[ad_1]

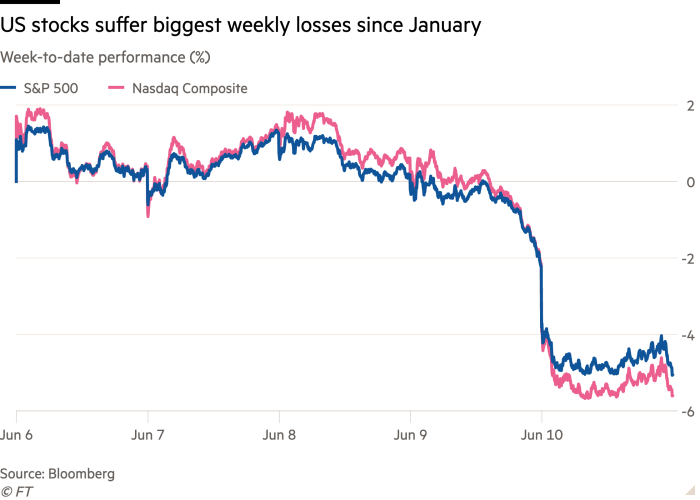

Wall Street’s S&P 500 and Nasdaq stock indices recorded their worst week since January as fresh evidence of red-hot inflation and expectations of an aggressive central bank response led to big losses on Thursday and Friday.

The broad-based S&P 500 fell 5.1 per cent this week, while the tech-heavy Nasdaq Composite, which is stacked with interest rate-sensitive growth stocks, dropped 5.6 per cent. Friday’s losses for the S&P and Nasdaq were 2.9 per cent and 3.5 per cent, respectively.

The US government reported on Friday that consumer prices had risen at an annual pace of 8.6 per cent in May, above April’s 8.3 per cent reading and exceeding economists’ forecasts as prices for food, energy and shelter all increased.

The persistent evidence of inflation drove fears that the Federal Reserve will be forced to raise interest rates strongly and steadily in order to slow down economic growth.

On Thursday, markets were rattled after the European Central Bank spelt out its own plans for tightening monetary policy.

The ECB, which has long been one of the world’s most accommodative central banks, signalled that it may lift its main deposit rate above zero in September, which would be its first departure from negative interest rates in eight years. It also said that it would end net purchases of member states’ debt, sparking fears about financial stress for the bloc’s weaker economies.

As Wall Street equities fell on Friday, the yield on the two-year Treasury note, which moves with interest rate expectations, rose above 3 per cent. The last time the two-year note surpassed this psychologically significant level was in 2008.

Meanwhile, the yield on the five-year Treasury surpassed the yield on the 30-year bond, an indication the market believes that the Fed’s campaign of raising rates could tip the US economy into recession.

“I don’t see inflation subsiding at all. It is going to be very, very tough for the numbers to actually dissipate in the future . . . I think by the autumn we’re going to be dealing with a much slower economy,” said Tom di Galoma, managing director at Seaport Global Holdings.

“Markets are trying to get ahead of more Fed tightening — that’s what’s going on with the equity market,” he said.

The Fed is widely expected to raise its main interest rate by a further 0.5 percentage points at its policy meeting next week. At the central bank’s May meeting, chair Jay Powell had set the stage for half-point rises in both June and July, but some questions remained about whether the Fed would continue at that pace at its meeting in September.

The futures market now expects the Fed’s benchmark interest rate to be 3.2 per cent by year end, implying half-point increases at the Fed’s next four meetings — June, July, September and November — plus a quarter-point increase in December.

With the prospect of a much tighter monetary policy, the dollar index, which measures the US currency against a basket of six rivals, rose to its highest level since mid-May as investors sought out haven assets.

Earlier in the day Europe’s regional Stoxx 600 share index dropped 2.7 per cent, also hit by worries about the US outlook along with the effects of eurozone interest rate rises.

“The message for the markets is that the priority now is quashing inflation, it’s not about growth,” said Paul O’Connor, head of the UK-based multi-asset team at Janus Henderson.

Germany’s 10-year government bond, which serves as a benchmark for borrowing rates in the region, rose 0.09 percentage points to 1.51 per cent, its highest level since 2014.

Italy’s 10-year bond yield rose by 0.16 percentage points to 3.75 per cent, more than triple its level at the start of the year.

In Asia, Hong Kong’s Hang Seng index traded flat and Tokyo’s Nikkei 225 fell 1.5 per cent. Mainland China’s CSI 300 rose 1.5 per cent.

[ad_2]

Source link