[ad_1]

Receive free Global Economy updates

We’ll send you a myFT Daily Digest email rounding up the latest Global Economy news every morning.

This article is an on-site version of the Free Lunch newsletter. Sign up here to get the newsletter sent straight to your inbox every Thursday

Hello and happy European Central Bank decision day. I’m Claire Jones, the FT’s international economy news editor, and I am standing in for Martin Sandbu, who is on holiday this week.

With the summer season upon us, it feels like a good time to take stock of the global economy’s performance in 2023 so far.

Few feel as though we’re in the throes of a vintage year. But things are not nearly as bad as many thought they would be last autumn, when many economies were dealing with double-digit inflation and central banks were raising rates at a rapid clip.

In line with this, the IMF earlier this week upgraded its growth forecasts yet again and its chief economist Pierre-Olivier Gourinchas told our ace US economics editor Colby Smith that the chances of the global economy imploding spectacularly had receded sharply since the spring.

His team is increasingly betting on a soft landing in the US and no longer thinks a recession in the UK is likely.

And that is largely down to strong consumer spending.

Which is what we want to make the focus of today’s Free Lunch.

Rising interest rates are supposed to dent demand for goods and services right? Especially when it comes to spending on discretionary goods.

So why, after a series of supersized increases in borrowing costs during 2022 — and a surge in the price of essentials such as food and energy — are we seeing Taylor Swift’s latest tour break records and Beyoncé stand accused of boosting an entire country’s inflation rate for driving up prices in Stockholm during her two-night sojourn in the Swedish capital?

Nor are spending sprees confined to musicians’ mega fans.

Luxury goods markets are booming globally.

In Europe, June flights were back close to levels last seen in 2019, suggesting that people are returning to the beaches in their droves (though hotel bookings have been relatively weak in recent months).

The twin releases of Oppenheimer and Barbie have led to the highest weekend box office take in the UK since before the pandemic.

There are a few reasons why we think spending has held up so well. One — the strength of the labour market — has been written about a lot. What’s also well known is that Covid-era stimulus enabled households in some countries, such as the US, to build up big savings buffers.

Today we want to highlight another factor: the enduring impact of more than a decade of ultra-low interest rates and plentiful liquidity on households’ debt servicing costs.

Let’s take the biggest debt burden for a lot of households: mortgage.

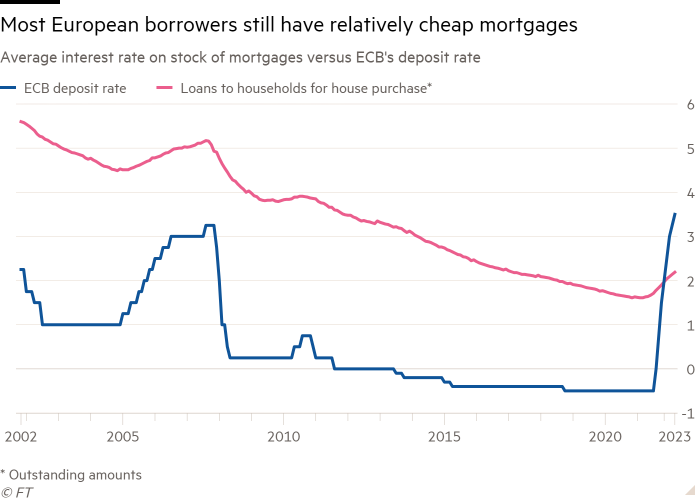

For those unfortunate enough to have to buy a new place, or refinance an existing deal, the pain of higher interest rates is acute. But, taking the economy as a whole, the impact of those rapid rises in central bank rates on households’ borrowing costs has been less profound than you might think.

We’re now a year or more into the tightening cycle for most central banks. Yet years of aggressive monetary easing continue to have a big impact on the average interest rate levied on the stock of mortgage debt.

Take, for instance, the euro area. Central bank interest rates have risen by 4 percentage points since the summer of 2022 from minus 0.5 per cent to 3.5 per cent. But look at the average rate charged on existing mortgages: it is well below the central bank’s benchmark at just 2.19 per cent.

This is far from normal. Up until the turn of this year, average mortgage rates had always been in excess of official rates. For the first time in the ECB’s history, the trend has now reversed.

The era of low borrowing costs also had a big impact on the sort of mortgage product that homeowners have gone for.

While longer-term, fixed interest rates have long been common in places such as France and the US, years and years of aggressive monetary easing have led to these contracts becoming increasingly popular in markets such as the UK (albeit with a lower average duration).

Even in southern Europe, where flexible rates — which immediately adjust to changes in central banks’ benchmark rates — have traditionally dominated the market, ultra-low rates have left their mark.

The average rate on an outstanding mortgage in Italy is 2.86 per cent. In Spain, the recent uptick in the cost of the average mortgage has been greater, but at 3.06 per cent, rates remain below the ECB’s 3.5 per cent benchmark.

The surge in property prices since the global financial crisis has also priced many younger people out of buying their own home. That rise in the average age of homeowners has meant that an increasing number of owner occupiers are now mortgage free.

I suspect that central banks’ money printing may also be a factor in lenders’ reluctance to pass on savings rates (a theme I plan on returning to later in the summer).

The effects of monetary policy, of course, always take time to feed through. And central banks remain in tightening mode — the ECB is widely expected to follow the US Federal Reserve’s lead and raise rates by a quarter point today, as is the Bank of England next week.

At some point, rate-setters’ actions will start to have more of an impact on discretionary spending. There are signs it is beginning to happen. European luxury group LVMH reported yesterday that demand in the US was waning as the dollar’s value declines and the savings buffers built up during the pandemic are finally exhausted.

Even if unemployment rates remain low, a greater portion of households will have to eventually refinance existing loans.

But shifts in the structure of mortgage markets suggest that the pass-through from higher rates this time around will be far slower than during previous tightening cycles. Ultimately, that says less about Swifties or Beyoncé fans, and more about the actions of rate-setters themselves.

Other readables

-

Want to understand what the Federal Reserve said and did yesterday? Read my FT colleague Colby Smith’s take. Or be like Kyla Scanlon and embrace the chaos that is central banking.

-

The repercussions of Coutts’ decision to unbank Nigel Farage rumble on, with NatWest chief Dame Alison Rose quitting her job yesterday after it emerged that she was the source of stories claiming that the former UK Independence party leader was dropped due to his financial status and not his politics. On the specifics of why exactly Farage was dropped, we would recommend this.

-

The Wall Street Journal has delved into the economic impact of Swifties.

Numbers news

-

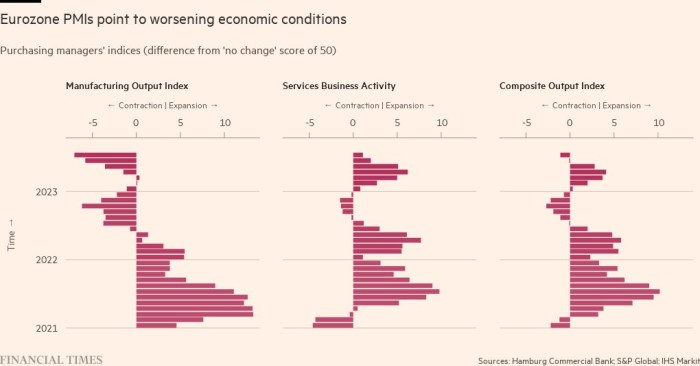

The eurozone economy is in much better health than people thought it would be this time last year. However, while forecasts of a deep winter recession proved incorrect, the story this year has been one of economic stagnation. The purchasing managers’ index for July, out earlier this week, showed signs that the region may enter a deeper downturn in the coming quarters as the impact of rate rises starts to really bite.

[ad_2]

Source link