[ad_1]

FPL Technologies, the Indian startup that operates OneCard, is set to double its valuation to about $1.5 billion in a new financing round, just a month after it disclosed its previous funding, according to three sources familiar with the matter.

Singapore’s Temasek, one of the world’s largest investors, is in advanced stages of talks to lead a new financing round of the Pune-headquartered startup, the sources said, requesting anonymity as the deliberation is ongoing and private.

The size of the round is over $100 million, two sources said.

OneCard declined to comment whereas Temasek said it does not comment on market rumors and speculation.

The new round follows a $75 million Series C funding that OneCard disclosed last month. The Series C round, led by QED, valued OneCard at about $750 million.

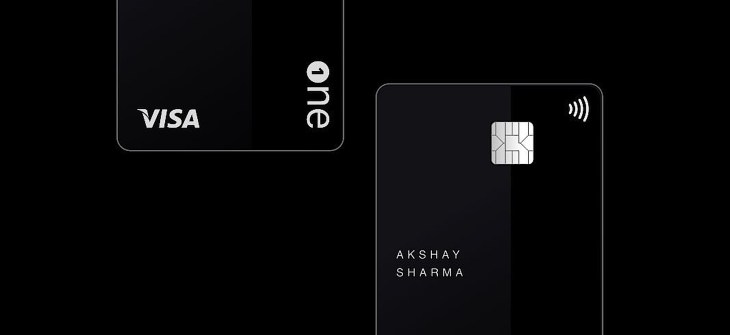

Founded by banking veterans, OneCard operates a mobile-first credit card. Its cards come without any joining or annual fee and give customers more control and flexibility over how and where they transact. It also offers a range of personalized rewards and loans to customers.

The startup also operates an app called OneScore, which helps users understand and find their credit score. The app is one of largest customer acquisition drivers for OneCard.

There are fewer than 30 million Indians who currently own a credit card even as nearly a billion bank accounts exist in the South Asian market.

Scores of startups including OneCard, Slice, which entered the unicorn club late last year, and Lightspeed Venture Partners and Elevation Capital-backed Uni are attempting to bring credit card features to more customers in India.

OneCard says it has amassed over 250,000 OneCard customers who are spending about $60 million with its cards each month.

Anurag Sinha, the startup’s co-founder and chief executive, said last month that he estimates that about 80 million to 90 million Indians are eligible to have a credit card.

[ad_2]

Source link