[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

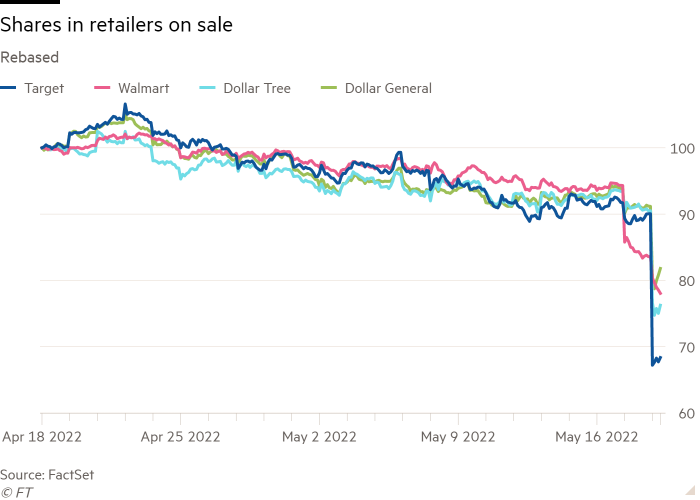

Yesterday, US stocks suffered their sharpest fall since the early months of the coronavirus pandemic as weak results from consumer bellwethers stoked concerns about the impact of inflation and choked-up supply chains on corporate earnings.

The benchmark S&P 500 share index fell 4 per cent, its biggest loss since June 2020, with 98 per cent of stocks in the index declining yesterday.

Target, the US retailer, led the declines, plunging 25 per cent after it said higher freight, wage and fuel costs and disrupted logistics would hit its profit margins. The warning came a day after Walmart, the world’s largest bricks-and-mortar retailer, cut its earnings guidance and said it had also been wrongfooted by broad inflationary trends.

The lacklustre quarterly reports sparked selling across US exchanges as investors, fearing an economic slowdown, cut positions across their portfolios. Tech giants including Apple, Nvidia and Amazon all dropped more than 5 per cent, with the tech-dominated Nasdaq Composite down 4.7 per cent.

“There’s a beginning of a deterioration in the [economic] growth story,” said Michael Metcalfe, head of macro strategy at State Street Global Markets. “And it’s started to get picked up in [corporate] earnings.”

Thanks for reading FirstFT Asia. Feedback on today’s newsletter? Email me at firstft@ft.com. — Sarah

Five more stories in the news

1. Erdoğan blocks Nato accession talks with Sweden and Finland Turkey’s president has held up Nato’s plans to bring the two Nordic countries into the military alliance but insisted it was not ruling out the membership bids. Ankara wants to “reach an agreement” which includes the extradition of 30 people accused of terrorism in the country.

2. International investors sell Chinese debt at record pace Foreign fund managers have sold $35bn worth of renminbi-denominated bonds in 2022, with nearly half of it in April. Covid-19 lockdowns have hit the country’s currency — which has fallen 5% against the dollar this year — while rising US yields have reduced appetite for Chinese debt.

-

More on China’s economy: Local governments have been forced to divert anti-poverty funds to finance mass coronavirus testing, as Xi Jinping’s zero-Covid policy causes growing financial strains.

3. Nike’s diversity chief to leave company after 2 years Felicia Mayo, who has served as chief talent, diversity and culture officer at the world’s largest sportswear maker since July 2020, will leave the company at the end of July. She is the second executive to leave that role in as many years. For more news on the business of sport sign up to our Scoreboard email.

4. Saudi Arabia’s PIF acquires 5% stake in Nintendo Saudi Arabia’s sovereign wealth fund has purchased 6.5mn shares in the Kyoto-based creator of Mario and Donkey Kong as it continues to expand in the games and e-sports industry.

5. Casino mogul accused by US of lobbying on behalf of China Steve Wynn, who helped transform Las Vegas and Macau into booming gambling centres, has been accused by the US justice department of lobbying the Trump administration on behalf of the Chinese government to deport a prominent critic from the US to China. Lawyers acting for Wynn denied the allegations.

The day ahead

Philippines monetary policy committee meeting Analysts at DBS Bank, HSBC, and Standard Chartered expect policymakers to announce a 25-basis point rise in the country’s interest rate. (The Manila Times)

Nato Defence chiefs will meet in Brussels on Thursday, while US president Joe Biden hosts the leaders of Finland and Sweden at the White House to discuss their Nato applications.

European Central Bank minutes Policymakers will release the minutes from their last meeting, at a time when central banks around the world are seeking an interest rate sweet spot in the inflation fight. Getting the balance between growth and inflation just right is fraught with difficulty.

What else we’re reading

India’s export shock exacerbates a global food crisis In an abrupt U-turn, India has announced an export ban on wheat after sudden heatwaves pushed down forecast domestic production and drove up prices. India’s volte-face highlights the need for some more efficient large-scale food producers who reliably prioritise exports, writes Alan Beattie.

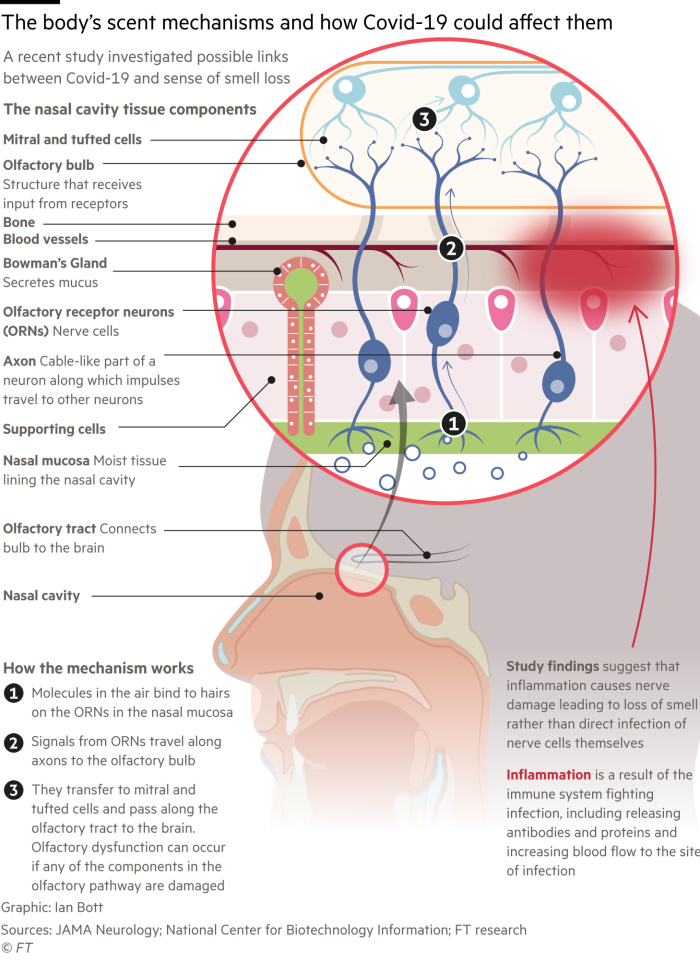

How Covid affects the human brain The cognitive impairment caused by severe Covid-19 is comparable with losing 10 IQ points, researchers have suggested. The FT’s global health editor Sarah Neville rounds up the latest research on the neurological effects of the disease.

Moderna chair defends its hiring process after CFO fiasco Last week, the top finance director stepped down one day after joining the vaccine maker, following an investigation at his former employer. But Noubar Afeyan says it would be wrong to conflate the sudden departure with a wider cultural problem at Moderna.

Top economies battle to lead supercomputer race The US has made a new breakthrough in processing power that will have a big effect on climate change research and nuclear weapons testing. But the success is likely to be muted, as China passed this milestone first and has led the world in supercomputing for years.

How do today’s musicians make money? Amazon Music, Apple Music, Spotify and YouTube Music, together have more than 560mn estimated subscribers and many more non-paying users. Unable to fight streaming giants, some artists are scrambling to develop their own business model.

Travel

Have you ever wondered what it is like to see the world through the eyes of a pilot? For Mark Vanhoenacker, great cities hold a special significance — and their post-pandemic reawakening is a joy to witness.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com. Sign up here.

[ad_2]

Source link