[ad_1]

This is an opinion editorial by Kudzai Kutukwa, a passionate financial inclusion advocate who was recognized by Fast Company magazine as one of South Africa’s top-20 young entrepreneurs under 30.

Our society today is plagued by a trust problem. The institutions that govern our world are built on trust while they have now proven to be untrustworthy. On February 11, 2009, Satoshi Nakamoto posted a thread stating,

“I’ve developed a new open source P2P e-cash system called Bitcoin. It’s completely decentralized, with no central server or trusted parties, because everything is based on crypto proof instead of trust. […] The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

By developing a decentralized monetary system that made trusted third parties (the banking system) obsolete, Nakamoto also chipped away at the source of their power: the money printer. It’s the money printer that made it possible for a small clique of central bankers to centralize and seize control of the global monetary system. Though waning, they continue to wield this power to this day.

The top-down, centralized decision-making structure is not unique to central banking, but it pervades all spectra of the political institutions that govern our society today. The World Economic Forum (WEF), the Bank of International Settlements, the International Monetary Fund (IMF), the U.S. Federal Reserve, the European Central Bank and the United Nations are but a few examples of the central planners of our day responsible for setting policy recommendations and regulatory frameworks that range from interest rates to carbon emissions. While, for the most part, these organizations are credible and trustworthy, more often than not, the policy recommendations they make create more harm than good when implemented at the community level. A recent example of this would be Sri Lanka, which is not only bankrupt, but is also experiencing hyperinflation and shortages of basic essentials such as food, fuel and medicine.

While this economic collapse was caused by numerous factors; one of the biggest factors behind Sri Lanka’s demise is its support for “the current thing,” i.e., prioritizing ESG compliance over food production. The megazord acronym “ESG” is the brainchild of the U.N. and stands for environmental, social and governance. It’s meant to be a set of investment criteria that guide corporations and governments to “further develop sustainable investments.” Sri Lanka has an exceptional ESG score of 98 that trumps that of both Sweden (96) and the US (51). In order to achieve their ESG-inspired, virtue-signaling goal of being the first “organic country,” the government abruptly banned the use of chemical fertilizers in April 2021. This led to a dramatic drop in yields across the board and by the time the government realized their blunder and tried reversing course in November 2021, the damage had already been done.

(Source)

According to environmental activist Michael Shellenberger,

“[O]ne-third of Sri Lanka’s farm lands were dormant in 2021 due to the fertilizer ban. Over 90% of Sri Lanka’s farmers had used chemical fertilizers before they were banned. After they were banned, an astonishing 85% experienced crop losses. The numbers are shocking. After the fertilizer ban, rice production fell 20% and prices skyrocketed 50 percent in just six months. Sri Lanka had to import $450 million worth of rice despite having been self-sufficient in the grain just months earlier. The price of carrots and tomatoes rose five-fold. While there are just two million farmers in Sri Lanka, 15 million of the country’s 22 million people are directly or indirectly dependent on farming.”

The bigger question is, how on Earth did Sri Lanka find itself in such a self-inflicted mess? Well, the short answer is: They were ill-advised by the likes of the WEF to go down this path of protecting the environment at the expense of severely compromising their food security. ESG has officially collapsed its first country, just like the IMF structural adjustment programs did in the 1980s and 1990s.

In a 2016 article, penned in collaboration with the WEF, economist Joseph Stiglitz showered praise on Sri Lanka’s overall economic development and wrote, “Given its education levels, Sri Lanka may be able to move directly into more technologically advanced sectors, high-productivity organic farming, and higher-end tourism.”

It is this very prescription that has failed dismally and the people of Sri Lanka are now facing the dire consequences of economic destruction, not “experts” like Joseph Stiglitz. What is suggested as a solution for the devastation caused by terrible ideas? More horrendous ideas from the institutions that caused the initial problem. In April 2022, as the government was negotiating with the IMF for a bailout, the United Nations Development Programme doubled down by recommending that the Sri Lankan government should become a candidate for a “debt for nature swap” that would unlock debt relief in exchange for investing a fixed sum on nature conservation. Furthermore, in May 2022, Sri Lanka signed onto a green finance taxonomy with the International Finance Corporation that, among other things, includes a commitment to organic fertilizers. It appears that they are determined to hold the line in support of “the current thing.”

Despite the apparent failure of these policies in Sri Lanka, the Dutch government also threw their hat into the ring and is actively pursuing similar policies. The Dutch government is aiming for a 50% reduction in overall nitrogen greenhouse gas emissions by 2030. A 25 billion euro Nitrogen Fund was set up to help farmers (voluntarily) quit, relocate or downsize their business and make them more “nature friendly” (e.g. organic farming just like in Sri Lanka). The Dutch Minister for Nitrogen and Nature Policy, Ms. Christianne van der Wal, indicated that she expects about one-third of the Netherlands’ 50,000 farms to disappear by 2030 as a result of the plans and went on to point out that expropriation of farms was on the table as a measure of last resort should the farmers refuse to cooperate. Is this the part where they will own nothing and be happy?

(Source)

Furthermore, in order to comply with this draconian emissions target decreed by the government, at least 30% of all cows, chickens and pigs will have to be culled. This has sparked protests by farmers who object to these green dictates. These protests are reminiscent of the Canadian Trucker protests earlier this year, and we have now seen farmers from Spain, Italy, Germany and Poland staging similar protests in a show of solidarity with their Dutch counterparts.

In addition to being the second largest exporter of food in the world after the U.S., the Netherlands is also the largest exporter of meat within the EU. Should the Dutch central planners have their way, it’s likely the Netherlands will join Sri Lanka on the list of countries destroyed by “the current thing.” Similarly, in an effort to cut emissions by half by 2030, both the U.S. and U.K. currently have different versions of “pay farmers to not farm” schemes in place. 35,000 acres of rice fields in California will remain unused, while in the U.K., dairy and meat farmers are being encouraged to retire in exchange for a one-time payment of up to 100,000 pounds. The Canadian government also intends to implement similar policies in an effort to reduce nitrogen greenhouse gasses by 30% by the year 2030. Not to be outdone, the New Zealand government unveiled plans to tax livestock for belching and flatulence, which they hope will reduce emissions. Such is the infinite wisdom of the central planners running the world today.

On the surface, ESG virtue-signaling may look like overzealous attempts by governments to do obeisance to “the current thing” in meeting their emissions targets, but these policies do seem like deliberate attempts to massively shrink the farming sector while nationalizing agricultural land in the process. According to the U.N., there is a looming food catastrophe around the corner. In a recent report, the World Food Program warned that 670 million people on average will be on the verge of starvation by the end of the decade. If this is true, why are governments around the world hindering the work of farmers?

While the WEF central planners are actively promoting “climate-smart” farming methods to make the full switch to net-zero, nature-positive food systems by 2030, the catastrophe in Sri Lanka is proof that it’s a path that likely ends in disaster. While this approach works for smaller communities, as of today, organic farming alone isn’t enough to sustain large-scale farming. A full switch to organic farming would require more land use — something the Dutch don’t have a lot of — and thus, more agricultural inputs to match current production levels required to feed large urban populations. Ironically, organic farming is unsustainable both economically and environmentally. For example, a permanent transition to organic production in Sri Lanka would reduce yields of every major crop; about 30% for coconut, 50% for tea, 50% for corn and 35% for rice. Why any sane government would embark on such a radical experiment is mind boggling.

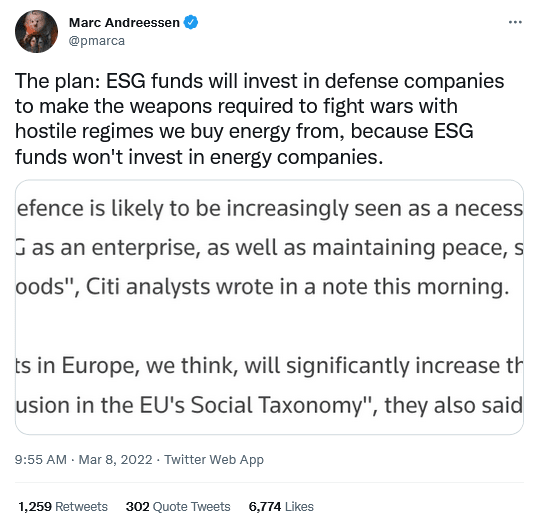

According to Bloomberg, ESG is the fastest growing asset management class, which currently has $35 trillion assets under management and is expected to exceed $50 trillion by 2025. Despite sounding altruistic on the surface, ESG is actually a political metric that is used to indirectly control private companies by central planners through influencing the direction of capital flows to investments that they deem “sustainable.”

It’s a mechanism to further centralize capital markets in the hands of the central planners who get to pick winners and losers based on adherence to a subjective and opaque criteria, instead of on the basis of value created. ESG is analogous to feudalism, in that an elite group of central planners and their cantillionaire cronies allocate capital to causes that further enrich themselves in the name of “social good.” This state of affairs is in stark contrast to Bitcoin which upends this dynamic by guaranteeing inalienable property rights to all participants within the network, not just to an elite few. In the same way that the Chinese Communist Party’s social credit system scores an individual based on their allegiance to the state, corporate companies as well as nation-states pledge their fealty to woke institutional investors and the Davos elite with their ESG scores.

ESG is a mirror image of our fiat monetary system that distorts price signals within the economy, making it almost impossible to accurately measure which economic activities are creating the most value. Just like the fiat system, ESG adherence also encourages misallocation of capital resources and disrupts meaningful productivity. Ernst & Young also point out that ESG is not only confusing and opaque, but is also vulnerable to rampant greenwashing. With this in mind, it is astonishing that sovereign states are jostling over each other to obtain higher ESG scores by implementing policies that are self-destructive. How can an unjust monetary system produce a just society? Or as Jeff Booth puts it in “The Price Of Tomorrow,” “How is it possible to solve climate change from an economic system that requires inflation?” Any nation or company that destroys its productive capacity will collapse no matter how high their ESG score is.

(Source)

In his classic essay, “The Use of Knowledge in Society,” renowned Austrian economist Friedrich Hayek wrote,

“The economic problem of society is thus not merely a problem of how to allocate ‘given’ resources—if ‘given’ is taken to mean given to a single mind which deliberately solves the problem set by these ‘data.’ It is rather a problem of how to secure the best use of resources known to any of the members of society, for ends whose relative importance only these individuals know. Or, to put it briefly, it is a problem of the utilization of knowledge which is not given to anyone in its totality.”

Central planners are not omniscient and therefore cannot accurately steer an entire economy that is composed of infinite complex systemic interactions that each require specialized knowledge. Knowledge which isn’t resident in any single individual or institution. Despite this obvious fact, a handful of central planners are slowly collapsing food production with their policies that do not factor in the unintended consequences of their decisions.

As a fully decentralized system, Bitcoin is the antithesis of central planning. It didn’t just become the beacon of a more just financial system but it represents a more superior governance model. Thanks to proof of work, all the nodes are able to arrive at the same truth independently without a central authority’s coordination. The true embodiment of rules without rulers.

Our current financial system is fueled by credit expansion and consumption. Such a system requires exponential growth to sustain itself. The end result is that the money supply continues to expand and money gradually loses its ability to coordinate economic activities efficiently. Price signals are mutilated in the process, thus erecting an economic Tower of Babel.

ESG is an attack vector that gains control of capital markets through this endless manipulation of money. The monetary policies that are being pursued globally by central planners are at odds with technological gains that would result in lower prices of goods over time. Instead, society is being kept on the treadmill of ever-increasing prices that require more consumption and more production ad infinitum in order to protect a credit-based system that would otherwise implode.

Political metrics like ESG do not hold sway over Bitcoin because it’s a monetary system that is anchored in objective truth. This opens up the room for capital allocation based solely on economic potential and value created — as opposed to “woke” capital allocation. De-growth strategies, top-down centralized management of resources and control of capital allocation via ESG are features (not bugs) of the current financial system. Countries like Sri Lanka are prime examples of the destruction ESG has caused.

The attacks clothed as ESG that are being meted out against farmers are strikingly similar to those that are usually directed at bitcoin miners. As the most secure computer network in the world, Bitcoin is censorship resistant and doesn’t bow to the tyrannical whims of central planners who have intentions of weaponizing the financial system against protesters. Unlike the Dutch farmland that is at risk of being confiscated, bitcoin cannot be confiscated via legislation; it’s money that you truly own. It’s for this reason that the energy usage of bitcoin mining has been incessantly attacked by ESG evangelists through coordinated media campaigns that portray bitcoin mining as an existential threat to the environment. This has resulted in some jurisdictions, like the EU, considering banning proof-of-work mining, like how the Dutch government is trying to get rid of some of its farmers. The truth is, bitcoin mining’s energy mix has the highest penetration of renewables of any industry in the world, plus it monetizes stranded energy that would have otherwise been wasted. A fact the ESG warriors conveniently ignore.

The time has come for the creation of bitcoin circular economies and for us to support our farmers in order to protect our food systems from Malthusian central planners. Instead of bowing to their zero-sum worldview, trade groups like the Beef Initiative should become the norm. These bitcoin-based commodity markets and/or exchanges can also play a big role in providing farmers with access to global markets in a frictionless manner. In addition, orange-pilling nation states is now more important than ever for two major reasons: First, it will give nations alternatives for raising capital, like the volcano bonds, that are not tied to “woke” capital with diabolical strings attached. Second, it will produce examples of the prosperity a nation with sound money can achieve. Samson Mow and JAN3 are doing great work on this front, but there is room for more to join.

In conclusion, should current trends of kowtowing to ESG by governments continue, Sri Lanka will end up being a harbinger of larger things to come in the months ahead.

This is a guest post by Kudzai Kutukwa. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

[ad_2]

Source link