 3AC before relocation). Regardless of whether the loan was to 3AC, the collapse in share price is certainly not a vote of confidence by the market for a U.S.-based public crypto lending platform.” – Fears Of Further Contagion

Now, with the announcement of Voyager’s bankruptcy proceedings, some interesting findings can be seen in the bankruptcy filings.

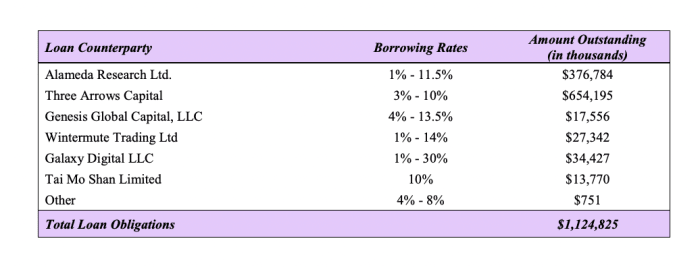

In the company’s filing, it was reported that Alameda Research has borrowed $376 million from Voyager, for unknown reasons.

While it is somewhat curious that the firm supposedly is working to shore up the industry and stem the balance sheet contagion is currently borrowing money from an insolvent firm (that Alameda holds 9.49% ownership in), there are a few reasons that come to mind.

- It is not unusual for a proprietary trading desk to borrow capital in the cryptocurrency industry (specifically denominated in assets other than the dollar).

- Given that Voyager’s assets (that were largely customer deposits) were partially bitcoin denominated, Alameda could possibly be borrowing BTC to use for market making/shorting, in which they would aim to cover the loan at a later date.

- Although the terms of the loan are unspecified, given Alameda’s ownership stake in Voyager, it would make sense that the firm wouldn’t call in the loan, which would lower expected interest revenues.

It is our belief that it will take the market either lower prices and/or significant time to recover from the damage suffered in recent months, from both a balance sheet impairment perspective as well as a reputational/legitimacy perspective.

[ad_2]

Source link