[ad_1]

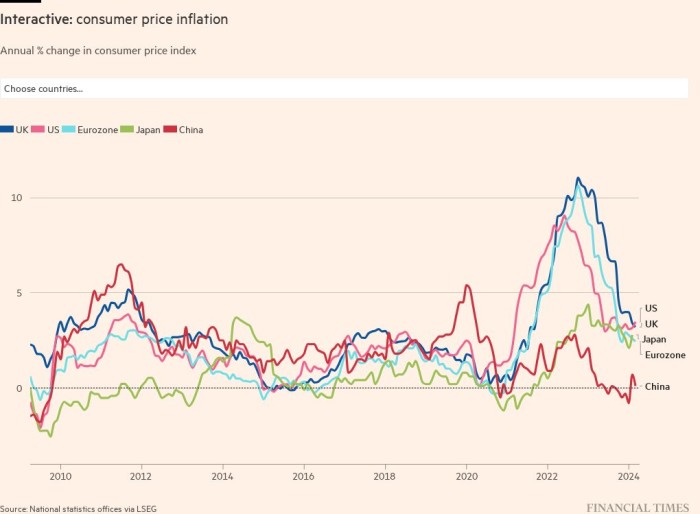

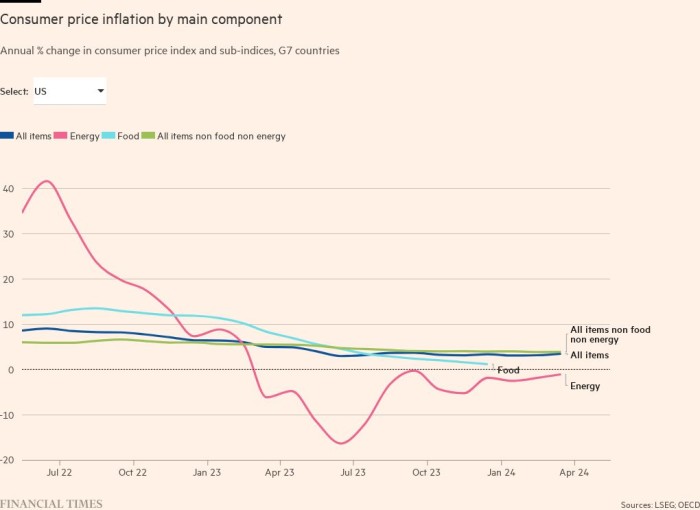

Inflation has hit its highest level in decades in many countries, with Russia’s invasion of Ukraine pushing up energy and food prices alongside squeezing households’ real incomes.

The latest figures for most of the world’s largest economies make for worrying reading, with price pressures surging to the highest level in many decades.

Central banks have reacted by raising interest rates, even though higher borrowing costs could exacerbate the squeeze on real incomes that have resulted from higher prices.

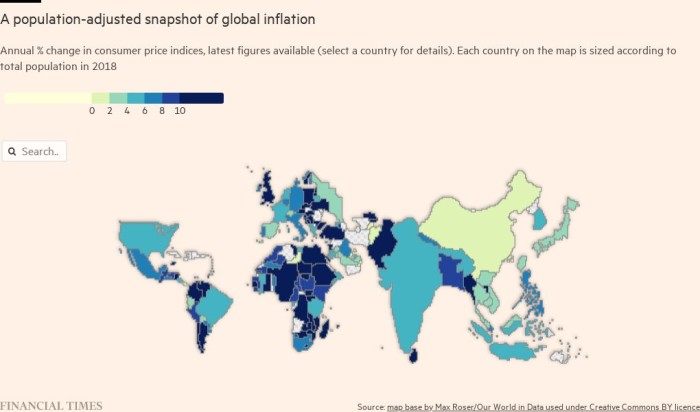

High inflation remains geographically broad-based. Consumer price growth has even started rising in Asia, a region that until recently had largely been an exception to the worldwide pattern.

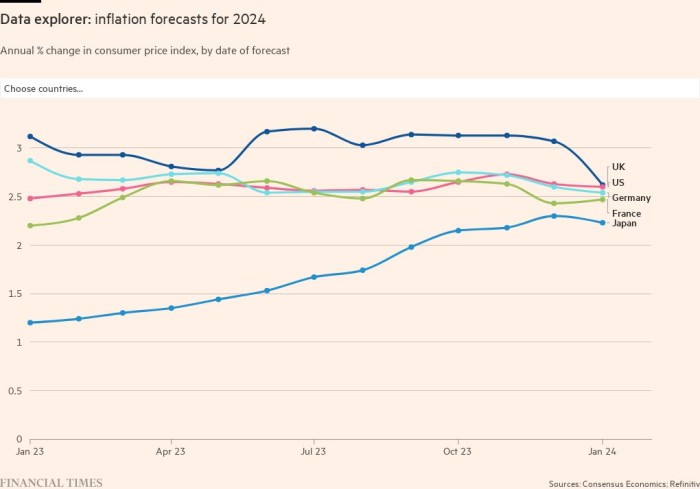

This page provides a regularly updated visual narrative of consumer price inflation around the world. This includes economists’ expectations for the future, which show inflation projections being steadily revised up for 2023, according to leading forecasters polled by Consensus Economics.

While higher inflation is now forecast to linger into next year, expectations of interest rates rises have led markets to become more optimistic that price pressures can be contained in the medium term. Central bank tightening has in recent months led investors to lower their expectations of where inflation will be five years from now.

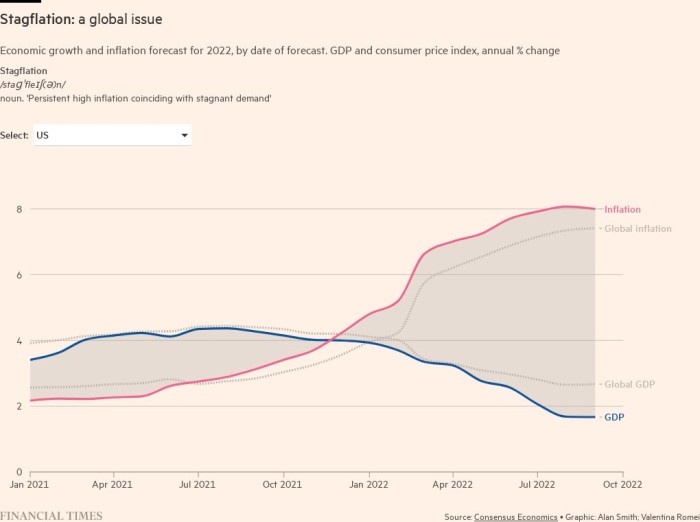

However, higher interest rates have also raised the chances of a recession in some countries, with economists fearing a return to the stagflation of the 1970s — a situation characterised by persistent price pressures and weak growth.

The rise in energy prices drove inflation up in many countries, even before Russia invaded Ukraine. Daily data show how the pressure has intensified on the back of a conflict that has left Europe fearing for its gas supply over the coming quarters.

Higher inflation is also spreading beyond energy to many other items, especially in countries where demand is strong enough for businesses to pass on higher costs.

Rising prices limit what households can spend on goods and services. For the less well-off, this could lead to people struggling to afford basics such as food and shelter.

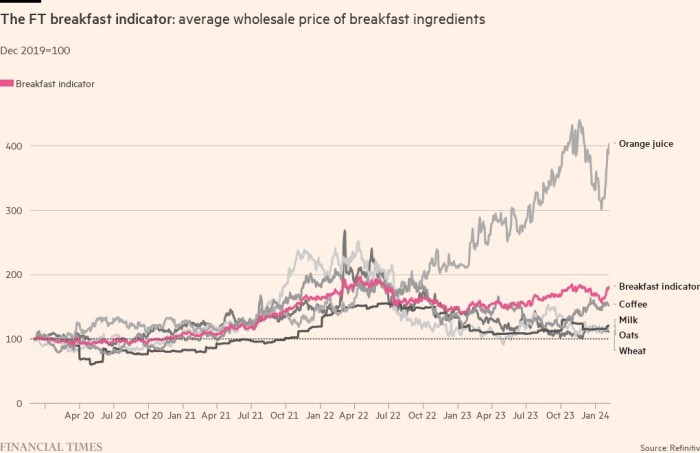

Daily data on staple goods, such as the wholesale price of breakfast ingredients, provide an up-to-date indicator of the pressures faced by consumers. In developing countries, the wholesale cost of these ingredients has a larger impact on final food prices; food also accounts for a larger share of household spending.

Another point of concern is asset prices, especially for houses.

These soared in many countries during the pandemic, boosted by ultra loose monetary policy, homeworkers’ desire for more space and government income-support schemes. However, higher mortgage rates could soon cool the pandemic-induced housing boom.

FT survey: How are you handling higher inflation?

We are exploring the impact of rising living costs on people around the world and want to hear from readers about what you are doing to combat costs. Tell us via a short survey.

[ad_2]

Source link