[ad_1]

This is an opinion editorial by Conor Chepenik, a bitcoin pleb.

When a nocoiner asks me about Bitcoin, it’s hard not to take a “Michael Saylor breath” and embark on a four-hour conversation about how there is no second best.

My Bitcoin elevator pitch has become better over time, but it’s hard explaining why the world so desperately needs an honest monetary ledger in 30 seconds. Proof-of-work is required to have the glorious experience of going down the Bitcoin rabbit hole. In this piece I attempt to lay out why the incentives of the network are so well thought out at every level.

Humanity has never before had such a fair game. A truly free market ledger that anyone can access, verify and update if they play by the rules. From individuals to small businesses, followed by grid operators and energy companies, and finally nation-states, everyone benefits in the long run by playing fairly with electricity rather than through coercion and violence. While I’m most hopeful that Bitcoin can help empower sovereign individuals, it appears we are entering the point where institutions start stacking sats.

As the network continues to grow in size, Bitcoin will reach a point where every company and nation-state will adopt the technology in some form or fashion, just like they have with TCP/IP. The Bitcoin rabbit hole makes learning fun and teaches people about energy, finance, philosophy, physics, history, game theory, economics, computer science and a bunch of other subjects. At my local Bitcoin meetups in Massachusetts, I’ve heard many similar stories of people starting to study and learn about subjects they otherwise would never have bothered to study. In order to have a good understanding of Bitcoin you must commit hundreds, if not thousands of hours. At which point you are just getting started because “no one has found the bottom of the Bitcoin rabbit hole.” Once you start to grasp what Bitcoin means for humanity, it almost feels like a cheat code for life. An apolitical, censorship-resistant, truly scarce, decentralized ledger that is being adopted by the masses from the ground up. It’s a blessing that the anonymous person or group named Satoshi Nakamoto solved the Byzantine generals problem.

(Source)

Individuals

Socialism doesn’t work because people are self-interested. I’d love to live in a utopia where everyone cooperates and helps their neighbor. I firmly believe that when you give via your own free will, it is one of the best feelings in the world. However, it does not feel very good to give when you are forced to do so in order to avoid violence. Throughout history, taking away the ability for people to keep the fruits of their labor has always ended poorly. Telling people they must produce for “the greater good” is a recipe for disaster. One example of this is what happened in China between 1959-1961. The country experienced what is now referred to as the Great Famine under Mao Zedong.

“Taking away all means of private food production (in some places even cooking utensils), forcing peasants into mismanaged communes, and continuing food exports were the worst acts of commission. Preferential supply of food to cities and to the ruling elite was the deliberate act of selective provision.” — Vaclav Smil

This is just one example of what happens when the government takes away the ability for its citizens to work on what they themselves deem worthy. It ruins the incentive structure for productive people to work on meaningful tasks. The world is not a utopia no matter how badly socialists want it to be. It is one thing to demonize monopolistic practices because they hinder the free market from operating properly. It is a completely different thing to demonize profit. If people can’t make a profit they won’t spend their time and resources making something of value. That is unless they are forced to do so by the threat of violence. The more coercion is applied, the less value is created because someone working for profit is a lot more motivated than someone working because they are being forced to do so.

One monopolistic practice hindering our modern world today is the monopoly central banks have on fiat currency. By centrally planning interest rates and having the ability to create fiat money without facing an opportunity cost for doing so, the free market becomes corrupted. This leads to distorted price signals and individuals being pushed out on the risk curve.

“Every day that goes by and Bitcoin hasn’t collapsed due to legal or technical problems, that brings new information to the market. It increases the chance of Bitcoin’s eventual success and justifies a higher price.” — Hal Finney

While bitcoin becomes less risky every day it exists, I tip my hat to the individuals who understood its importance before buying bitcoin was a mainstream thing. Before exchanges like Mt. Gox, people were not using fiat currency to buy bitcoin. They were using electricity and computers to mine it, which is what made Bitcoin so special. A new system that is completely outside the traditional one of relying on credit and growth. Many projects that came before Bitcoin failed in the long run, but various ideas from these projects were referenced in Nakamoto’s white paper. Logically, over time, more people will come to the Bitcoin network to protect their purchasing power as long as the network keeps adding blocks of transactions approximately every 10 minutes.

The more people who see the impact that fiat currency debasement has on their purchasing power, the more likely they are to look for alternatives to protect said purchasing power. This is what initially attracted me to buy some bitcoin in early 2017. My friend told me about this new form of currency that had appreciated greatly since its inception. I watched the documentary “Banking On Bitcoin,” which I still highly recommend because it helped open my eyes to the fact that money is just a ledger. Unfortunately, I didn’t fully go down the rabbit hole at that time. I spent the first couple of years of my journey looking at my exchange balances as my bitcoin and altcoins multiplied 10 times, only to be depressed when my gains came crashing down after the bull market ended. Like most who are initially attracted to cryptocurrency for the speculation, I obsessed over the fiat price. Doing so caused me to miss the whole point of not having to rely on any counterparties to verify and hold bitcoin. While it sucked losing all the fiat gains I had made, it taught me some very valuable lessons.

“The danger is if people are buying bitcoins in the expectation that the price will go up, and the resulting increased demand is what is driving the price up. That is the definition of a BUBBLE, and as we all know, bubbles burst.” — Hal Finney

As Finney so eloquently pointed out in those early days, when something goes parabolic superfast it will likely crash just as fast. Pain is the best teacher and this was my first hint at why having a low time-preference is so important. It also served as a lesson for myself to focus on Bitcoin, not crypto. I kept an interest in Bitcoin, but it wasn’t until 2020 that I really started digging into the rabbit hole. When I got a stimulus check in the mail for doing nothing, that set off an alarm inside my mind. While free money is always nice, it was obvious that there would be consequences to the United States government handing out cash to its citizens. I didn’t fully understand why at the time. It was annoying me that I couldn’t put my finger on what was wrong so I started down the Bitcoin rabbit hole which led me to Austrian economics and how money actually works. It was both frustrating and enlightening to learn about Bretton Woods, 1971 and why central banks are in a race to debase their currency.

When I learned that most U.S. dollars are held on a server (in an SQL database) at the Federal Reserve, I was shocked. These people can press buttons on a keyboard and print trillions. By granting 12 unelected officials the privilege to centrally plan the cost of borrowing money we have hindered the free market’s ability to effectively tell market participants what the cost of capital is. Fiat is latin for “by decree”; thus, it makes a lot of sense why central bankers will fight tooth and nail to keep the ability to control money. The Fed claims to be an apolitical organization, but as debt levels increase to numbers typically seen during times of war, central bankers are pressured politically to debase their currency. The other option is to default on the debt and that is never politically viable. The silver lining is that more people are waking up because they get frustrated watching their purchasing power decline rapidly in inflationary environments. Being self-interested is not a bad thing. It is what motivates individuals to work hard so they can enjoy the fruits of their labor. Bitcoin optimizes for this, while the Keynesian economic models of ever-expanding credit steal the fruits of people’s labor. No one knows how it ends but over time it makes sense more people would end up saving their “fruits” in the harder money.

Small Businesses

Visa and Mastercard have a combined market capitalization of about $775 billion dollars at the time of this writing. They charge around 3% of retailers’ revenue for their services which eats into the profits or get passed onto consumers of the companies accepting debit and credit cards. While cards make it much easier to transact, many businesses and consumers would be happy to avoid these fees if possible. There is an option of going cash-only for final settlement, but that means missing out on business from younger generations who don’t carry cash. By accepting bitcoin, these companies not only avoid the fees, but they also receive final settlement transactions just like cash. No more waiting 90 days to make sure a credit card doesn’t get charged back. Bitcoin will massively disrupt many financial rails we have today. Many in the Western world might not appreciate what a big deal this is because our financial rails are pretty well established. However, those in less developed countries know perfectly well what a pain it is to have hucksters butting in to take a cut. It won’t be instant, but bitcoin can help wean small businesses off middlemen who are no longer necessary. Bitcoin can also serve as an incredible marketing tool. I’d gladly spend some satoshis at any local small businesses that took bitcoin. Tahinis is a great example of a small business who leveraged bitcoin to get some brand awareness. I’ve never been to Canada, but if I ever go, I’d like to eat at Tahinis so I can use bitcoin to buy shawarma. Bitcoin forms a special bond between people to the point where you literally want to support their business because you know they have taken the orange pill.

(Source)

Energy Companies And Grid Operators

Energy companies and grid operators also have a massive incentive to adopt a bitcoin strategy. Rather than just having one buyer on the grid that demands more energy during the day than at night, the grid could have a second buyer who is willing to consume energy 24/7, 365 days/year. Bitcoin miners can monetize energy that would otherwise go to waste. There is the up-front cost of buying an ASIC and having the technical whereabouts to maintain and run said ASIC. This means more jobs for the talented individuals who understand how to do so. More talented workers creating value means more energy efficient grids. It amazes me how much fear, uncertainty and doubt gets spread about Bitcoin’s energy usage, when the reality is Bitcoin can stabilize grids and make the capital put up to build green energy infrastructure much less risky.

If you wanted to build a massive hydro plant in a rural area before there was Bitcoin, it would be very hard to raise the capital. Investors would not want to put up their money for a power plant that did not have buyers for the power being generated. With Bitcoin, the investors can rest assured there is always a buyer for that power. While I think there will be a point when miners just keep the bitcoin, they can also sell them for fiat at any point in time. Unlike traditional markets, bitcoin never stops trading. Since fiat depreciates over time, the most efficient miners will be able to hold and accumulate their bitcoin, while the less efficient miners will have to sell for money that is constantly being debased by the money printer. The best companies will thrive over the long run, while the inefficient operators will have to adapt or die. It is the free market doing its job.

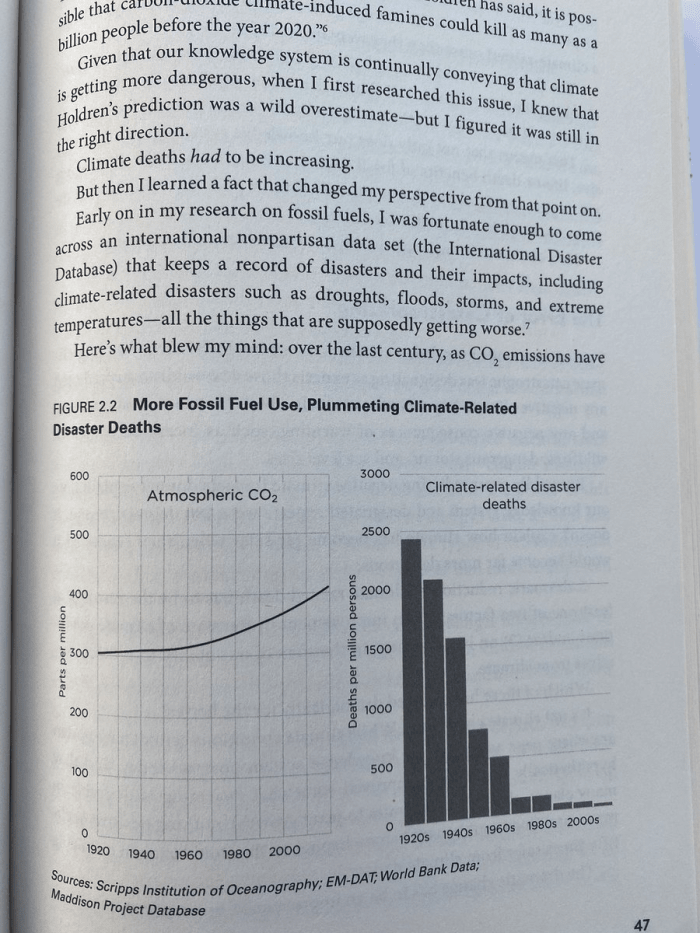

The more I learn about how grids operate, the more apparent it becomes that bitcoin can help usher in an abundant energy future where energy prices aren’t going parabolic because of poor decisions made by central planners who are printing money at unheard-of rates. The whole green energy and environmental, social and governance (ESG) narrative is an antihuman farce meant to hide the disaster that the central banks have created. These greeniacs claim that CO2 is going to suffocate the world, but this chart in Alex Epstein’s “Fossil Future” shows why more fossil fuel use is needed.

(Source)

Energy is the base layer of society. Without reliable and reasonably priced energy, things will get ugly fast. Just look at what happened to Sri Lanka who had one of the highest ESG ratings in the world before their economy collapsed. Every example of hyperinflation stems from irresponsible monetary policy. Calling currency debasement “quantitative easing” doesn’t change the fact that it results in more money chasing the same number of goods. People joke that Bitcoiners are psychopaths who can’t stop talking about magic internet money, but the truth is we just want others to take the orange pill so we can stop suffering from the central planners. Bitcoin Maximalists have a reputation of being mean online for calling out bad actors, but almost every Bitcoiner I’ve met in person turns out to be one of the most genuine, kind and intelligent people I meet. In person, I’ve seen that Bitcoiners are willing to help onboard as many people as they can because we all strongly believe Bitcoin is the best way to achieve a pro-human future where we have an abundance of food, energy and choice.

In my opinion, helping people understand that bitcoin is the life raft is one of the most noble things a person can do. History has shown that the free market will ultimately end up with one form of money winning out. Before bitcoin that was gold and then we ended up with fiat to keep up with the speed of commerce. Now that we have bitcoin, I believe fiat will continue to rapidly lose its purchasing power as more people and businesses realize that bitcoin can’t be debased by a single entity.

Nation-States

This one is a double-edged sword. I want as many individual people to adopt bitcoin before the nation-states start accumulating. I’m hopeful that the nation-states who do end up adopting bitcoin will be able to utilize its fiat price appreciation to create a more abundant society for the individuals that live there. At the time of writing, two countries have adopted bitcoin as legal tender. According to the World Population Review’s prosperity index, El Salvador ranks 98 and the Central African Republic ranks 165 out of 167 countries. Neither of these countries is in the top 50% of prosperous nation-states and they were the first to adopt bitcoin. I believe this trend will continue since the most prosperous countries have much more to lose by not being able to “decree” what happens with their country’s money. Before bitcoin, El Salvador was a dollarized economy. Now they allow both USD and BTC to operate as legal tender. The Central African Republic had the CFA franc as its currency. According to Wikipedia:

“Critics point out that the currency is controlled by the French treasury, and in turn African countries channel more money to France than they receive in aid and have no sovereignty over their monetary policies.”

It is encouraging to see nation-states that are at the mercy of foreign central banks adopt bitcoin to get around these monopolies. I imagine at some point the richest nation-states will be forced to adopt bitcoin if their currency is hyperinflated because it will be the only viable way to trade with other countries. These wealthy nations will fight for as long as they can to keep control of their monopoly on fiat currency. It is the poorer nations who don’t have complete sovereignty over their money that will look to bitcoin to protect their purchasing power because they have the least to lose.

If you are a nation-state and you can’t create your own money to fund government spending, you are much more likely to invest in a truly scarce currency than another nation-state that can create more of its own currency out of thin air. While El Salvador might not be in the green in terms of where they bought bitcoin on the spot market, they have made up for it with the massive boost in tourism and interest in their country. Personally, I would love the opportunity to visit El Salvador and use bitcoin to buy stuff. El Salvador will likely continue to experience a massive influx of tourism as more Bitcoiners, like myself, start to plan trips there so they can use this new form of money. The cyber hornets don’t mess around and as more countries notice the impact bitcoin can have on their local economies, the logical conclusion is to adopt it as legal tender and attract tourists to bolster their economy.

(Source)

Conclusion

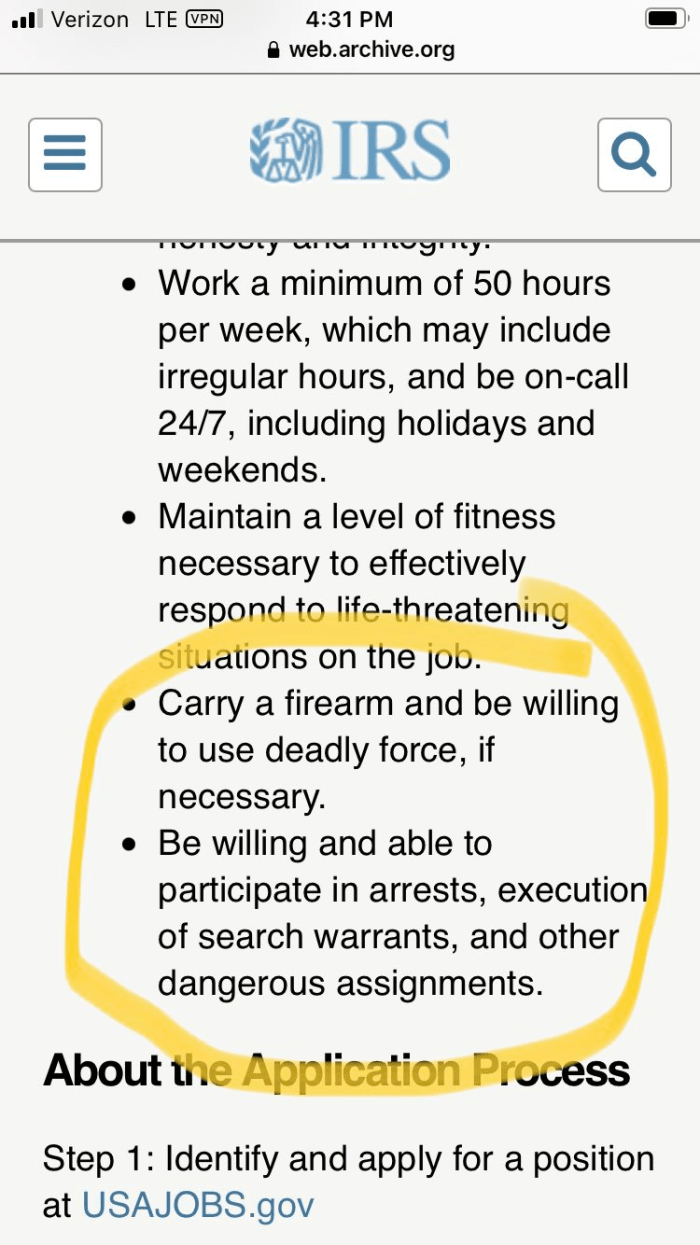

It might get messy. Rich nations, the World Bank and The International Monetary Fund aren’t just going to toss up their hands and go, “Well, it was fun controlling fiat while it lasted.” Just look at the U.S. who passed the Inflation Reduction Act, which includes hiring and arming an additional 87,000 IRS agents. The United States is planning on printing money out of thin air so they can pay citizens to do this.

It is quite ironic that the nation which was created because we demanded no taxation without representation is doubling down on its tax force.

The people in power will fight tooth and nail to protect their interests and hinder bitcoin’s adoption. Top-down controls can only go so far. Individuals, companies and nation-states are all self-interested. No one likes a parasite when they are the one dealing with the consequences that are draining their resources, time and value. Over a long enough time horizon, it seems bitcoin will bleed these parasites dry as they lash out and try to impose top-down controls across the world. The truth can only be hidden so long; it always comes out in the end. Bitcoin can fix energy, monopolistic central banks, credit-based systems and massive surveillance states. It can help disincentivize violence because if someone stores their private keys in their head, no one can steal that bitcoin. They can kill the person who holds the keys, but if they were not able to torture those private keys out of the victim’s head, that just results in a donation to the rest of the network since that person’s bitcoin will never be moved.

If enough people adopt bitcoin and use solid safety practices, powerful entities stand to gain more by cooperating with these sovereign individuals rather than killing them. I don’t want it to get messy and I truly believe the best way to avoid conflict is by getting more people to take the orange pill and showing them how to run a node. Individuals, companies and nation-states theoretically no longer need banks to transact.

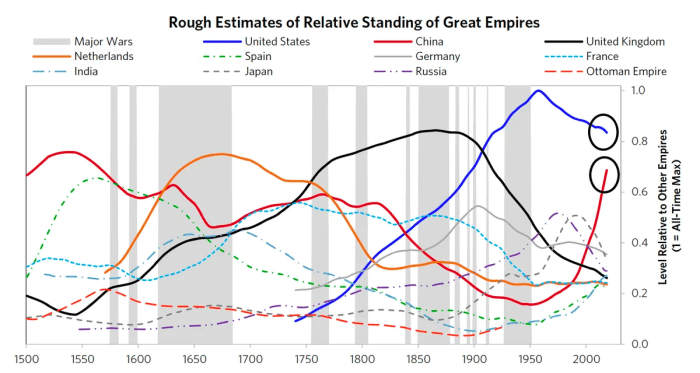

As a U.S citizen, I hate to see America in disarray. Ray Dalio makes some excellent and terrifying points about the state of our republic in his book “The Changing World Order.” The U.S is a declining empire at this point and China is on the rise. This chart from Dalio really helped me understand what it means to have world reserve currency status.

The Netherlands had reserve currency status and lost it to the British, who lost it to the United States. Now it looks like China is getting ready to gain world reserve currency status over the U.S. There is little hope of reversing the trend of USD no longer being a global reserve currency. While losing reserve status is never a fun experience, the U.S could benefit greatly from having bitcoin as a neutral world reserve currency rather than the Chinese yuan. Having a central bank digital currency (CBDC) as the reserve currency would serve as the ultimate tool for central planners to corrupt the free market and wreak havoc on value creation. As a country, China has a deep, rich history and a nation full of hardworking people. However, their massive surveillance state and CBDCs are not something that will ever fly in a free country. It is up to the masses to say “enough!” and opt out.

Future generations deserve a better world than one where the government can turn off access to its citizens’ money with the flick of a switch. These past two years have been absolutely insane. We are seeing people get their bank accounts frozen because they donated to a peaceful protest put on by truckers in Canada. We are seeing an attack on farmers across the globe to meet antihuman ESG agendas that will destroy countries in the same way it did Sri Lanka. We are even seeing the greatest nation on the planet come after its own citizens by devaluing their currency at unprecedented levels, hiring more IRS agents and raising taxes during a recession. All of this is what is at stake if the masses don’t wake up and peacefully opt out from these corrupt regimes with bitcoin.

All we have to do is use an old computer or a Raspberry Pi and run Bitcoin Core. Now, it is that easy to transact with anyone in a peer-to-peer manner and verify that only 21 million bitcoin will ever be created. It brings a warm, tingly feeling to my heart thinking about the freedom, prosperity and abundance bitcoin can bring to the world.

“Abundance in money creates scarcity everywhere else, and scarcity in money creates abundance.” — Jeff Booth

Once the masses understand this, they will understand why the phrase “Fix the money; Fix the world,” is the embodiment of the Bitcoin ethos.

This is a guest post by Conor Chepenik. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

[ad_2]

Source link