[ad_1]

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. Hedge funds have lined up the biggest bet against Italian government bonds since the global financial crisis on concerns over political turmoil in Rome and the country’s dependence on Russian gas imports.

The total value of Italy’s bonds borrowed by investors to wager on a fall in prices hit its highest level since January 2008 this month, at more than €39bn, according to data from S&P Global Market Intelligence.

The rush to wager against Italy comes as the country faces rising economic headwinds from surging European natural gas prices prompted by Russia’s supply cuts and a fraught political climate, with elections looming in September.

“It’s the most exposed [country] in terms of what happens to gas prices, and the politics is challenging,” said Mark Dowding, chief investment officer at BlueBay Asset Management, who is shorting Italian 10-year bonds using derivatives known as futures.

The IMF warned last month that a Russian gas embargo would lead to an economic contraction of more than 5 per cent in Italy and three other countries. Italy is also considered one of the most vulnerable countries to the European Central Bank’s decision to halt its bond purchases that propped up the country’s vast debt market.

Thanks for reading FirstFT Europe/Africa — Gary

Five more stories in the news

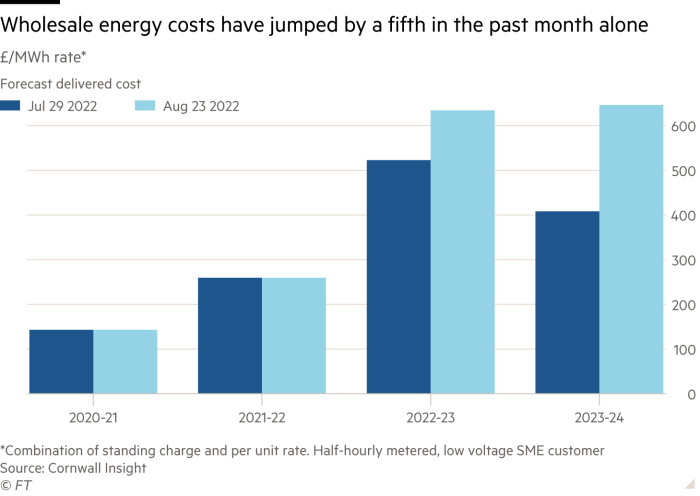

1. UK faces ‘cost of doing business’ crisis Companies face a “cost of doing business crisis”, ministers have been warned, with many commercial energy bills — due to be renegotiated in October — poised to rise to more than four times their size in 2020.

We don’t have the luxury of waiting any longer . . . winter could spell the end for many businesses — Paul Wilson, the Federation of Small Businesses

2. Lars Windhorst pledges to repay €550mn to H2O The controversial German financier has pledged to hand over more than €500mn to H2O Asset Management in a matter of weeks, which would clear a significant chunk of his debts with the troubled investment firm, an erstwhile star of European asset management that is being probed by multiple regulators.

3. Criminal defence solicitors warn sector is dying out Criminal defence lawyers in England and Wales are struggling for a viable long-term career in the legal aid system, which is facing a crisis following a decade of austerity cuts that have prompted solicitors to quietly exit the profession in droves, while barristers are preparing to walk out next month.

4. UK steelmakers forced to pay 25% tariff on N Ireland sales British steel producers will have to pay a 25 per cent tariff to sell certain construction products into Northern Ireland after EU quotas for global imports were exhausted earlier than expected.

5. Blackstone seeks Pink Floyd catalogue The US private equity group is vying to buy Pink Floyd’s back catalogue, a big bet on music rights that could value the psychedelic rock band’s songs at almost half a billion dollars. Artists including Bruce Springsteen and Bob Dylan have sold their songbooks for hundreds of millions of dollars in recent years.

The day ahead

GCSE results Examination results are published in England, Wales and Northern Ireland, following the release of A-level grades last week that dipped from record highs in the past two years.

Economic data The European Central Bank publishes minutes from its July meeting, when it raised interest rates for the first time in more than a decade. France and Germany release August business confidence data; the latter also has second-quarter GDP figures, as does the US, which also reports personal income, goods trade balances and weekly jobless claims. The UK Society of Motor Manufacturers and Traders releases monthly vehicle manufacturing figures.

Jackson Hole Economic Symposium The annual conference of central bankers, sponsored by the Federal Reserve Bank of Kansas City, begins in Wyoming, with investors watching for guidance on inflation and interest rates.

Algeria France’s president Emmanuel Macron begins an official visit to the north African country.

What else we’re reading and listening to

The budget drone changing global warfare The sleek Bayraktar TB2 is fast, cheap — with a seven-figure price tag — and deadly. Ukraine’s drone of choice has made Turkey one of the world’s top drone powers, pointing to a new era in which the technology becomes accessible to regimes that cannot buy from more established arms producers.

Opinion: Europe is becoming a global power The crisis caused by Russia’s invasion of Ukraine has triggered new forms of co-operation among EU member states, accelerating the bloc’s evolution into a fully-fledged sovereign political power, writes Laurence Boone, France’s minister of state for Europe.

Big budget blockbusters land amid ‘peak TV’ fears Audiences can enjoy some of the most expensive programmes ever produced this autumn, from Amazon Prime’s The Rings of Power to HBO Max’s House of the Dragon. But the shows are being served at subsidised prices by streaming platforms making record losses, begging the question: have we finally reached “peak TV”?

Wiretap cases turn up heat on Greek PM Nikos Androulakis wants answers. Since the Greek secret service admitted this month that it tapped his phone, the leader of the opposition Pasok party has insisted one man — Prime Minister Kyriakos Mitsotakis — clear up his own role in the affair.

Afghanistan one year later On the latest episode of our Behind The Money podcast, south Asia correspondent Ben Parkin explains how Afghanistan’s economy has changed in the year since US forces left and the Taliban retook control of the government.

Technology

We are in an era in which the unpredictability of people meets the as-yet-not-fully-capable autonomous car. In this moment, which San Francisco correspondent Dave Lee calls the “Human-Autonomy Clash”, there will be crashes, and there will be anger.

[ad_2]

Source link