[ad_1]

Chapter 4 of the JBP series. Unless noted otherwise quotes are from Jordan B. Peterson.

The series continues. If you’ve not yet read parts one through three, you can find them here.

The fourth chapter of Jordan Peterson’s “12 Rules for Life” is titled,

The basic premise is that life is not easy and in order to find contentment and fulfillment, one must make progress. Comparing oneself to others, particularly in a globally interconnected world, may not be the healthiest way to do so because you are always stacking the deck against yourself. It makes internal, self-negotiation more difficult and as such, you are inclined to make poorer decisions.

Peterson makes clear that value judgments are at the center of all decision-making and that what we aim at, how we negotiate with ourselves and the degree to which we value the future are all critical to the quality of life we ultimately live.

I highly recommend reading the entire book of course, and this chapter in particular, if you’re working on yourself.

So… how is this related to Bitcoin? The answer in this essay might seem trite, but when I read this chapter, two ideas that came to mind right away:

1. “Bitcoin is self-love.”

2. Bitcoin makes you a better person.

A few people have discussed variations of these, including AmericanHODL, and they’re themes I’d like to explore in this two-part chapter of the series, alongside:

- Time preference.

- Self-respect.

- Excellence.

- Value judgements/evaluation.

- Behavior.

- Personality.

- Maturity.

- Human action.

As usual, we’ll do this by pulling threads and ideas from JBP’s book and expanding on them through a Bitcoin lens, and we’ll likewise take Bitcoin-centric ideas and explore those through a JBP lens.

Let’s begin.

Value, Decisions And Action

All action is preceded consciously or subconsciously by a series of value judgements. In order to act better, and to forge yourself into a better human you must continually make more accurate and realistic value judgements. You receive feedback from the system you’re impacting or the environment you’re operating within and you then adjust or adapt (i.e., make new value judgements) before you then take subsequent action. Rinse and repeat.

All systems, micro or macro, work like this. Those that are stable and effective have high-fidelity information transmission media embedded within them. Those that fail or disintegrate do so because information either cannot flow, has all become noise or the feedback loops are short-circuited.

Standards of better or worse are not illusory or unnecessary. If you hadn’t decided that what you are doing right now was better than the alternatives, you wouldn’t be doing it. The idea of a value-free choice is a contradiction in terms. Value judgments are a precondition for action.

How we treat the feedback from the system and what we do with that information, whether from perceived failure or success, can over time become a standard. A standard is an abstract rule or Lindy-compatible guideline that emerges through experimentation and iteration. Good standards will enhance feedback loops and make a system more efficient, but there is a price (failure/correction). Poor or no standards might feel more inclusive, but over time means entropy and dissolution. Macro obsolescence is a higher price to pay than micro failures and corrections.

Failure is the price we pay for standards and, because mediocrity has consequences both real and harsh, standards are necessary.

We are not equal in ability or outcome, and never will be.

In a world infected by fiat, where notions of correction, feedback and truth are daily being stripped away, where the scorecard of life is a series of meaningless digits conjured up by bureaucrats and standards are “oppressions of the patriarchy,” how is the individual capable of calculating their own worth, whether relative to themselves yesterday or their peers on a regular basis?

While it’s not impossible (yet), relative value and worth are certainly difficult to measure and extraordinarily inaccurate. Not only are we wrong, but we are wrong about what we’re wrong about, so we find it hard to correct.

Correction is important because as the word implies, it is the process of making “correct” that which is currently not, whether that be a judgment of value, a behavior or action. This requires honesty and a recognition of error!

How can you actually know if you’re making better decisions if you either refuse to admit error or are fundamentally unable to? How can you correct something when your measuring stick is broken? You might think what you’re doing is aligned with your highest good, but in reality you’re likely doing damage.

Modernity abounds with blind men building structures with broken tools. In fact, the best way to think about the difference between a Bitcoin standard and a fiat standard is the following analogy:

“The Blind Man discovers sight:

A fiat economy is like a series of blind men building a house with an elastic tape measure, and broken tools.

Bitcoin is like eyesight and a fixed, high-quality tape measure was given to the men building that house.

The two houses are a universe apart in structural integrity, practicality, resource usage and beauty.” — Bitcoin Fable by Svetski

Fiat blinds, and absolute fiat blinds absolutely.

Not only is the value we ascribe to things all wrong, but the structures that emerge and the incentives that support them are all distorted and deformed.

What starts out blurry one day (if not kept in check) becomes blind.

Relative Value

All value is relative, of course. The Austrians, and in fact praxeological evidence and observation of humans of all walks of life, have proven without a doubt that the subjective theory of value is not just a “theory.”

It’s applicable not only to how we value the things and stuff around us, but to how we value ourselves, our actions, our status in the world and all of the same in relation to other human beings.

These value differentials are how we move ourselves forward, or when pathologized, how we drive ourselves further into despair and nihilism.

How can we, in a modern, interconnected world, perform the former, without getting lost in the latter?

JBP answers this from a psychological perspective better than I can do here, so my addition to his argument will be the praxeological and economic notion of “saving” across time.

When one can store the product of their labor (wealth), across time, without risk of confiscation or devaluation, it lowers their uncertainty toward the future, enables them to take stock, plan ahead and “look up.”

No this is not some Marxist argument of “removing privation” as the solution to man’s problems. This is the simple fact that when one can actually save, they have the space to lower their time preference and can build the personal pride that comes from labor (and not handouts).

It’s very different to a person whose only focus is food and shelter at the moment. There is a reason why hyperinflating territories that are rich in resources, energy and human potential are so economically poor.

Increasing The Fidelity Of Human Action

The game of life in a human society is economic. It is the process or study of agents with (conscious or unconscious) ends, who make value judgments, decide and then act towards those ends, while using or allocating resources (time, energy, material/matter) under their command or ownership.

This is arguably a flavor of the same primary game all living species play. We just call it economics in the anthropological context.

To do anything at all is therefore to play a game with a defined and valued end, which can always be reached more or less efficiently and elegantly.

The question you must therefore ask yourself, dear reader, is how can we play a valid game when the scoring mechanism is broken?

If the literal game of life is rigged, and the scoreboard is just an illusion to make you feel like you are playing, then what do you expect will happen over time?

Will people play honestly? Will they play forthrightly? Will they show up at or as their best? Who are the ones actually climbing up the status hierarchy? What subconscious message does that send to the rest of us? Who becomes the role model? What effect does that have on value judgements, and therefore behavior downstream for others?

I don’t have to answer it for you. Just look around.

We’re strip-mining humanity’s very soul by lying, cheating and stealing our way to false notions of winning, or just to survive.

Meaningful Games

For humans to prosper, the games they play need to have some meaning associated with them.

In a fiat world, meaning is one of the first things to be eroded.

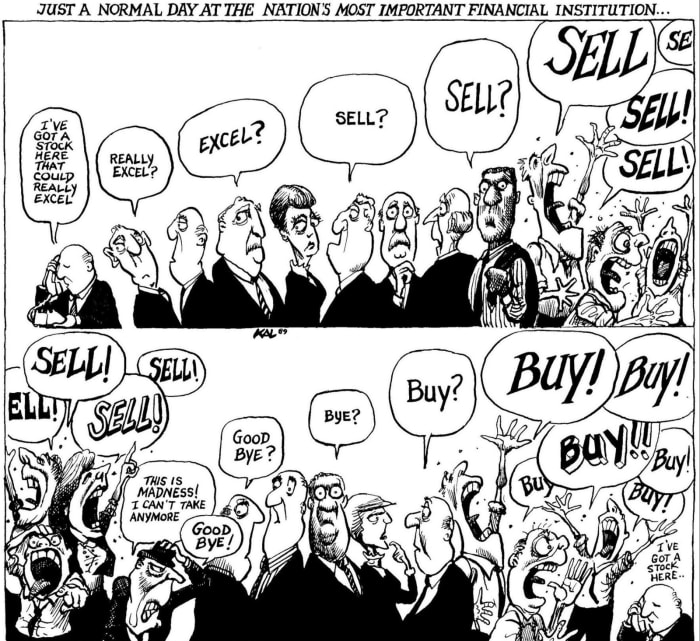

A great example is these people who have become “at-home traders,” whose lives have devolved into a high-anxiety, opportunistically-desperate-gambling fusions of Trading View and Porn Hub.

It reminds me of the following quote from JBP’s book:

But winning at everything might only mean that you’re not doing anything new or difficult. You might be winning but you’re not growing, and growing might be the most important form of winning. Should victory in the present always take precedence over trajectory across time?

Blind Weimar-style gambling is a perfect example of perceived present victory over long-term opportunity for growth and meaning (the true victory).

Our barometers for meaning are broken and as such, we’re not only playing the wrong games, but we’re also playing the few right games available, wrong. Therein lies your answer to corruption. When the cost of corruption is low, when it’s the click of a button (brrr), a committee-meeting by those with no skin in the game (e.g., Federal Open Market Committee or the World Economic Forum) or a popularity contest (election), what else do you expect to happen?

Fiat corrupts, and absolute fiat corrupts absolutely.

A New Game

Bitcoin allows us to flip the script, initially at the micro, personal level and over time on the macro level.

Bitcoin’s inherent number-go-up technology is a sure-fire way to simultaneously do what is moral (store the product of your labor safely, and outside the hands of thieves) and get ahead financially speaking.

There’s never been a revolution quite like this. One that undermines the corrupt status quo, but is organically emergent, respects private property rights, aligns with natural order, incentivizes both friend and foe to enhance it and makes its supporters (not verbal supporters, but those with skin in the game) disproportionately wealthy by simply preserving their purchasing power perfectly across time.

There is no greater “alpha” in the 21st century, and likely there never was or ever will be. This is an inflection point for the human race and if perceived as such, could be an inflection point for your life.

If the cards are always stacked against you, perhaps the game you are playing is somehow rigged (perhaps by you, unbeknownst to yourself).

Beyond the advantage of playing the Bitcoin game, and stacking the cards in your favor, Bitcoin’s inherent properties make it something that forces you to lengthen your time horizon and thus play a better long-term game for you, your family, your tribe and the world.

There’s not been an invention or discovery made by man more evidently impactful on personal time preference than Bitcoin — perhaps other than offspring, and that might be another category.

When you can safely and securely store the product of your labor for future use, when you can not only transport it securely across space, but more importantly across time, you begin to think and behave differently.

You begin to have the “space” to play more meaningful games. Games that inspire you. Games that you’re good at. Games that you can actually compete in, that you have a chance at winning. Therein lies true hope.

Contrast this with schemes and charades masquerading as games, fed to you by false idols, gamblers, talking heads and a cancerous state apparatus. This is false hope, and a large source of modern nihilism.

Multiple Games

But what about those who cannot play these new games?

I’m glad you asked.

The economy is not zero-sum, because the games in which we are able to succeed or fail are unlimited.

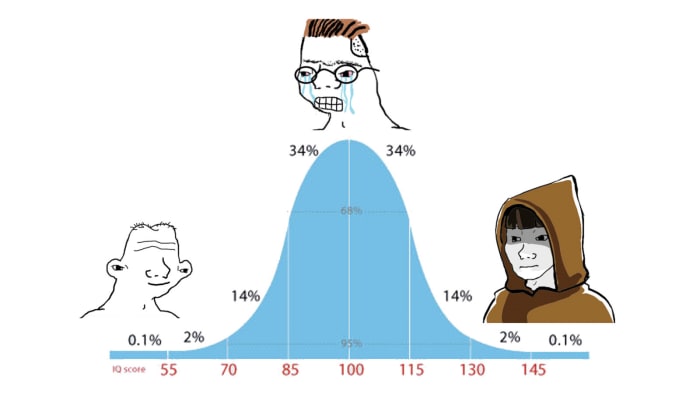

The idea that IQ is a determinant for success is too narrow, because success is multi-dimensional and people excel at different things, for different reasons.

For more intellectual pursuits, and in a world that’s become highly cerebral, IQ might matter; but even that has been challenged and likely disproven (as much as I don’t like Nassim Taleb the person, his argument against IQ is strong).

Mike Tyson is the perfect example that refutes IQ as a marker of success, and in a world not so narrow or confined, these kinds of examples would flourish.

The key is finding a game that suits you, which is more likely to occur in a diverse society where humans have the option to explore, perform, pursue, innovate and add value by virtue of their unique talents.

The centrally planned attempt to transform all humans into obedient automatons that work from home over Zoom, blindly gamble on Robinhood and receive universal basic income for their subsistence, is the kind of environment where people in the middle of the bell-curve,— who are not pursuing what’s meaningful, but instead what they’ve been told to pursue — can easily be cognitively categorized by an IQ test.

They are the NPCs — the people in the perennial rat race.

Unfortunately, their existence is in large part a function of a world where saving the product of your labor is no longer possible, and social orientation is not emergent, but decreed. In this world, you are forced to become an obedient serf or a choiceless slave.

You cannot play any new games because the one game you must play is the one of survival. You are a dependent. And the state… it wants you to be more dependent. It’s much easier to manage a long tail of lemmings than it is to herd lions.

There is not just one game at which to succeed or fail. There are many games and, more specifically, many good games — games that match your talents, involve you productively with other people, and sustain and even improve themselves across time.

We want people to play multiple games because it not only increases their chance for prosperity and fulfillment, but the macro opens up more opportunities for more games, which in time leads to more total wealth creation. That’s how a rising tide lifts all boats.

When you’re unable to save, you are stuck playing a singular game in which you feel that you can never get ahead.

It’s no wonder nihilism is so rampant.

It’s also unlikely that you’re playing only one game. You have a career and friends and family members and personal projects and artistic endeavors and athletic pursuits.

None of this is to say that people cannot rise up through this villainy. That’s certainly possible as evidenced by new entrepreneurs, influencers and competent individuals who pull themselves up by their bootstraps.

The problem is that the “activation energy” required to move beyond that threshold has increased to a point where fewer and fewer people can rise up and play these nuanced games. And that’s not to mention the incentives to play them crookedly.

This is creating a greater and greater divide between the haves and have-nots in modern society, which in a globally connected “social-media world” has a disastrously negative impact on people’s outlook and their performance. Their only refuge slowly becomes a dependence on daddy government and the nanny state.

Bitcoin and the space it makes for us by allowing human beings to simply save opens the door for more honest, varied games. It also gives every single saver (prudent-life player) greater purchasing power over time, thus acting like an ETF on macro-human-progress. The more efficient and advanced we become, the more games we play, the more wealth we collectively produce, and the more each unit of money measures and thus the greater the space for every saver and user of said money.

Bitcoin is a rising tide that lifts all boats, in stark, stark contrast to the modern fiat world which is creating a divide like no other.

I know it sounds too easy, but it’s not. It’s that simple. Huge difference. The most complicated things are usually solved in this way. Not surgically, but holistically. Simply but not easily. Losing weight doesn’t require sophisticated diets. It just requires you to eat less and move more.

Fixing society doesn’t need convoluted 2,500-page budgets every couple of months, which are read by nobody and passed as “law” on red-felt-carpets, by nursing-home-age bureaucrats. Fixing society simply requires that people save more and have the mental space to choose where to apply their efforts and when to play.

This is maturity.

Maturation Of The Individual

The more mature an individual becomes, the further he can lengthen his time horizons. The taller he stands, the farther he can see.

Maturity is a function of time preference. The higher the preference, the more childlike and ultimately dependent you are, while the lower the preference, the more sovereign, responsible and adult-like you are.

The society we’re currently living in is one that is becoming increasingly filled with adult-infants who are dependent on the good will of their state overlords.

As we mature we become, by contrast, increasingly individual and unique. The conditions of our lives become more and more personal and less and less comparable with those of others. Symbolically speaking, this means we must leave the house ruled by our father, and confront the chaos of our individual Being.

A mature person is one that is becoming an individual, and a more complex, nuanced and multi-dimensional one at that.

Modern society wants us all to become monotonous conformists that refuse to leave the house ruled by our “father-government.”

They want to shield us from the “chaos of life” and blanket us in false promises of safety in return for our obedience and compliance.

Each day that goes by, the aggregate of the human race becomes more and more infantilized.

This is not progress. This is regress.

Fiat weakens, absolute fiat weakens absolutely.

Bitcoin represents a move toward responsibility and maturity. A move toward becoming an individual who will stand up straight with their shoulders back, and confront the chaos of life.

The more strong individuals a society has, the stronger it becomes.

Transcending The Infantilism Of The State

Bitcoin helps us reverse the trend and trajectory we are currently on.

The infant is dependent on his parents for almost everything he needs. The child — the successful child — can leave his parents, at least temporarily, and make friends. He gives up a little of himself to do that, but gains much in return. The successful adolescent must take that process to its logical conclusion. He has to leave his parents and become like everyone else. He has to integrate with the group so he can transcend his childhood dependency. Once integrated, the successful adult then must learn how to be just the right amount different from everyone else.

As responsible adults, we are no longer school children that require caretakers to tell us what to do on a regular basis. All of modern society is structured in this way, because bureaucrats need something to bureaucratize about. If they’re not regulating something or someone, then what else would they be doing?

So to validate their existence, they proceed to design ever more complicated regulatory and social frameworks within which everyone needs to operate, which in turn create more complexity that needs to be further regulated.

It’s a social Benjamin Button in action, and the victim is the sovereign individual. He is suffocated by red tape and mindless nonsense that imprisons him inside a fragile glass cube of “safety.”

He loses his willingness to “dare” which is critical to his ability to play diverse, meaningful games.

Dare

As Cooper says in Interstellar, the 2014 movie by Chris Nolan:

“We used to look up at the sky and wonder at our place in the stars, now we just look down and worry about our place in the dirt.”

A sophisticated and mature civilization can lift its gaze and dare to be better. It will discover more, do more, produce more and experience more. Not from a place of desperation or distraction, but from a place of curiosity and courage.

We’ve lost that. Over the past 24 months alone, people have been convinced that otherwise healthy individuals are a danger to their health, that they need to distance themselves from all humans because everyone is a walking pathogen lab, that speech is violence, that honking is hailing Hitler, that science is something you “trust” and that safety is somehow a virtue.

The spirits of our ancestors are embarrassed for us right now.

And it’s no wonder. To dare one needs confidence, but what happens to confidence when you’ve been coddled all your life and society was designed to resemble a mental asylum or nursing home?

And mind you, not all of this was built on purpose by some lizards behind a red curtain. It is largely a result of orienting for poor values and measuring progress with a fraudulent scorecard.

We must turn this around:

Dare, instead, to be dangerous. Dare to be truthful. Dare to articulate yourself, and express (or at least become aware of) what would really justify your life.

To do this in a social sense, with real confidence, you must know that the rug you stand on shall not be pulled from beneath you. Certainty is the base human need and in order to function like sane humans, we must have healthy means of meeting that need. The healthiest is being able to save resources and thus lower the risk of an uncertain future.

Modernity has us all standing on a rug whose brand name is “PULL HARDER.”

Bitcoin on the other hand is stable ground. No rugs. No genies. No bullshit. Just a map that resembles the territory and an opportunity for you to play an honest game with an honest scorecard.

In closing…

Taking Stock

Bitcoin allows you to take stock.

Modernity is like one of those people who are always busy, always stressed out, perpetually in a rush toward something, all the while achieving nothing of substance.

Even the best and most capable of us get caught up in this racket. We get so busy that we rarely make the time necessary to just take stock.

Imagine a couple of people randomly running in a particular direction. All of a sudden a few more join, after a little while everyone is running in the same direction and nobody knows why, from where, or toward what they’re running. That’s modern life. Nobody is taking stock. We’re all caught on this incessant treadmill or rat wheel where stopping means dissolving into oblivion.

To buck the trend, to stand out from the madness of crowds requires first courage and second the mental space to discern and decide for oneself.

This is the kind of person who can stand up to and resist the tyrannical tendency to constantly compare oneself with who others are today rather than with who they were yesterday.

This is what it means to be a sovereign individual. Someone who has the wherewithal to say no when everyone else is blindly saying yes. Or vice versa. Like that one guy in Nazi Germany who was not blindly heiling with the crowd. This is who Bitcoiners remind me of.

When you take the natural desire to compare ourselves with others (which alone must be tempered in an ever-connected world, as Dr. Peterson discussed in the chapter) and embed it into a society where blind consumption and rampant speculation is driven by a need to survive because savings is impossible; then overlay that with an arbitrary group-identity-via-state-coddling form of responsibility erosion — what do you expect to happen?

You’re going to completely pathologize that already potentially dangerous comparative desire, and it will metastasize into god-knows-what over time.

Bitcoin allows you to focus once more on yourself first, and then what matters most next. Yes, you will also measure your wealth against other large-stack HODLers, but as your own bottom line and personal balance sheet strengthens, you have room to breathe and take stock.

Do you want to march onward, build value, build businesses and develop enough wealth to catch up? Or do you want to relax a little? Do you want to perhaps raise a family? Do you want to start a small lifestyle business in some beautiful corner of the world? Perhaps one of the many soon-to-emerge Bitcoin beaches?

Optionality exists when you have the ability to save.

Bitcoin Is Self Care

By storing the product of your labor in something impenetrable and incorruptible, you are in effect doing a service to your future self.

By transmitting your wealth across time, you have optionality in the future. As such, you are better able to negotiate with yourself instead of becoming a tyrant. A tyrant is he who has no options, or at least feels they have none, so they lash out at everyone; they take, they coerce and they project their own inadequacies onto everyone else.

Do you negotiate fairly with yourself? Or are you a tyrant, with yourself as slave?

This is true toxicity, not the hope that Bitcoin has given people, and the droves of tireless Bitcoiners who have been calling out scams and educating freely from the beginning.

Don’t let these snake oil salesmen, aspiring digital central bankers (i.e., shitcoiners) and bureaucrats con you into obsolescence by making you believe that Bitcoin and its proponents are toxic to you.

As discussed in chapter three of the series, Bitcoin and Bitcoiners are toxic to the empire of lies and all of its central organs.

Bitcoin is Saving. Bitcoin is Responsibility.

Saving is the literal cornerstone of society because it gives you certainty across time. It is critical to becoming someone that operates from a place of calm and ownership versus one that operates from desperation and victimhood.

Responsibility is the literal cornerstone of functional human behavior and the natural limiter to unhinged freedom. On a macro scale it enables the development of a robust, moral society with healthy boundaries and strong constituents.

What greater acts of love can one perform for themselves, for their family, their tribe and the world?

Bitcoin is Saving.

Bitcoin is Responsibility.

Bitcoin is Moral.

Bitcoin is Self-Love.

Simple.

This is a guest post by Aleks Svetski, author of “The UnCommunist Manifesto,” The Bitcoin Times and Host of anchor.fm/WakeUpPod. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link