[ad_1]

President Xi Jinping will this week pay his first visit to Saudi Arabia in six years as part of efforts to boost China’s relations with the Gulf region, five months after the US warned Beijing that it would not cede the Middle East to it or anyone else.

Xi will meet King Salman bin Abdulaziz al-Saud and Crown Prince Mohammed bin Salman, the kingdom’s day-to-day ruler in Riyadh, and attend two summits with Arab and Gulf leaders. Neither side has given details about the Chinese leader’s meeting with the Saudi royals, but the two countries could sign a deal on co-operation ranging from free trade to nuclear power.

The Chinese president’s visit, which comes as he faces mounting pressure at home over opposition to his “zero Covid” strategy, underscores China’s desire to boost links in a region that is traditionally seen by Washington as falling under its sphere of influence.

US president Joe Biden’s message to the assembled Arab leaders when he visited Riyadh in July was: “We will not walk away and leave a vacuum to be filled by China, Russia, or Iran . . . the US is not going anywhere.”

Yet relations between Biden and Crown Prince Mohammed are tense. And despite the president’s pledge to stick around, the view in the Gulf is that the US has grown increasingly distant as it switches focus to other regions — and that China is among those keenest to fill any gap.

“Everyone thinks the US is on the way out,” said Gedaliah Afterman, an expert on China and the Middle East at the Abba Eban Institute for Diplomacy and Foreign Relations in Israel. In the strategic battle between Washington and Beijing, “every 10 metres [China] manages to move the Saudis in their direction is not only a win, it’s a double win, because they’re moving away from the US,” he added.

Gulf officials make clear, however, their wariness of getting too caught up in any China-US disputes, in the knowledge that they have to maintain relations with the pair.

Both Saudi Arabia and the United Arab Emirates count on Washington as a supplier of military hardware and protection. The US hardware would be almost impossible to replace with what China has to offer.

Yet that has not stopped Saudi Arabia and other Gulf nations from moving closer to Beijing on co-operation in trade, technology, and even ballistic missile technology and armed drones.

Nissa Felton, senior manager at Janes IntelTrak, a consultancy, said that while China was not presently a threat to the US’s historic role as regional security provider, “increasing political ties, whether at the top of government, exercised through votes in international organisations like the UN or pursuing joint strategic initiatives . . . is potentially problematic for US long-term interests”.

“This broader co-operation — the willingness to sync China’s foreign policy with their own domestic agendas — signals an openness to diversify away from these countries’ traditional relationships with the US.”

At home, Xi faces widespread angst over a severe economic downturn and rising opposition to his policies, which erupted in protests late last month across several big cities. “Xi Jinping needs to divert attention because of domestic dissatisfaction,” said Willy Lam, an expert in Chinese politics at the Chinese University of Hong Kong.

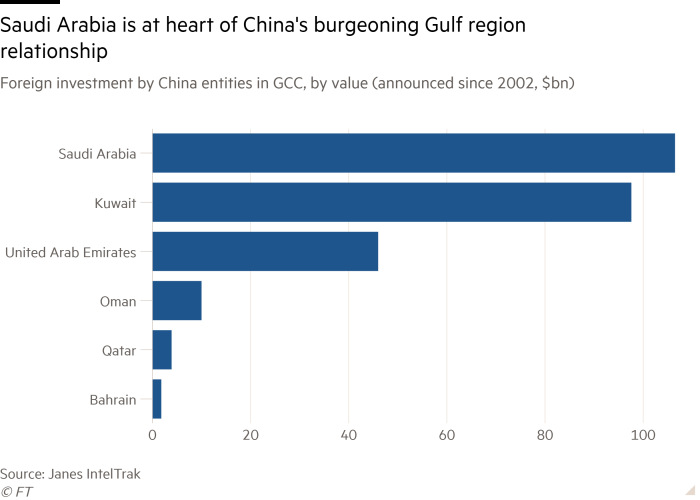

Saudi Arabia tops the list of destinations for announced Chinese foreign investment in the Gulf region over the past 20 years, totalling $106.5bn, ahead of Kuwait with $97.6bn and $46bn for the UAE, according to Janes IntelTrak data.

The Beijing-Riyadh relationship is underpinned by oil. Saudi Arabia is China’s largest supplier of crude and China is the kingdom’s largest trading partner.

Oil will loom large over this week’s visit, which takes place around an important Opec+ meeting, a deadline for Europe to impose an embargo on Russian crude and the possible introduction of a price cap on Russian oil.

But China’s relationship with the kingdom, and other Gulf countries, has gone beyond oil in recent years, particularly when it comes to technology, something the US has opposed on occasion.

That co-operation, particularly on Huawei 5G technology, concerns the US administration, as does the prospect of allowing China security facilities in the Gulf. The UAE last year shut down a purported Chinese military facility in the country after US objections.

“There are certain partnerships with China that would create a ceiling to what we can do,” Brett McGurk, the Biden administration’s top Middle East official, told a conference in Bahrain last month.

The US has agreed with Saudi Arabia to work on 5G technology, but the kingdom is still pursuing its co-operation with Huawei. US hackles have also been raised by speculation that Saudi Arabia could sign a deal with China to settle oil trades in renminbi.

Saudi government officials have privately briefed that any such deal would not include oil trades, which are conducted in dollars, but extend to other sectors. A senior Saudi official said he was unaware of any trade deal in renminbi that would be agreed this week, but that there would be nothing wrong with doing so.

[ad_2]

Source link

Comments are closed.