[ad_1]

Editor’s note: This article is the second in a three-part series. Plain text represents the writing of Greg Foss, while italicized copy represents the writing of Jason Sansone.

In part one of this series, I reviewed my history in the credit markets and covered the basics of bonds and bond math in order to provide context for our thesis. The intent was to lay the groundwork for our “Fulcrum Index,” an index which calculates the cumulative value of credit default swap (CDS) insurance contracts on a basket of G20 sovereign nations multiplied by their respective funded and unfunded obligations. This dynamic calculation could form the basis of a current valuation for bitcoin (the “anti-fiat”).

The first part was dry, detailed and academic. Hopefully, there was some interesting information. At the end of the day, though, math is typically not a strong subject for most. And, as for bond math, most people would rather chew glass. Too bad. Bond and credit markets make the capitalist world function. However, when we socialize losses, and reward the risk takers with government funded bailouts, the self-correcting mechanism of capitalism (creative destruction) is jeopardized. This topic is important: Our leaders and children need to understand the implications of credit, how to price credit, and ultimately, the cost of crony-capitalism.

Heretofore, we will continue our discussion of bonds, focusing on the risks inherent to owning them, the mechanics of credit crises, what is meant by contagion and the implications these risks have for individual investors and the credit markets in general. Buckle up.

Bond Risks: An Overview

The main risks inherent to investing in bonds are listed below:

- Price*: rRsk that the interest rates on U.S. treasuries rise, which then increases the yield the market requires on all debt contracts, thereby lowering the price of all outstanding bonds (this is also referred to as interest rate risk, or market risk)

- Default*: Risk that the issuer will be unable to meet their contractual obligation to pay either coupon or principal

- Credit*: Risk that the issuer’s “creditworthiness” (e.g., credit rating) decreases, thereby rendering the return on the bond inadequate for the risk to the investor

- Liquidity*: Risk that bond holder will need to either sell the bond contract below original market value or mark it to market below original market value in the future

- Reinvestment: Risk that interest rates on U.S. treasuries fall, causing the yield made on any reinvested future coupon payments to decrease

- Inflation: Risk that the yield on a bond does not keep pace with inflation, thereby causing the real yield to be negative, despite having a positive nominal yield

*Given their importance, these risks will each be covered separately below.

Bond Risk One: Price/Interest, Rate/Market Risk

Historically, investors have primarily been concerned with interest rate risk on government bonds. That is because over the last 40 years, the general level of interest rates (their yield to maturity, or YTM) have declined globally, from a level in the early 1980s of 16% in the U.S., to today’s rates which approach zero (or even negative in some countries).

A negative yielding bond is no longer an investment. In fact, if you buy a bond with a negative yield, and hold it until maturity, it will have cost you money to store your “value.” At last count, there was close to $19 trillion of negative yielding debt globally. Most was “manipulated” government debt, due to quantitative easing (QE) by central banks, but there is negative-yielding corporate debt, too. Imagine having the luxury of being a corporation and issuing bonds where you borrowed money and someone paid you for the privilege of lending it to you.

Going forward, interest rate risk due to inflation will be one directional: higher. And due to bond math, as you now know, when interest rates rise, bond prices fall. But there is a bigger risk than this interest rate/market risk that is brewing for government bonds: credit risk. Heretofore, credit risk for governments of developed G20 nations has been minimal. However, that is starting to change…

Bond Risk Two: Credit Risk

Credit risk is the implicit risk of owning a credit obligation that has the risk of defaulting. When G20 government balance sheets were in decent shape (operating budgets were balanced and accumulated deficits were reasonable) the implied risk of default by a government was almost zero. That is for two reasons: First, their ability to tax to raise funds to pay their debts and, secondly and more importantly, their ability to print fiat money. How could a federal government default if it could just print money to pay down its outstanding debt? In the past, that argument made sense, but eventually printing money will (and has) become a credit “boogie man,” as you will see.

For the purpose of setting a “risk-free rate,” though, let’s continue to assume that benchmark is set by the federal government. In markets, credit risk is measured by calculating a “credit spread” for a given entity, relative to the risk-free government rate of the same maturity. Credit spreads are impacted by the relative credit riskiness of the borrower, the term to maturity of the obligation and the liquidity of the obligation.

State, provincial and municipal debt tends to be the next step as you ascend the credit risk ladder, just above federal government debt, thereby demonstrating the lowest credit spread above the risk-free rate. Since none of the entities have equity in their capital structure, much of the implied credit protection in these entities flows from assumed federal government backstops. These are certainly not guaranteed backstops, so there is some degree of free market pricing, but generally these markets are for high grade borrowers and low risk tolerance investors, many of whom assume “implied” federal support.

Corporates are the last step(s) on the credit risk ladder. Banks are quasi-corporates and typically have low credit risk because they are assumed to have a government backstop, all else being equal. Most corporations do not have the luxury of a government backstop (although lately, airlines and car makers have been granted some special status). But in the absence of government lobbying, most corporations have an implied credit risk that will translate into a credit spread.

“Investment grade” (IG) corporations in the U.S. market (as of February 17, 2022) trade at a yield of 3.09%, and an “option adjusted” credit spread (OAS) to U.S. treasuries of 1.18% (118 basis points, or bps), according to any Bloomberg Terminal where you might care to look. “High-yield” (HY) corporations, on the other hand, trade at a yield of 5.56% and an OAS of 3.74% (374 bps), also per data available through any Bloomberg Terminal. Over the past year, spreads have remained fairly stable, but since bond prices in general have fallen, the yield (on HY debt) has increased from 4.33%… Indeed, HY debt has been a horrible risk-adjusted return of late.

When I started trading HY 25 years ago, the yield was actually “high,” generally better than 10% YTM with spreads of 500 bps (basis points) and higher. However, because of a 20-year “yield chase” and, more recently, the Federal Reserve interfering in the credit markets, HY looks pretty low yield to me these days… but I digress.

Subjective Ratings

From the above, it follows that spreads are largely a function of credit risk gradations above the baseline “risk-free” rate. To help investors evaluate credit risk, and thus price credit on new issue debt, there are rating agencies who perform the “art” of applying their knowledge and intellect to rating a given credit. Note that this is a subjective rating that qualifies credit risk. Said differently: The rating does not quantify risk.

The two largest rating agencies are S&P and Moody’s. In general, these entities get the relative levels of credit risk correct. In other words, they correctly differentiate a poor credit from a decent credit. Notwithstanding their bungling of the credit evaluations of most structured products in the Great Financial Crisis (GFC), investors continue to look to them not only for advice, but also for investment guidelines as to what determines an “investment grade” credit versus a “non-investment grade/high yield” credit. Many pension fund guidelines are set using these subjective ratings, which can lead to lazy and dangerous behavior such as forced selling when a credit rating is breached.

For the life of me, I cannot figure out how someone determines the investment merits of a credit instrument without considering the price (or contractual return) of that instrument. However, somehow, they have built a business around their “credit expertise.” It is quite disappointing and opens the door for some serious conflicts of interest since they are paid by the issuer in order to obtain a rating.

I worked very briefly on a contract basis for Dominion Bond Rating Service (DBRS), Canada’s largest rating agency. I heard a story among the analysts of a Japanese bank who came in for a rating because they wanted access to Canada’s commercial paper (CP) market, and a DBRS rating was a prerequisite for a new issue. The Japanese manager, upon being given his ratingm, inquired, “If I pay more money, do I get a higher rating?” Sort of makes you think…

Regardless, rating scales are as follows, with S&P/Moody’s highest to lowest rating: AAA/Aaa, AA/Aa, A/A, BBB/Baa, BB/Ba, CCC/Caa and D for “default.” Within each category there are positive (+) and negative (-) adjustments of opinion. Any credit rating of BB+/Ba+ or lower is deemed “non-investment grade.” Again, no price is considered and thus I always say, if you give me that debt for free, I promise it would be “investment grade” to me.

Poor math skills are one thing, but adhering to subjective evaluations of credit risk are another. There are also subjective evaluations such as “business risk” and “staying power,” inherently built into these ratings. Business risk can be defined as volatility of cash flows due to pricing power (or lack thereof). Cyclical businesses with commodity exposure such as miners, steel companies and chemical companies have a high degree of cash flow volatility and therefore, their maximum credit rating is restricted due to their “business risk.” Even if they had low debt levels, they would likely be capped at a BBB rating due to the uncertainty of their earnings before interest. tax, depreciation, and amortization (EBITDA). “Staying power” is reflected in the industry dominance of the entity. There is no rule that says big companies last longer than small ones, but there is certainly a rating bias that reflects that belief.

The respective ratings for governments are also very, if not completely, subjective. While total debt/GDP metrics are a good starting point, it ends there. In many cases, if you were to line up the operating cash flows of the government and its debt/leverage statistics compared to a BB-rated corporation, the corporate debt would look better. The ability to raise taxes and print money is paramount. Since it is arguable that we have reached the point of diminishing returns in taxation, the ability to print fiat is the only saving grace. That is until investors refuse to take freshly printed and debased fiat as payment.

Objective Measures Of Credit Risk: Fundamental Analysis

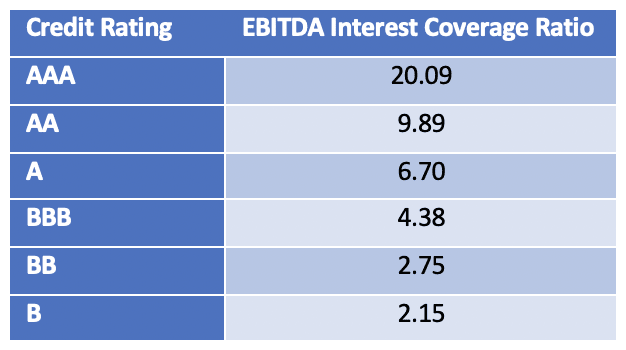

In the case of corporate debt, there are some well-defined metrics which help to provide guidance for objectively evaluating credit risk. EBITDA/interest coverage, total debt/EBITDA and enterprise value (EV)/EBITDA are great starting points. EBITDA is essentially pre-tax cash flow. Since interest is a pre-tax expense, the number of times EBITDA covers the pro-forma interest obligation makes sense as a measure of credit risk. In fact, it was this metric that I had determined to be the most relevant in quantifying the credit risk for a given issuer, a finding I published in “Financial Analysis Journal” (FAJ) in March 1995. As I mentioned in part one, I had worked for Royal Bank of Canada (RBC), and I was well aware that all banks needed to better understand and price credit risk.

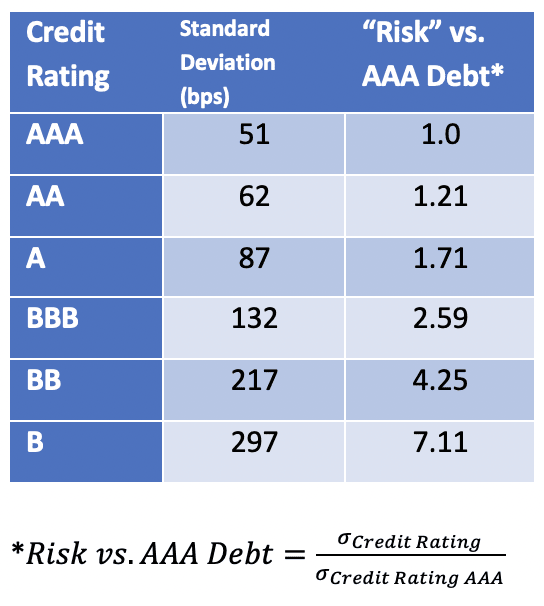

The article was titled “Quantifying Risk In The Corporate Bond Markets.” It was based on an exhaustive study of 23 years of data (18,000 data points) that I painfully accumulated at the McGill Library in Montreal. For our younger readers out there, this was before electronic data of corporate bond prices was available, and the data was compiled manually from a history of phonebook-like publications that McGill Library had kept as records. In it, I showed a nice pictorial of risk in the corporate markets. The dispersions of the credit spread distributions measures this risk. Notice, as the credit quality decreases the dispersion of the credit spread distributions increases. You can measure the standard deviations of these distributions to get a relative measure of credit risk as a function of the credit rating.

The data and results were awesome and unique, and I was able to sell this data to the RBC to help with its capital allocation methodology for credit risk exposure. The article was also cited by a research group at JPMorgan, and by the Bank for International Settlements (BIS).

It should be obvious by now that anyone who is investing in a fixed income instrument should be keenly aware of the ability of the debt issuer to honor their contractual obligation (i.e., creditworthiness). But what should the investor use to quantitatively evaluate the creditworthiness of the debt issuer?

One could extrapolate the creditworthiness of a corporation by assessing various financial metrics related to its core business. It is not worth a deep dive into the calculation of EBITDA or interest coverage ratios in this article. Yet, we could all agree that comparing a corporation’s periodic cash flow (i.e., EBIT or EBITDA) to its periodic interest expense would help to quantify its ability to repay its debt obligations. Intuitively, a higher interest coverage ratio implies greater creditworthiness.

Referencing the aforementioned article, the data proves our intuition:

Indeed, one could convert the above data into specific relative risk multiples, but for the purposes of this exercise, simply understanding the concept is sufficient.

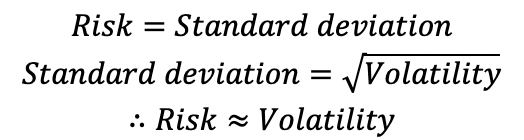

Similarly, one can use some basic math to convert subjective ratings into relative credit risk. But first, realize that risk is related to both standard deviation and volatility as follows:

A glance at market data provides the standard deviation of the risk premium/yield spread for various credit rating categories, which then allows the calculation of relative risk.

The standard deviation of risk premium/yield for various credit ratings allows for the calculation of relative risk.

Therefore, as an example, if an investor wishes to purchase the debt of corporation XYZ, which has a credit rating of BB, that investor should expect a risk premium/yield spread of 4.25 times the current market yield for AAA-rated investment-grade debt (all other factors being equal).

Objective Measures Of Credit Risk: Credit Default Swaps

CDS are a relatively new financial engineering tool. They can be thought of as default insurance contracts where you can own the insurance on an entity’s credit. Each CDS contract has a reference obligation that trades in a credit market so there is a natural link to the underlying name. In other words, if CDS spreads are widening on a name, credit/bond spreads are widening in lock step. As risk increases, insurance premiums do, too.

Allow me to get into the weeds a bit on CDS. For those less inclined to do so, feel free to skip down to the italicized section… CDS contracts start with a five-year term. Every 90 days, a new contract is issued and the prior contract is four-and-three-quarters-years old, etc. As such, five-year contracts eventually become one-year contracts that also trade. When a credit becomes very distressed, many buyers of protection will focus on the shorter contracts in a practice that is referred to as “jump to default” protection.

The spread or premium is paid by the owner of the contract to the seller of the contract. There can be, and usually is, much higher notional value of CDS contracts among sophisticated institutional accounts, than the amount of debt outstanding on the company. The CDS contracts can thus drive the price of the bonds, not the other way around.

There is no limit to the notional value of CDS contracts outstanding on any name, but each contract has an offsetting buyer and seller. This opens the door for important counterparty risk considerations. Imagine if you owned CDS on Lehman Brothers in 2008 but the counterparty was Bear Stearns? You may have to run out and purchase protection on Bear Stearns, thereby pouring gas on the credit contagion fire.

I believe it was Warren Buffet who famously referred to CDS as a “financial weapon of mass destruction.” That is a little harsh, but it is not altogether untrue. The sellers of CDS can use hedging techniques where they buy equity put options on the same name to manage their exposure. This is another reason that if CDS and credit spreads widen, the equity markets can get punched around like a toy clown.

Many readers may have heard of the CDS. Although technically not an insurance contract, it essentially functions the exact same way: “insuring” creditors against a credit event. Prices of CDS contracts are quoted in basis points. For example, the CDS on ABC, Inc. is 13 bps (meaning, the annual premium to insure $10 million of ABC, Inc. debt would be 0.13%, or $13,000). One can think of the premium paid on a CDS contract as a measure of the credit risk of the entity the CDS is insuring.

In other words, applying the logic from Foss’ FAJ article described above, let’s estimate the relative CDS premiums of two corporate entities:

- ABC, Inc.: Credit rating AA+, EBITDA interest coverage ratio 8.00

- XYZ, Inc.: Credit rating BBB, EBITDA interest coverage ratio 4.25

For which entity would you expect the CDS premium to be higher? That’s right: XYZ, Inc.

It turns out that the difference between CDS premiums and risk premiums/yield spreads is typically quite small. In other words, if the market’s perception is that the credit risk of a given entity is increasing, both the CDS premium and the required yield on its debt will increase. Two examples from recent events highlight this point:

- Look at the recent fluctuations in CDS pricing on HSBC (a bank). It turns out HSBC is one of the main creditors of Evergrande (of Chinese real estate fame). According to my interpretation of historical CDS data, five-year CDS pricing on September 1, 2021 was 32.75 bps. Just over a month later, it had increased nearly 36% to 44.5 bps on October 11, 2021. Note: This was during the month of September that news of Evergrande’s impending collapse circulated.

- Turkey has been experiencing a well-publicized currency collapse of late. The one-month and s-month variance on five-year CDS pricing of Turkey’s sovereign debt is +22.09% and +37.89%, respectively. Note: The yield on the Turkish 10-year government bond currently sits at 21.62% (up from 18.7% six months ago).

One could argue that the most accurate way to assess credit risk is via tracking CDS premiums. They are neither subjective, nor are they an abstraction from financial data. Rather, they are the result of an objective and efficient market. As the saying goes: “Price is truth.”

This dynamic interplay between CDS premia and credit spreads is extremely important for corporate credit and it is a well-worn path. What is not so well worn, though, is CDS on sovereigns. This is relatively new, and in my opinion, could be the most dangerous component of sovereign debt going forward.

I believe inflation risk considerations for sovereigns will become overwhelmed by credit risk concerns. Taking an example from the corporate world, two years prior to the GFC, you could purchase a CDS contract on Lehman Brothers for 0.09% (9 bps), per historical CDS data. Two years later, that same contract was worth millions of dollars. Are we headed down the same path with sovereigns?

Think of the potential for long-dated sovereign bonds to get smoked if credit spreads widen by hundreds of basis points. The resultant decrease in bond value would be huge. This will cause many bond managers (and many economists) indigestion. Most sovereign bond fund managers and economists are still focused on interest rate risk rather than the brewing credit focus.

Moreover, the price of sovereign CDS premia effectively set the base credit spread for which all other credits will be bound. In other words, it is unlikely that the spreads of any institution or entity higher up the credit ladder will trade inside the credit spread of the jurisdictional sovereign. Therefore, a widening of sovereign CDS premia/credit spreads leads to a cascading effect across the credit spectrum. This is referred to as “contagion.”

So, I ask the reader again: Is the U.S. treasury rate really “risk free”? This would imply that the inherent credit risk is zero… yet, at present, the CDS premium on U.S. sovereign debt costs 16 bps. To my knowledge, 16 bps is greater than zero. You can look up CDS premia (and thus the implied default risk) for many sovereigns at WorldGovernmentBonds.com. Remember, price is truth…

Bond Risk Three: Liquidity Risk

What exactly is liquidity, anyway? It’s a term that gets thrown around all the time: “a highly liquid market,” or “a liquidity crunch,” as though we are all just supposed to know what it means… yet most of us have no idea.

The academic definition of liquidity is as follows: The ability to buy and sell assets quickly and in volume without moving the price.

OK, fine. But how is liquidity achieved? Enter stage left: Dealers…

Let’s imagine you own 100 shares of ABC, Inc. You would like to sell these 100 shares and buy 50 shares of XYZ, Inc. What do you do? You log into your brokerage account and place the orders… within a matter of seconds each trade is executed. But what actually happened? Did your broker instantly find a willing counterparty to purchase your 100 shares of ABC, Inc. and sell you 50 shares of XYZ, Inc.?

Of course they didn’t. Instead, the broker (i.e., “broker-dealer”) served as the counterparty in this transaction with you. The dealer “knows” that eventually (in minutes, hours or days) they will find a counterparty who desires to own ABC, Inc. and sell XYZ, Inc., thereby completing the opposite leg of the trade.

Make no mistake, though. Dealers do not do this for free. Instead, they buy your shares of ABC, Inc. for $x and then sell those shares for $x + $y. In the business, $x is termed the “bid” and $x + $y is termed the “ask.” Note: The difference between the two prices is termed the “bid-ask spread” and serves as the profit incentive to the dealer for providing the market with liquidity.

Let’s recap: Dealers are for-profit entities that make markets liquid by managing surplus and/or deficit inventory of various assets. The profit is derived from the bid-ask spread, and in liquid markets, the spreads are small. But as dealers sense market risk, they quickly begin to widen the spreads, demanding more profit for taking the risk of holding inventory.

Except… What happens if widening the bid-ask spread is not enough compensation for the risk? What if the dealers simply stop making markets? Imagine, you are holding the debt of ABC, Inc., and wish to sell it, but no one is willing to buy (bid) it. The risk that dealers/markets seize up, describes the concept of liquidity risk. And this, as you could imagine, is a big problem…

For very liquid securities you can execute tens of millions of dollars of trades on a very tight market. While equity markets have the semblance of liquidity because they are transparent and trade on an exchange that is visible to the world, bond markets are actually far more liquid even though they trade over the counter (OTC). Bond markets and rates are the grease of the global financial monetary machine and for that reason central banks are very sensitive to how the liquidity is working.

Liquidity is reflected in the bid/ask spread as well as the size of trades that can be executed. When confidence wanes and fear rises, bid/ask spreads widen, and trade sizes diminish as market-makers (dealers) withdraw from providing their risk capital to grease the machine, as they don’t want to be left holding a bag of risk (inventory) for which there are no buyers. What tends to happen is everybody is moving in the same direction. Generally, in “risk off” periods, that direction is as sellers of risk and buyers of protection.

Perhaps the most important component for assessing credit market liquidity is the banking system. Indeed, confidence amongst entities within this system is paramount. Accordingly, there are a few open market rates that measure this level of counterparty confidence/trust. These rates are LIBOR and BAs. LIBOR is the London Interbank Offered Rate, and BAs is the Bankers’ Acceptance rate in Canada. (Note: LIBOR recently transitioned to Secured Overnight Financing Rate [SOFR], but the idea is the same). Both rates represent the cost at which a bank will borrow or lend funds in order to satisfy its loan demand. When these rates rise meaningfully it signals an erosion of trust between counterparties and a growing instability in the interbank lending system.

Contagion, Exhibit One: The Great Financial Crisis

Leading up to the GFC (Summer 2007), LIBOR and BAs were rising, indicating that the credit markets were starting to exhibit typical stresses seen in a “liquidity crunch” and trust in the system was starting to erode. Equity markets were largely unaware of the true nature of the problem except that they were being flung around as credit-based hedge funds reached for protection in the CDS and equity volatility markets. When in doubt, look to the credit markets to determine stresses, not the equity markets (they can get a little irrational when the punch bowl is spiked). This was a time of preliminary contagion, and the beginning of the Global Financial Crisis.

At that time, two Bear Stearns hedge funds were rumored to be in big trouble due to subprime mortgage exposure, and Lehman Brothers was in a precarious spot in the funding markets. Market participants at the time will no doubt remember the famous Jim Cramer rant (“They know nothing!”), when on a sunny afternoon, in early August 2007, he lost his patience and called out the Fed and Ben Bernanke for being clueless to the stresses.

Well, the Fed did cut rates and equities rallied to all-time highs in October 2007, as credit investors who were purchasing various forms of protection reversed course, thus pushing up stocks. But remember, credit is a dog, and equity markets are its tail. Equities can get whipped around with reckless abandon because the credit markets are so much larger and credit has priority of claim over equity.

It is worth noting that contagion in the bond market is much more pronounced than in the equity markets. For example, if provincial spreads are widening on Ontario bonds, most other Canadian provinces are widening in lockstep, and there is a trickle-down effect through interbank spreads (LIBOR/BAs), IG corporate spreads and even to HY spreads. This is true in the U.S. markets too, with the impact of IG indices bleeding into the HY indices.

The correlation between equity markets and credit markets is causal. When you are long credit and long equity, you are short volatility (vol). Credit hedge funds who want to dampen their exposure will purchase more vol, thereby exacerbating the increase in vol. It becomes a negative feedback loop, as wider credit spreads beget more vol buying, which begets more equity price movements (always to the downside). When central banks decide to intervene in the markets to stabilize prices and reduce volatility, it is not because they care about equity holders. Rather, it is because they need to stop the negative feedback loop and prevent seizing of the credit markets.

A brief explanation is warranted here:

- Volatility = “vol” = risk. The long/short relationship can really be thought of in terms of correlation in value. If you are “long x” and “short y,” when the value of x increases, the value of y decreases, and vice versa. Thus, for example, when you are “long credit/equity” and “short volatility/“vol”/risk,” as risk in markets increases, the value of credit and equity instruments decreases.

- The VIX, which is often cited by analysts and news media outlets, is the “volatility index,” and serves as a broad indicator of volatility/risk in the markets.

- “Purchasing vol” implies buying assets or instruments that protect you during an increase in market risk. For example, buying protective put options on your equity positions qualifies as a volatility purchase.

Regardless, reality soon returned as 2007 turned into 2008. Bear Stearns stock traded down to $2 per share in March 2008 when it was acquired by JP Morgan. Subprime mortgage exposure was the culprit in the collapse of many structured products and in September 2008, Lehman Brothers was allowed to fail.

My fear was that the system truly was on the brink of collapse, and I was not the only one. I rode the train to work every morning in the winter/spring of 2009 wondering if it was “all over.” Our fund was hedged, but we had counterparty risk exposure in the markets. It was a blessing that our investors had agreed to a lockup period and could not redeem their investments.

We calculated and managed our risk exposure on a minute-by-minute basis, but things were moving around so fast. There was true fear in the markets. Any stabilization was only a pause before confidence (and therefore prices) took another hit and dropped lower. We added to our hedges as the market tanked. Suffice to say: Contagion builds on itself.

Liquidity is best defined as the ability to sell in a bear market. By that definition, liquidity was non-existent. Some securities would fall 25% on one trade. Who would sell something down 25%? Funds that are being redeemed by investors who want cash, that’s who. In this case, the fund needs to sell regardless of the price. There was panic and blood in the streets. The system was broken and there was a de facto vote of no confidence. People didn’t sell what they wanted to, they sold what they could. And this, in turn, begot more selling…

Contagion, Exhibit Two: Reddit and GameStop (GME)

The events surrounding the recent “short squeeze” on GME were well publicized in the mainstream media, but not well explained. Let’s first recap what actually occurred…

According to my interpretation of events, it began with Keith Gill, a 34-year-old father from the suburbs of Boston, who worked as a marketer for Massachusetts Mutual Life Insurance Company. He was an active member of the Reddit community, and was known online as “Roaring Kitty.” He noticed that the short interest on GME was in excess of 100% of the number of shares outstanding. This meant that hedge funds, having smelled blood in the water and predicting GME’s imminent demise, had borrowed shares of GME from shareholders, and sold them, pocketing the cash proceeds, with plans to repurchase the shares (at a much lower price) and return them to their original owners at a later date, thus keeping the difference as profit.

But what happens if, instead of the share price crashing, it actually increases dramatically? The original share owners would then want their valuable shares back… but the hedge fund needs to pay more than the profit from the original short sale in order to repurchase and return them. A lot more. Especially when the number of shares the hedge funds are short outnumbers the number of shares in existence. What’s more, if they can’t get the shares no matter the price they are willing to pay, the margin clerks at the brokerage houses demand cash instead.

Galvanizing the Reddit community, “Roaring Kitty” was able to convince a throng of investors to buy GME stock and hold it. The stock price skyrocketed, as hedge funds were forced to unwind their trades at a significant loss. And that is how David beat Goliath…

GME caused a leverage unwind which cascaded through the equity markets and was reflected in increased equity volatility (VIX), and associated pressure on credit spreads. It happened as follows: Up to 15 major hedge funds were all rumored to be in trouble as their first month results were horrible. They were down between 10% and 40% to start the 2021 year. Cumulatively, they controlled about $100 billion in assets, however, they also employed leverage, often as high as ten times over their amount of equity.

To quote from the “Bear Traps Report” on January 27, 2021:

“Our 21 Lehman Systemic Indicators are screaming higher. The inmates are running the asylum… when the margin clerk comes walking by your desk it is a very unpleasant experience. You don’t just sell your losers, you must sell your winners. Nearly ‘everything must go’ to raise precious cash. Here lies the problem with central bankers. Academics are often clueless about systemic risk, even when it is right under their nose. The history books are filled with these lessons.”

The Federal Reserve Saves The Day?

As described previously in part one, the turmoil in the GFC and COVID-19 crisis essentially transferred excess leverage in the financial system to the balance sheets of governments via QE. Printed money was the painkiller, and unfortunately, we are now addicted to the pain medicine.

The Troubled Asset Relief Program (TARP) was the beginning of the financial acronyms that facilitated this initial risk transfer in 2008 and 2009. There was a huge amount of debt that was written down, but there was also a huge amount that was bailed out and transferred to the government/central bank books and thus are now government obligations.

And then in 2020, with the COVID crisis in full swing, more acronyms came as did the high likelihood that many financial institutions would again be insolvent… But the Fed ran into the market again. This time with not only the same old QE programs, but also new programs that would purchase corporate credit and even HY bonds. As such, the Federal Reserve has completed its transition from being the “lender of last resort” to being the “dealer of last resort.” It is now willing to purchase depreciating assets in order to support prices and provide the market with liquidity in order to prevent contagion. But at what cost?

Lessons From The GFC, COVID And The Fed’s QE

Price Signals In The Market Are No Longer Pure And Do Not Reflect The Real Level Of Risk

Quantitative easing by central banks tends to focus on the “administered” level of interest rates (some call it manipulation), and the shape of the yield curve, using targeted treasury bond purchases (sometimes called “yield curve control”). Under these extreme conditions, it is difficult to calculate a natural/open market “risk-free rate,” and due to central bank interference, true credit risks are not reflected in the price of credit.

This is what happens in an era of low rates. Costs to borrow are low, and leverage is used to chase yield. What does all this leverage do? It increases the risk of the inevitable unwind being extremely painful, while ensuring that the unwind fuels contagion. A default does not have to occur in order for a CDS contract to make money. The widening of spreads will cause the owner of the contract to incur a mark-to-market gain, and conversely, the seller of the contract to incur a mark-to-market loss. Spreads will widen to reflect an increase in the potential for default, and the price/value of credit “assets” will fall accordingly.

For this reason, we implore market participants to follow the CDS rates on sovereign governments for a much better indication of the true risks that are brewing in the system. One glaring example in my mind is the five-year CDS rates on the following countries:

- USA (AA+) = 16 bps

- Canada (AAA) = 33 bps

- China (A+) = 64 bps

- Portugal (BBB) = 43 bps

Even though Canada has the highest credit rating of the three, the CDS market is telling us otherwise. There is truth in these markets. Do not follow subjective credit opinions blindly.

Falsely rated “AAA” credit tranches were a major cause of the unraveling of structured credit products in the GFC. Forced selling due to downgrades of previously “over-rated” structures and their respective credit tranches was contagious. When one structure collapsed, others followed. Selling begets selling.

While a default by a G20 sovereign in the short term is still a lower probability event, it is not zero. (Turkey is a G20 and so is Argentina). As such, investors need to be rewarded for the risk of potential default. That is not currently happening in the environment of manipulated yield curves.

There are over 180 fiat currencies, and over 100 will likely fail before a G7 currency does. However, CDS rates are likely to continue to widen. Contagion and the domino effect are real risks, as history has taught us.

Sovereign Debt Levels Resulting From QE And Fiscal Spending Are Unsustainable

According to the Institute for International Finance, in 2017, global debt/global GDP was 3.3x. Global GDP has grown a little in the last three years, but global debt has grown much faster. I now estimate that the global debt/GDP ratio is over 4x. At this ratio, a dangerous mathematical certainty emerges. If we assume the average coupon on the debt is 3% (this is conservatively low), then the global economy needs to grow at a rate of 12% just to keep the tax base in line with the organically-growing debt balance (sovereign interest expense). Note: This does not include the increased deficits that are contemplated for battling the recessionary impacts of the COVID crisis.

In a debt/GDP spiral, the fiat currency becomes the error term, meaning that printing more fiat is the only solution that balances the growth in the numerator relative to the denominator. When more fiat is printed, the value of the outstanding fiat is debased. It is circular and error terms imply an impurity in the formula.

Therefore, when you lend a government money at time zero, you are highly likely to get your money back at time x; however, the value of that money will have been debased. That is a mathematical certainty. Assuming there is no contagion that leads to a default, the debt contract has been satisfied. But who is the fool? Moreover, with interest rates at historic lows, the contractual returns on the obligations will certainly not keep pace with the Consumer Price Index (CPI), let alone true inflation as measured by other less-manipulated baskets. And notice we have not even mentioned the return that would be required for a fair reward due to the credit risk.

I paraphrase the main question as follows: If countries can just print, they can never default, so why would CDS spreads widen? Make no mistake: sovereign credits do default even though they can print money.

Remember the Weimar hyperinflation following World War I, the Latin American Debt Crisis in 1988, Venezuela in 2020 and Turkey in 2021, where fiat is (actually or effectively) shoveled to the curb as garbage. There are plenty of other examples, just not in the “first world.” Regardless, it becomes a crisis of confidence and existing holders of government debt do not roll their obligations. Instead, they demand cash. Governments can “print” the cash, but if it is shoveled to the curb, we would all agree that it is a de facto default. Relying on economics professors/modern monetary theorists to opine that “deficits are a myth” is dangerous. The truth may be inconvenient, but that makes it no less true.

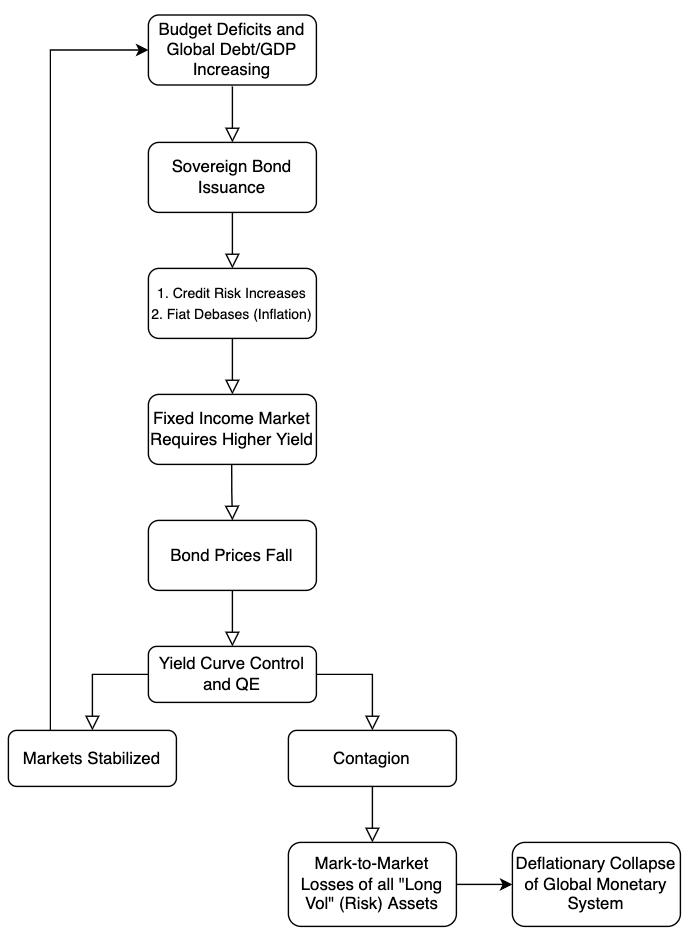

Conclusion

We conclude this section with a visual flowchart of how things could theoretically “fall apart.” Remember, systems work until they don’t. Slowly then suddenly…

Proceed accordingly. Risk happens fast.

This is a guest post by Greg Foss and Jason Sansone. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

[ad_2]

Source link