[ad_1]

UK businesses expect costs and inflation to ease but wage pressures to remain high, according to an influential Bank of England survey released on Thursday that could deepen divisions among policymakers on future interest rate rises.

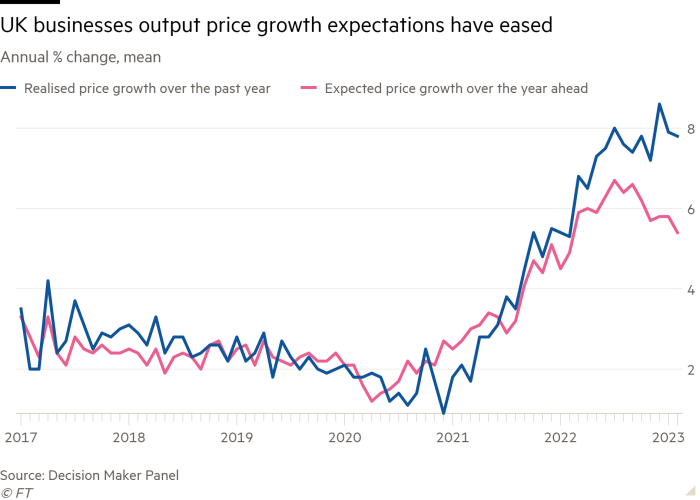

Responding to the central bank’s monthly decision maker panel for February, business leaders forecast output prices to increase by 5.4 per cent in the coming year. That is down from 5.8 per cent in January, and the lowest level since February 2022.

The closely watched study, based on interviews with almost 2,500 chief financial officers, also found that businesses expected consumer price inflation to decline. DMP members’ expectations of one-year-ahead inflation fell to 5.9 per cent, down from 6.4 per cent in January.

However, year-ahead wage growth averaged at a high pace of 5.7 per cent in February. That was unchanged from the previous month, but down from a peak of 6.3 per cent in December. Realised annual wage growth rose month on month by 0.3 per cent to 6.6 per cent.

Meanwhile, cost pressures stayed high, rising by 9.8 per cent in the year to February, broadly unchanged from the previous month. But costs growth for the year ahead was forecast to ease to a rate of 7 per cent, down from 8 per cent in January.

The survey’s findings come a day after BoE governor Andrew Bailey said he would not commit to further interest rate rises because the economy was “evolving much as we expected”.

His comments were interpreted as pushing back against financial markets, which expect rates to increase from 4 per cent now to 4.75 per cent by the end of 2023.

Members of the BoE’s Monetary Policy Committee have been split over interest rate raises at their past few meetings, with two voting to leave the rate unchanged in February and December. The combination of falling inflation expectations alongside strong wage pressures in Thursday’s data is likely to reinforce that divide.

Markets are pricing in a rise of 25 basis points at the next MPC meeting on March 23, a slowdown from the 50bp increase announced in February.

James Smith, economist at the bank ING, said that although Thursday’s data was unlikely to stop a quarter point rise this month, “if these trends continue through the spring, it suggests that this will mark the end of the current tightening cycle”.

The survey, conducted by the BoE alongside academics from Stanford University and the University of Nottingham, also showed that forecasts for year-ahead employment growth rose to 2.7 per cent in February, up from 1.2 per cent from the previous month.

Olivia Cross, economist at the consultancy Capital Economics, said Thursday’s data “certainly does point to resilient wage growth”, adding that “we haven’t yet seen signs of much looser labour demand”.

Business leaders also reported a fresh rise in finding new staff in February, with 45 per cent saying that recruitment had been “much harder” than usual, compared with 35 per cent in January.

Yael Selfin, chief economist at KPMG, an advisory firm, said that the “stronger wage momentum” caused by a relatively tight labour market “may make inflation a bit stickier but is unlikely to reverse the downward trend in inflation that we are expecting this year.”

[ad_2]

Source link