[ad_1]

This is an opinion editorial by Will Schoellkopf, author of “The Bitcoin Dog,” and host of the “It’s So Early!” Bitcoin podcast.

When it comes to stacking sats, the ends do not justify the means.

It seems to me that some so-called Bitcoin Maximalists think it’s OK to be Bitcoin Maximalist–ish or to be almost a Bitcoin Maximalist. As a Bitcoiner who believes in freedom, who am I to judge? Still, anyone who is almost but not quite a Bitcoin Maximalist ought to pause and reflect on if they really think their path from fiat to bitcoin is furthering a world with hyperbitcoinization if it is done “by any means necessary.”

Author’s note: My aim is not to attack anyone personally. I will use specific people’s tweets for my examples, but my intent is to respectfully challenge bad ideas, not attack people. Healthy debate of ideas in good faith helps Bitcoin, so I hope they understand. They may be of sound moral character, but a toxic Bitcoin Maximalist must call out their actions that may be hindering hyperbitcoinization.

The bad ideas are:

- Trading altcoins to buy more bitcoin.

- Removing laser eyes to expand focus elsewhere.

- Removing laser eyes due to an over-emphasized focus on BTC/USD price.

To be a Bitcoin Maximalist, you don’t have to store a huge percentage of your net worth in bitcoin. On the contrary, it’s very important to make sure you have enough fiat to pay your rent! But for the almost maximalists, they’ll say that the vast majority of their cryptocurrency holdings are in bitcoin. This is not maximalism. This is diversification of a crypto portfolio.

If you truly believe that ultimately only one tool can serve as a money for the world, then as a Bitcoin Maximalist, you know the only one worth holding is bitcoin. Moreover, if you admit to others that you privately dabble in other cryptocurrencies, then you’re sending mixed messages. To be a toxic Bitcoin Maximalist, you cannot ignore your own advice and buy altcoins as well.

(Source)

Will Clemente may say he only trades alts so that he can stack more sats, but it hurts the suckers on the other side of the trade giving up their bitcoin for his altcoins. He will have given the venture capitalists that run these altcoins what they want: exit liquidity. Toxic Bitcoin Maximalists do not give a false impression that altcoins have sufficient on-chain activity, have many active participants or are used for transactions. They do not give ICO-funded venture capitalists the satisfaction of dumping their liquidity on unsuspecting users without a goal or purpose. Instead of wasting their time on technical analysis looking at charts for altcoins, toxic Bitcoin Maximalists further hyperbitcoinization.

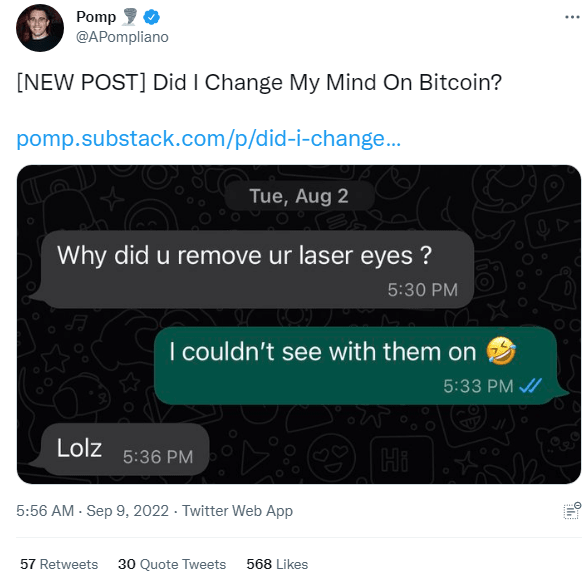

(Source)

As Anthony Pompliano wrote in a recent issue of “The Pomp Letter”:

“The truth is that it is really hard to be an independent person who thinks critically if your identity is tied to a financial asset. How can you seriously evaluate an asset if you have it in your bio? Are you really willing to change your mind if you receive new information if your entire identity is tied to something? Maybe. But it definitely makes it harder. As I told a friend months ago, it is hard to see with laser eyes on.”

The whole point of Bitcoin Maximalism is you do not change your mind because you recognize Bitcoin as a zero-to-one invention. Toxic Bitcoin Maximalists wear their laser eyes because they know there is no way to further decentralization by any means other than proof-of-work bitcoin. While it can be worthwhile to learn how proof-of-stake ether and other tokens form consensus, it can’t be ignored that they are fatally flawed compared to bitcoin. There won’t be another bootstrapped, decentralized blockchain that can serve as a money for the world, ever! Pomp said it is “hard to see with laser eyes on,” but it seems like he may see greater value pushing mattresses onto his followers instead of promoting Bitcoin!

(Source)

Additionally, prominent bitcoin traders like Dylan LeClair have removed their laser eyes, but even if LeClair isn’t buying or selling altcoins, he’s given up on “laser ray to $100k.” This signals not only a lack of confidence in the bitcoin price, but in bitcoin overall. He may align with the Bitcoin Maximalist viewpoint, but he falls short of being a toxic maximalist since he isn’t keeping his laser eyes on, knowing that the value of Bitcoin is bound to continue growing over time. Besides, turning laser eyes on/off further compares bitcoin to the equities markets and its bull and bear cycles. Bitcoin is not an equity. It’s a once-in-a-civilization monetary revolution for the world.

(Source)

(Source)

As Bitcoin Gandalf says, “Bitcoin is not an investment.” Bitcoin is a savings vehicle, a savings technology! Do not take your eyes off the timechain. When you store the value of your hard work, your energy, your life force in bitcoin, then you will finally be financially free! Do not wait for bottoms that you will likely mistime trying to catch. Follow the advice I gave my daughter, and diligently save in bitcoin!

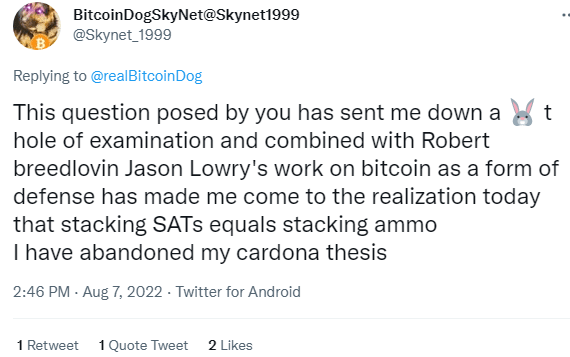

(Source)

I had asked CryptoDogSkyNet (now BitcoinDogSkyNet) why he buys altcoins, and he ended up abandoning his thesis, but you can learn without buying and selling. You can even mint your own NFTs to learn how to implement them on Bitcoin, but do not get suckered into buying as a way to learn. Learn by building, not giving away your sats. There is only one blockchain decentralized with the greatest network effects to be money, and Bitcoin Maximalists know which it is!

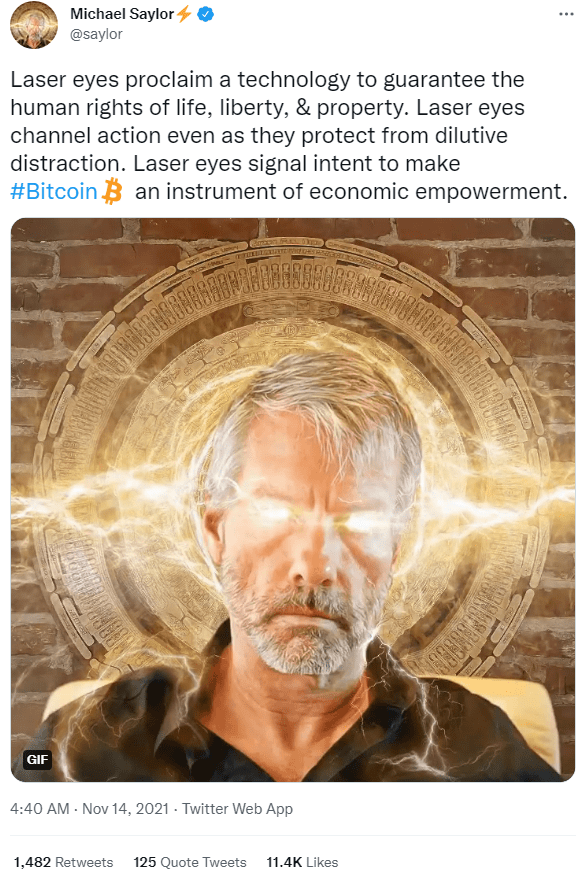

(Source)

As Michael Saylor says, “Laser eyes proclaim a technology to guarantee the human rights of life, liberty and property. Laser eyes channel action even as they protect from dilutive distraction. Laser eyes signal intent to make Bitcoin an instrument of economic empowerment.” Fix the money, fix the world.

(Source)

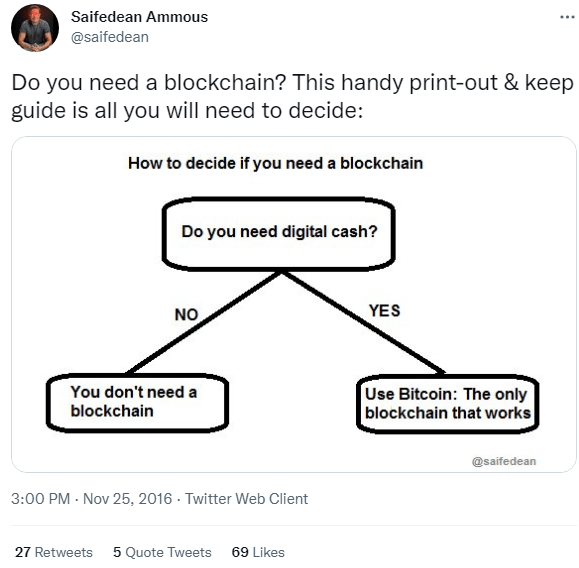

Dr. Saifedean Ammous’ simple flowchart helps remind us of all the reasons we could have to need a blockchain. The only purpose for the most inefficient database ever created is digital cash, and the blockchain to use is the only one that works: Bitcoin.

(Source)

While Saylor’s quote is famous, it’s done a disservice to the almost-Bitcoin-Maximalists. They need to hear the full quote:

“Which one is the best crypto asset?”

“Well Bitcoin’s the best crypto asset.”

“What’s the second best?”

“There is no second best. There is no second best crypto asset. There’s a crypto asset, and it’s called Bitcoin.”

Don’t get confused. There are no other crypto assets. There are no other blockchains that can reliably enforce decentralized digital property rights. The ends don’t justify the means. Don’t be a hypocrite. Don’t provide liquidity to altcoins for the sake of buying more bitcoin and stop trying to time the bottom. Stack sats, stay humble. Ascend towards a hyperbitcoinized future and embrace toxic Bitcoin Maximalism!

This is a guest post by Will Schoellkopf. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

[ad_2]

Source link