[ad_1]

Has the surge in US consumer prices accelerated further?

US inflation is expected to have hit another 40-year high in March. Consumer price index data, due out on Thursday, are forecast to have risen by 8.4 per cent year over year, according to estimates from Bloomberg, the fastest pace since 1981.

The rate of price growth is up from 7.9 per cent in February, when the war in Ukraine was just beginning. Since then, prices of commodities have risen, with Brent crude, the international oil benchmark, rising to its highest level since 2008. While oil prices have backed off since that peak, they remain elevated, pushing up consumer prices.

The measure of consumer prices that excludes the volatile food and energy sectors, so-called core CPI, is also expected to rise but at a much slower pace. Core CPI in February increased 6.4 per cent from the same month last year. The gauge is forecast to have risen 6.6 per cent in March, a fresh four-decade high, but the slowest increase in year over year growth since last summer.

The gap between headline and core CPI points to a growing problem for the Federal Reserve. Inflation produced by supply chain bottlenecks or sanctions on Russia is not within the Fed’s direct control, but will nevertheless produce a higher headline number. That could prompt calls for evermore aggressive policy.

“I think we can expect a growing divide between headline and core [CPI]. The risk is that this keeps the Fed needing to surprise the market on the hawkish side just to catch up to inflation risks,” said Jim Caron, a portfolio manager at Morgan Stanley. Kate Duguid

How much have rising energy prices pushed up UK inflation?

Like the US, the UK has also faced record price growth in recent months. Annual inflation reached a 30-year high of 6.2 per cent in February, before Russia’s invasion of Ukraine sent energy prices even higher.

Economists polled by Reuters expect March data, released on Wednesday, to show that consumer price growth accelerated to 6.7 per cent on an annual basis as pressures become more widespread across the economy. Many economists expect inflation to surge further in April, to around 8 per cent, after the energy regulator authorised a higher cap on prices.

Silvia Dall’Angelo, economist at Federated Hermes International said: “Going forward, headline inflation is set to rise further, mainly reflecting a large increase in international oil prices, large adjustment to utility prices in April and October and, more generally, the impact from high commodity prices.”

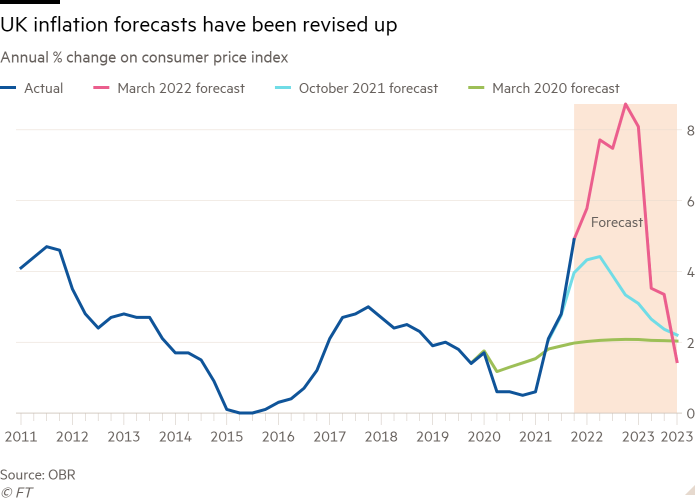

The limit on energy bills is expected to rise by a further 40 per cent in October, which would add to inflationary pressure. The Office for Budget Responsibility, the UK fiscal watchdog, expects consumer price growth to peak at close to 9 per cent in the fourth quarter of this year, double the rate of its previous forecast and the highest inflation rate in about 40 years.

The OBR said soaring prices were largely driven by higher energy costs, but “excess demand in the domestic economy means we expect that much of these cost increases will be passed on to consumer prices and will be partly matched with higher nominal wage growth”. That could mean a more prolonged period of high inflation than currently expected. Valentina Romei

Will the ECB speed up monetary tightening?

The governing council of the European Central Bank will meet in Frankfurt on Thursday with its members being pulled into two competing

directions on eurozone monetary policy.

The more ‘hawkish’ officials argue the surge in eurozone inflation to a record 7.5 per cent in March means they should accelerate the ECB’s plans to end net bond-buying and quickly raise interest rates for the first time in over a decade.

But an opposing camp of council members are pushing back, saying a rate increase would come at the worst time for the eurozone economy, which is already facing a downturn due to the war in Ukraine, especially if Russian gas supplies to Europe are suddenly cut off because of the conflict.

“Looming stagflation in the eurozone has complicated the ECB’s life,” said Carsten Brzeski, head of macro research at ING. “Higher inflation for longer and a very uncertain outlook for growth not only in the

short but also longer-term will worsen the ongoing controversy between ECB [policymakers].”

Contrasting statements from ECB officials last week highlighted the divergence of opinion at the top of the central bank. German central bank president Joachim Nagel said soaring inflation “worries us all” and predicted “savers may soon be able to look forward to higher interest rates again”.

Hours earlier, ECB executive board member Fabio Panetta said most price pressures came from energy markets and other factors outside the central bank’s control, so it would “have to massively suppress domestic demand to bring down inflation”.

Analysts expect the ECB is likely to stick to its plans for ending net bond purchases in the third quarter, and to say it will keep its options open for speeding up or slowing down the withdrawal of stimulus, depending on how the economy responds in the coming months. Martin Arnold

[ad_2]

Source link