[ad_1]

This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Good evening

Pressure on Russia over its war on Ukraine stepped up a gear today. Nato beefed up its military defences in eastern Europe while G7 leaders agreed new sanctions to prevent Moscow importing technology for its arms industry and tightened measures against those responsible for war crimes and those “stealing and exporting Ukrainian grain”.

The G7 summit in the Bavarian Alps comes as western leaders get to grips with a series of crises sparked by the invasion, ranging from worries over food and energy supplies to galloping rates of inflation, all of which are putting the global economy under severe stress.

The meeting is discussing a price cap on Russian oil as part of efforts to stymie Moscow’s ability to fund the war. Non-G7 countries such as India, which has been a big importer from Russia, are also taking part. The EU has already agreed a phased-in ban on shipments by sea, but allowing crude oil deliveries via pipeline to continue, while the US has banned all oil imports and the UK plans to do so by the end of the year.

Energy sanctions should have an effect in the medium term, says the Lex column, but in the meantime their implementation will be painful. “What started as an economic shock-and-awe campaign is turning into a war of attrition,” it concludes.

The global economic outlook, meanwhile, continues to deteriorate and the surge in inflation shows little sign of easing.

The Bank for International Settlements, the body that operates services for the world’s central banks, warned yesterday that leading economies were close to “tipping” into a high inflation world where rocketing price rises become normalised, a process that becomes very hard to reverse.

“We may be reaching a tipping point, beyond which an inflationary psychology spreads and becomes entrenched. This would mean a major paradigm shift,” the BIS report said. The key for central banks was to “act quickly and decisively before inflation becomes entrenched”, said BIS general manager Agustín Carstens.

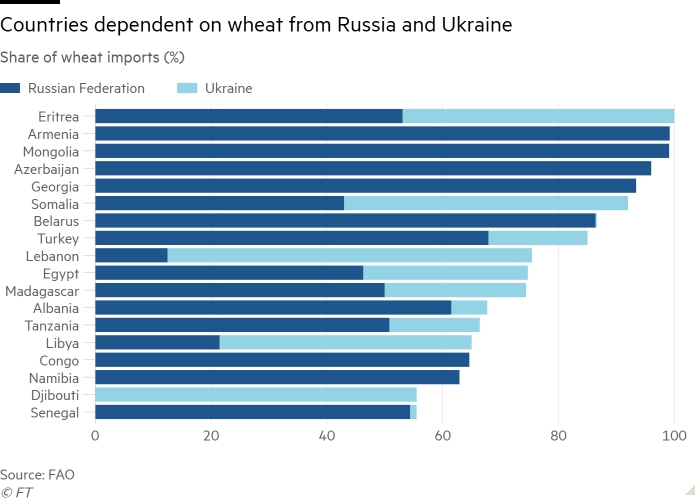

Food shortages are also becoming an increasing concern, as blockades of Ukrainian ports threaten supplies to developing countries, especially in Africa, where millions face hunger. Sharp spikes in food prices have compounded problems caused by the pandemic, threatening an “unprecedented food emergency”. Unrest over food and fuel prices is also growing in Latin American countries such as Ecuador.

A de facto naval blockade means Ukraine, one of the world’s top grain producers, has been unable to export most of the grain stored in its silos, helping push prices to record highs. Turkey and Russia are set to hold UN-brokered talks with Ukraine to overcome the impasse in the coming weeks.

Latest news

For up-to-the-minute news updates, visit our live blog

Need to know: the economy

Russia was on course to default on its debt for the first time since 1998 after it missed a deadline for overdue interest payments. The country has plenty of foreign currency thanks to oil and gas revenues and has repeatedly said it wants to carry on servicing its debt, accusing western governments of trying to force the country into an “artificial” default.

“Bad times lie ahead. The question is how bad.” That’s the conclusion of chief economics commentator Martin Wolf as he assesses the grim impact of high inflation and low growth on the UK.

A must for DT readers is our July 7 event: capitalising on disruption to create business opportunities. Register for free today

Latest for the UK and Europe

UK taxpayers now own a stake in Killing Kittens, a sex party organiser known for its exclusive events, under a scheme set up by the government to help innovative firms hit by the pandemic.

Air travel chaos, cost of living worries and a weak pound making foreign jaunts more expensive have sparked a surge in bookings by Brits for domestic summer holidays.

Plans to end production at the Groningen reserve in the Netherlands, Europe’s largest gasfield, could be put on ice as the war in Ukraine squeezes supplies — despite its link to earth tremors that have led to more than 160,000 damages claims.

The FT’s version of Glastonbury, aka the Weekend Festival, returns on September 3 to Kenwood House in London, featuring a stellar line-up of FT columnists, authors, performers, chefs and much more. As a newsletter subscriber you can get £10 off your festival pass using promo code FTWFxNewsletters.

Global latest

Fresh data today showed that industrial profits in China shrank again in May as the country’s businesses were hit by Beijing’s zero-Covid strategy. As our Big Read explains, “runxue” — the study of quitting the country altogether — is the new buzzword of those tiring of incessant lockdowns. However, there was better news in Shanghai, where authorities declared victory over the recent outbreak of infections, lifting stock prices in the process.

Authorities in Tokyo today told business and the public to save power to avert a blackout, reviving the debate about whether the country should restart its nuclear reactions.

The business model of US farming with its emphasis on producing cheap food with little regard to nutrition (or the health of the planet), needs to be fundamentally overhauled, writes global business columnist Rana Foroohar. Meanwhile, “food deserts” — places without easy access to healthy foods — are deepening racial disparities in US cities.

Investors, homeowners and commercial landlords around the world are all asking the same question: could a crash be coming? Property correspondent George Hammond assesses the impact of rising interest rates and the end of the cheap debt era.

Brazil’s economy has grown just 2 per cent since rightwing populist Jair Bolsonaro became leader in 2019, while it has also suffered the world’s second-highest death toll from Covid. Our Big Read looks at what Bolsonaro might be planning to stay in office if he loses in October’s elections.

Need to know: business

Soaring material and labour costs are putting paid to thousands of local building businesses in the UK. More than 3,400 went into administration in the year to April, the highest number since the financial crisis.

There is no S&P Vilification Index, writes US business editor Andrew Edgecliffe-Johnson, but if there were, it would definitely be on the rise. Executives at fossil fuel companies in particular are feeling the heat from angry consumers over excess profits.

The bankruptcy of Revlon, the 90-year old US beauty giant, highlights how the industry has changed to a much more competitive and fast-paced model, demanding huge investment in digital marketing and product innovation. “It is as if the big established beauty companies are like a tortoise, who is racing not against one hare, but against hundreds of them,” said one analyst.

Chinese chip company YMTC is expanding, with a second plant in Wuhan, as it moves to close the tech and output gap with major players such as South Korea’s Samsung and Micron in the US. Meanwhile, Japan’s biggest semiconductor companies warned that a shortage of engineers could wreck the government’s plans to revive its domestic chip industry. Asia business editor Leo Lewis says Tokyo is failing to keep up with other global financial centres.

Have we hit bottom in yet? Not according to Société Générale which has looked at 56 “crisis” periods in the US stock market over the past 150 years and concluded the S&P index will touch lows of 30 to 40 per cent below its 2022 peak over the next six months. Hedge funds seem to concur as they brace for further market turmoil. Noted distressed debt investor Howard Marks reckons the time is right to snap up some “bargains”.

The World of Work

The decision to quit your job, as so many did during the pandemic, is a life-changing move, but equally important is how you leave, writes Naomi Shragai, the author of The Man Who Mistook His Job for His Life. If you do stay put, try nail-biting and lip-chewing: a new study shows that the more we show signs of stress, the more likeable we seem to become, writes columnist Pilita Clarke.

Fears that the switch to remote working could fatally damage the London office market eased with new analysis showing that the number of companies leasing facilities hit a record last year. A third were businesses relocating from outside London and the remainder were start-ups signing their first office lease in the city.

One city that has been particularly badly hit by working from home is San Francisco, which is lagging behind other locations in getting people back to the office, much to the ire of local politicians desperate for tax revenues. Read about this and more in our new special report: The future of cities.

Covid cases and vaccinations

Total global cases: 538.0mn

Total doses given: 12.0bn

Get the latest worldwide picture with our vaccine tracker

And finally…

From literary thrillers to cold war romances and the post-pandemic case for a new settlement, editor Roula Khalaf and FT writers pick their must-read titles in our summer books special.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link