[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Sam Bankman-Fried’s businesses owe more than $3bn to their largest creditors, according to court filings, as the cryptocurrency group’s huge bankruptcy process gets under way.

The crypto exchange FTX and linked companies founded by Bankman-Fried filed a list of their 50 largest creditors yesterday, all of which are customers and owed more than $20mn, with two of them due more than $200mn. The companies’ total liabilities are estimated at more than $10bn, according to earlier filings, and it may have more than 1mn creditors.

Publication of the list as part of Chapter 11 bankruptcy proceedings in Delaware had been delayed as bankruptcy practitioners struggled to locate reliable records at FTX group, which collapsed this month after a liquidity crisis and accusations it mishandled client funds. The collage of the crypto exchange caused former FDIC head Sheila Bair to call for crypto regulation under existing law.

John Ray III, the bankruptcy expert who has taken control of the business and who oversaw the liquidation of Enron, said in earlier filings he had never seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information”. Ray also noted that the group will prioritise pursuing a reorganisation or sale.

Join leaders including Singapore’s minister of trade and industry, the deputy chair, CEO and executive director of Mewah International Inc. and more on November 23 in Singapore at The Westin and online to speak about the future of the commodities industry. Register here for your in person or digital pass today.

Five more stories in the news

1. Malaysian elections produce first hung parliament Rival political leaders are fighting to secure a majority after this weekend’s election produced Malaysia’s first hung parliament. Nonagenarian ex-prime minister Mahathir Mohamad lost his seat and the lack of a clear winner will complicate efforts by the south-east Asian economy to tackle slowing growth and rising inflation.

2. Elizabeth Holmes sentenced to over 11 years for Theranos fraud In what prosecutors called one of the “most substantial” white collar crimes in the US, the disgraced founder of failed blood-testing start-up Theranos has been sentenced to 135 months in prison. Holmes, who is 38 and pregnant with her second child, will begin serving her sentence in April.

3. Turkish jets strike Kurdish militants after Istanbul bombing Turkey launched air strikes in Syria and Iraq on Saturday night, targeting Kurdish militants in attacks that risk escalating tensions in the volatile region. The operation came a week after Turkey blamed the Kurdistan Workers’ party for a bomb attack in Istanbul, killing six people, and the ministry’s statement cited Ankara’s right to self-defence in carrying out the assault.

4. Qatar’s World Cup preparations run into extra time Construction workers were rushing to apply the finishing touches to temporary accommodations for football fans over the weekend as the Gulf state of just 3mn people gets ready to host 1.5mn visitors for the tournament, which kicked off yesterday.

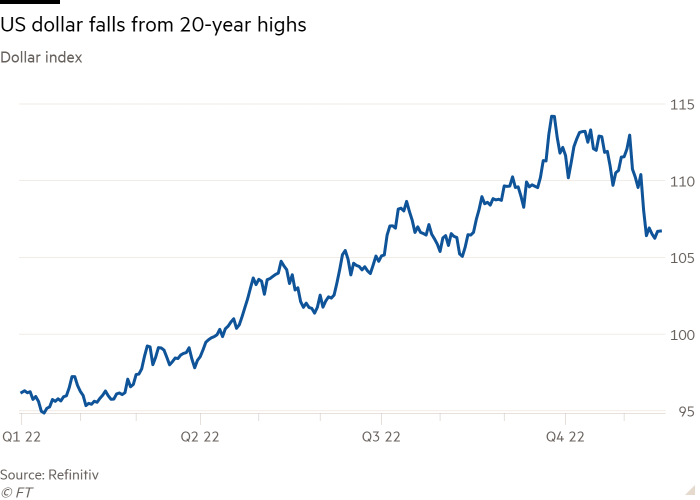

5. Dollar tumbles from 20-year high as US inflation eases The US dollar has fallen in the past fortnight, fuelling speculation that the Federal Reserve will soon slow down its interest rate rise and offering early indication that inflation may finally be easing. The greenback has fallen more than 4 per cent against a basket of six peers so far in November, leaving it on track for the biggest monthly fall since September 2010.

The day ahead

CBI conference British business leaders will be able to have their say about UK politics at the Confederation of British Industry conference, which starts today in Birmingham. Speakers include a “senior cabinet minister”, John Lewis Partnership chair Sharon White and BT Group chief executive Philip Jansen.

Economic indicators China releases its monthly interest rate decision, Germany releases its October producer price index (PPI) inflation rate data, Hong Kong publishes October consumer price index (CPI) inflation rate data and Thailand also has its Q3 GDP figures today.

Corporate results Urban Outfitters and Zoom will have their Q3 results today; Agilent Technologies releases its Q4 results; Compass Group and Virgin Money release their FY results.

American Thanksgiving ceremony President Joe Biden will pardon the National Thanksgiving turkey in the annual ceremony at the White House.

What else we’re reading

Russians struggle to make sense of Ukraine war after Kherson retreat After nine months of war, Russia still describes its activity in Ukraine as a “special military operation”. Amid the drumbeat of state propaganda, the mood among Russian citizens is one of low-level anxiety, according to independent polls, and many are left with more questions than answers.

Coinbase’s Brian Armstrong: ‘I’m just as bullish on crypto as ever’ Amidst a severe downturn in crypto, the founder-CEO of crypto exchange Coinbase has lunch with the FT to discuss his enduring belief in blockchain, his “no politics in the workplace” policy, and why the solution to crypto chaos is . . . more crypto.

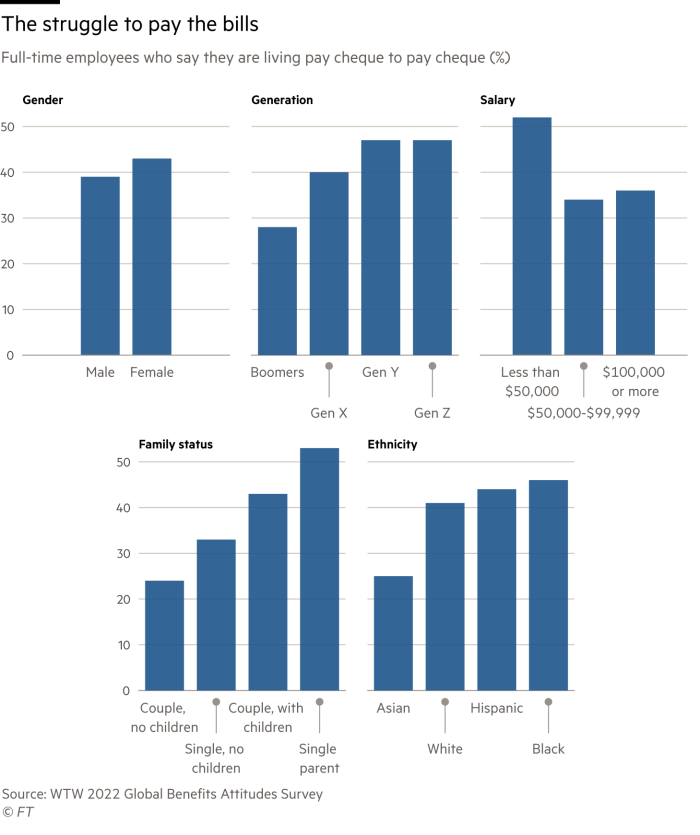

When your boss becomes your banker Inevitably, employees bring their financial concerns into the workplace. And as people’s financial concerns grow amid the cost of living crisis, more companies are finding ways to offer financial services such as loans or pay advances to their staff. What is the risk?

How to succeed with a family business succession Succession is the most emotionally taxing question facing entrepreneurs, writes John Gapper. And, after years of observing how businesses operate, many of the emerging generation must have noticed that being publicly responsible for everything has drawbacks.

Lessons from a decade of ‘Candy Crush’ The addictively casino-esque puzzle game has generated billions of dollars in revenue since its launch in 2012 and its reach is huge — so why isn’t it more talked about culturally? The fault might lie in its format and its lack of a central protagonist.

Travel

From the balmy weather and romantic plazas to its residents’ easy-going turns of phrase, Simon Kuper found much to love about his year in Madrid.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link

Comments are closed.