[ad_1]

The thing about macroeconomic forecasting is that it’s extremely complicated, as illustrated by the below chart from Morgan Stanley:

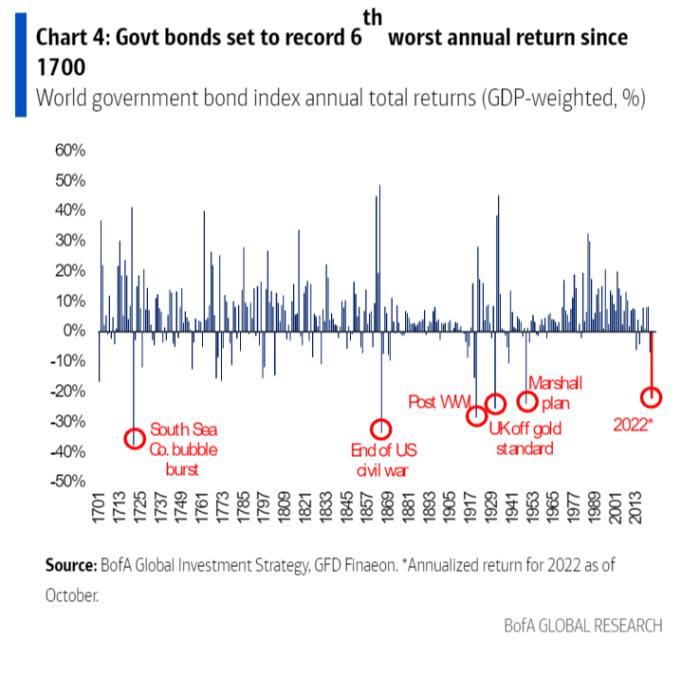

Yet even allowing for these many complexities, 2022 has been a challenging year to predict. Its outlier status can be demonstrated by this 322-year data snapshot from Bank of America:

Luckily, the themes of 2023 appear to be much more predictable. In fact, judging by the slew of year-end economics and markets strategy previews landing in recent weeks, they’re identical to the current investment consensus.

Everyone seems to agree that global GDP growth will keep slowing, and that inflation will crest but remain sticky. Central banks will keep tightening, albeit not quite so quickly. A Fed-induced recession will tame the US consumer spending binge, but household, corporate and bank balance sheets will all remain generally healthy. In sum, that means all the usual titles — The Great Rotation; Welcome to the New Normal; At A Crossroads; The Sum of All Fears; Darkest Before Dawn; The Changing World Order — can be recycled once again.

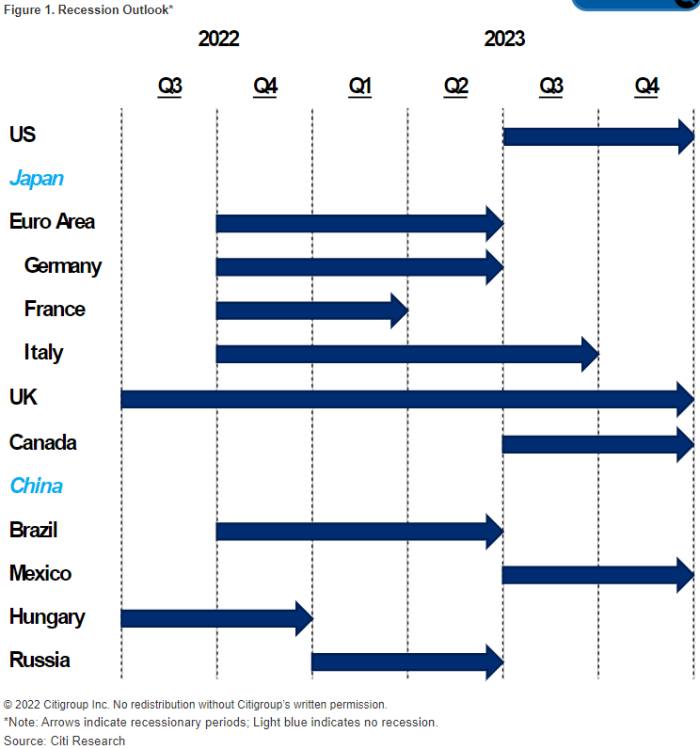

When opening a year-ahead preview it’s good be downbeat, such as with a reminder that recession is coming nearly everywhere. The below chart via Citigroup uses the technically correct measure of two or more quarters:

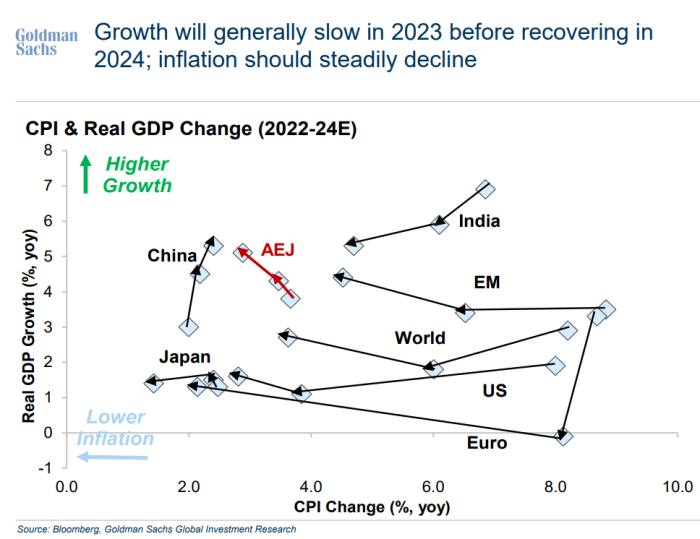

So for an investor, the key will be understanding the regional interplay between slowing growth and slowing inflation. Enlightenment can be found somewhere, somehow, within this GDP/CPI zodiac constellation from Goldman Sachs:

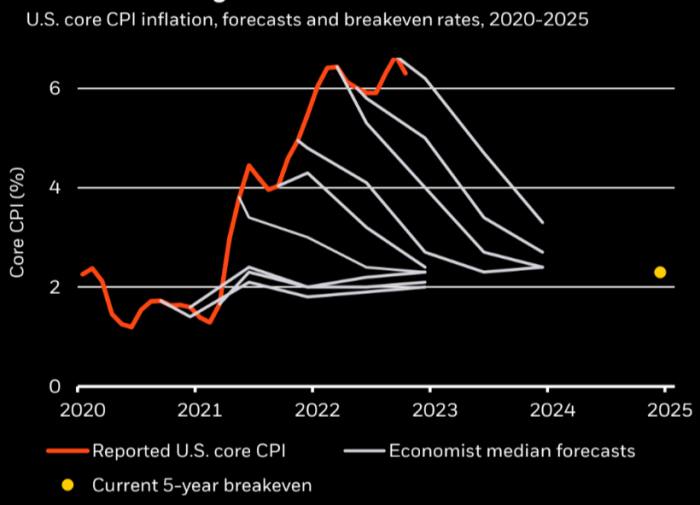

Of course, past performance on inflation forecasting isn’t often indicative of future returns. BlackRock provides the frond chart:

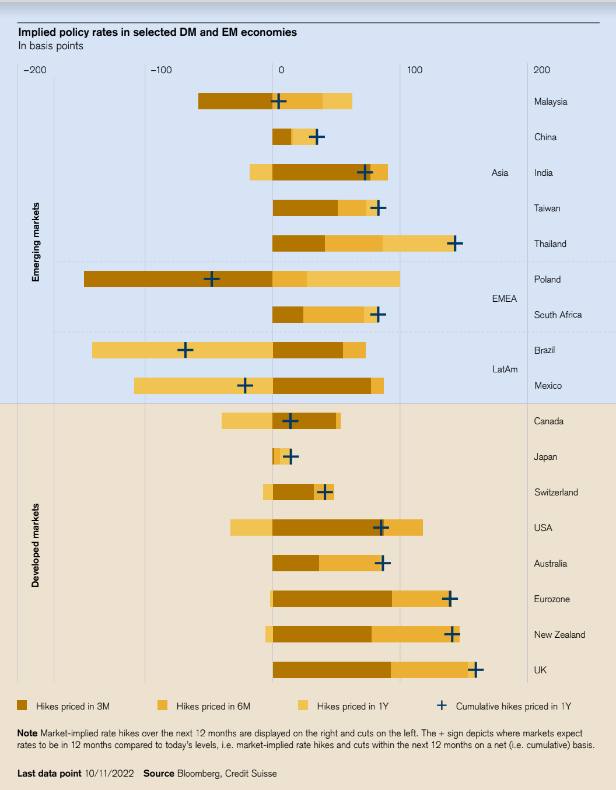

But there’s no arguing with rates markets. The money says interest rates are going to go up quickly, except where they’re going up slowly or are going down, per Credit Suisse:

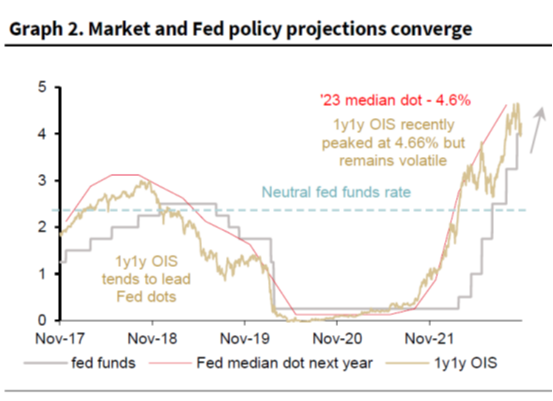

About now, a cynical reader might point out that money markets are nearly as bad at predicting rates as economists are at predicting inflation . . .

Nonetheless! With global inflation (probably) peaking, 2023 will (probably) be the year of the pivot.

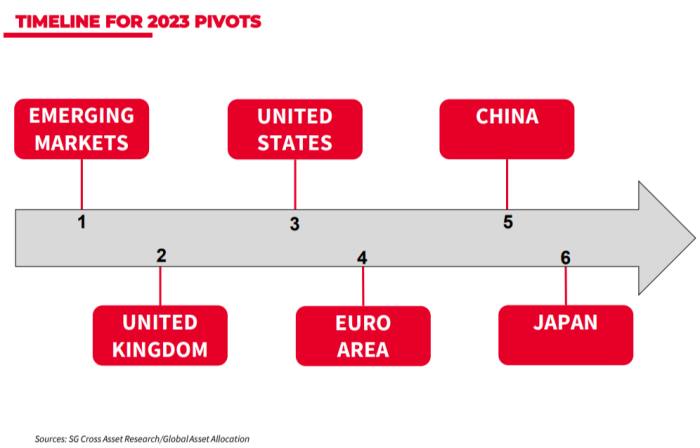

Predicting exactly when central banks pause is beyond the scope of any economist, it seems, but at least some are willing to have a stab at the order. That’s SocGen’s method:

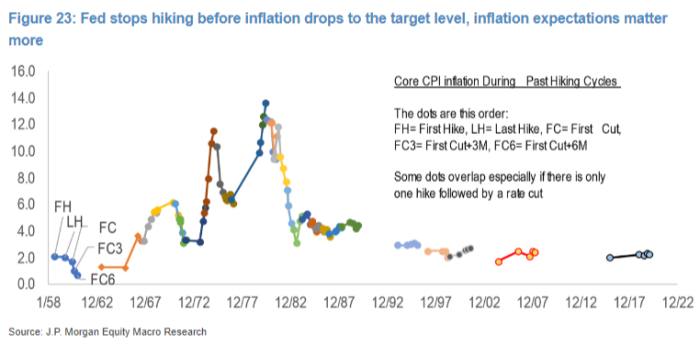

Another way to approach the timing question is to cite precedent. Below, apparently, is JPMorgan plotting of a Fed pivot around inflation expectations:

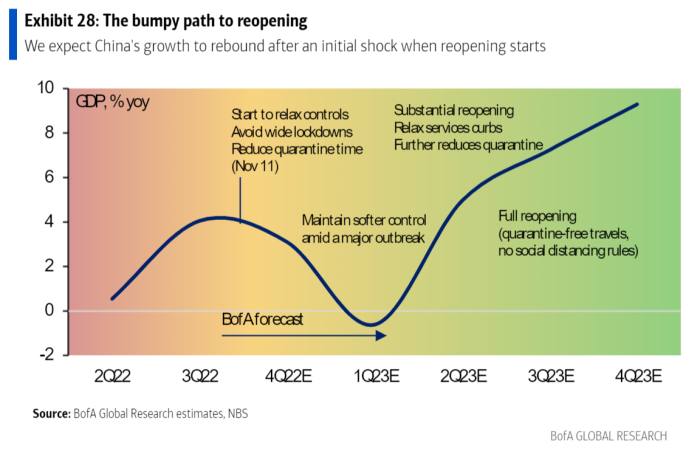

The biggest known unknown of 2023 is China. Economists are, generally speaking, not trained either in virology or political science. But like BofA below, they’re willing to give both a bash:

Emerging markets are largely dependent on Chinese policymaking so logic says they’re impossible to call. Luckily, logic isn’t a prerequisite when generating client-focused content. The consensus advice therefore is to buy in anticipation of China’s rebound in combination with a looser US monetary conditions, but don’t buy any time soon because EM recessions will be deep and long.

Citi illustrates the quandary of near-term caution around EMs with . . . an unshaven businessman with a ladder?

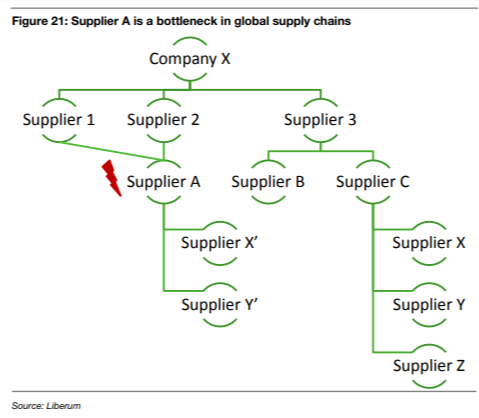

Also, China’s reopening is only positive if supply chains start working again. But supply chains are complex and fulminous, as illustrated here by Liberum:

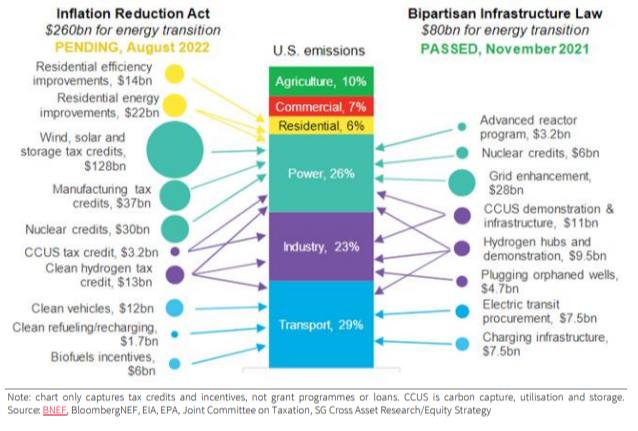

On the flipside, there’s always money in greenwashing. Here’s SocGen to illustrate where some of that cash might land:

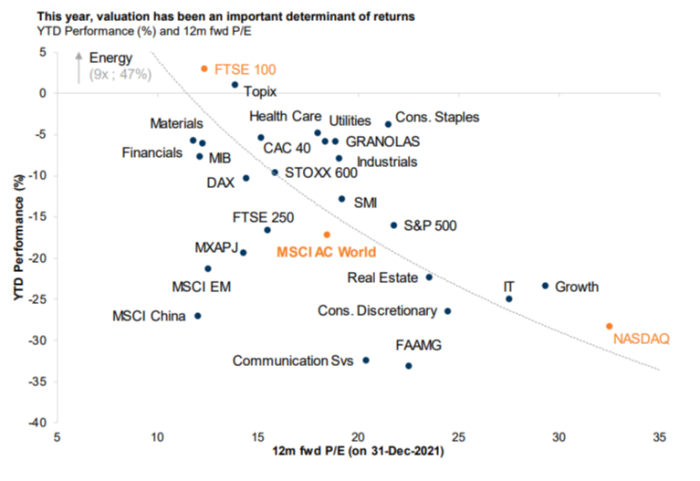

Valuationwise, some markets are looking cheap and others are not.

OK — banks might say every single year that now is the time to be selective, favour quality over things that aren’t quality, and so on. But this time they really mean it! Just look at the scatter chart from Goldman:

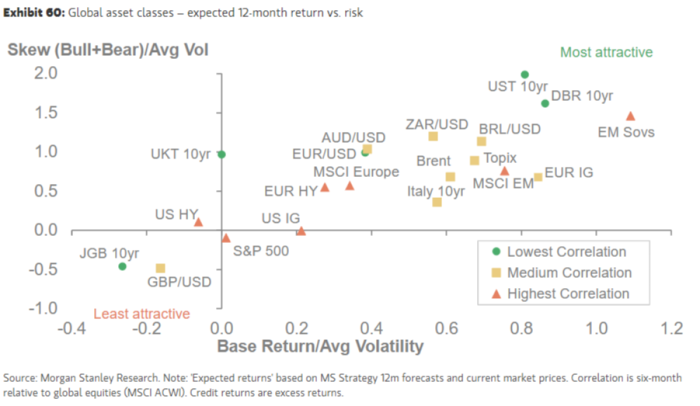

And look at this even more exciting scatter chart from Morgan Stanley, which casts forward the forecasts while adding in correlations and relative volatility:

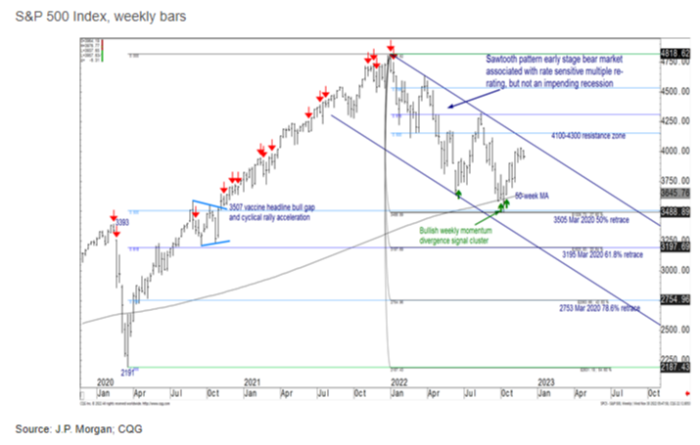

So in conclusion . . . wait, what? There’s still a technical analyst on the JPMorgan payroll? Fine. Let’s have it:

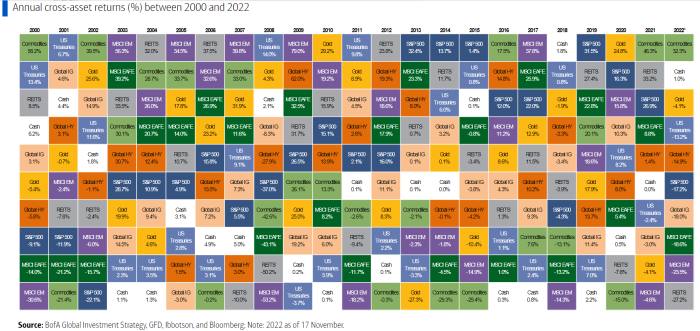

. . . so in conclusion, we’ll probably need to do more than cherry-pick the weirdest looking graphs to write a proper summary of the year-ahead previews. Until time allows, however, it appears your options for navigating the coming 12 months can be summarised either by a paint sampler chart from BofA . . .

. . . or, from Credit Suisse, by a train speeding away from a QR code labelled “find out more”:

[ad_2]

Source link

Comments are closed.