[ad_1]

The Bank of England painted two pictures of the outlook for the UK economy on Thursday. Both scenarios were bleak.

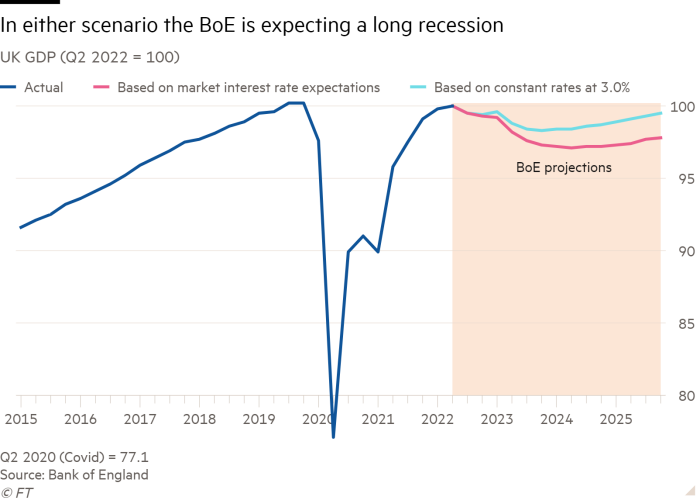

Whatever happened, said the central bank, the British economy was slipping into a recession that would last at least all of next year. Unlike the Federal Reserve, which on Wednesday was still hoping for a “soft landing” for the US economy, the BoE’s talk was of falling gross domestic product and a “very challenging” outlook.

Andrew Bailey, BoE governor, said this was inevitable because there were “important differences between what the UK and Europe were facing in terms of shocks and what the US is experiencing”. Europe, unlike the US, has been grappling with soaring gas prices following Russia’s invasion of Ukraine.

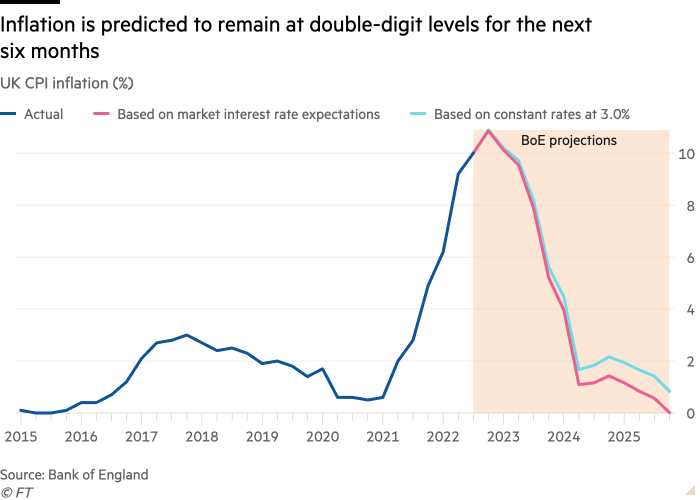

The BoE’s grim predictions did not end with recession. Inflation would stay above 10 per cent for the next six months, and above 5 per cent for the whole of 2023. Unemployment, currently at a 50-year low of 3.5 per cent, would end next year above 4 per cent.

If all of this pain was common to both of the BoE’s scenarios, the differences between them were key to the central bank’s messaging.

In the first BoE scenario — normally considered its headline forecast — predictions were based on the assumption that financial market expectations for future interest rates would involve them peaking at 5.25 per cent next year.

Were rates to top out at this level, the BoE Monetary Policy Committee thought it most likely the UK would have to endure eight quarters of economic contraction: the longest recession since the second world war. Unemployment would rise to 6.4 per cent. This economic pain would weigh on inflation, sending it to down to zero by late 2025.

But with the BoE having an inflation target of 2 per cent, Bailey was clear this scenario suggested markets risked getting their bets wrong on future monetary policy. “We think [the] bank rate will have to go up by less than currently priced into financial markets,” said Bailey.

The BoE’s alternative scenario — which is normally buried in the central bank’s forecasting documents — that interest rates stay constant at the current level of 3 per cent was given much more prominence in presentations by Bailey and his team.

Under this prediction, output would still shrink, but by only half as much as in the first scenario, resulting in a mild recession by historical standards. Inflation would fall to 2.2 per cent in two years’ time, before slipping below the BoE’s target. Unemployment would rise, but only to 5.1 per cent.

Many economists said the BoE’s alternative scenario was a clear signal by the central bank that it was close to being done with interest rate rises, now it had increased them from 0.1 per cent a year ago to 3 per cent, the highest level since 2008.

Kallum Pickering, economist at Berenberg, said the recessionary overkill in the BoE’s first scenario meant the central bank “may need to do much, much less than the market expects in terms of further rate hikes to return inflation to its 2 per cent target”.

When asked which of its two scenarios the BoE thought was most likely to happen, Bailey would not be drawn. He did not want to pin himself down to a specific view of future interest rates, saying: “Where the truth is between the two, we’re not giving guidance on that.”

His main reason for refusing to be more specific is the possibility that inflation proves more entrenched than the BoE currently thinks.

Bailey said that while no prediction would ever be exactly right, the main risk was that inflation would still be higher than the central forecasts in both BoE scenarios.

One key danger for the BoE is that wage growth could easily stay higher than it would like, with companies feeling able to raise prices without losing too much business.

Ruth Gregory, economist at Capital Economics, said the BoE’s many revisions upward for market expectations on future interest rates over the past year suggested inflation might prove “stickier” than it hoped.

By the end of the day, markets had taken scant notice of the BoE’s dovish scenario. Before the BoE’s announcement at noon, markets were pricing in interest rates peaking at 4.75 per cent next year. By the end of the day, they were betting they would top out at 4.72 per cent next September.

Market expectations for future monetary policy will move around, and Bailey was keen to highlight what would guide BoE decisions in the weeks ahead.

Most important, he said, would be the evolution of economic data, particularly on wages and firms’ pricing strategies. If these soften, the BoE would feel less need to raise interest rates further.

The path of wholesale energy prices would also be crucial, and the BoE will be hoping that these moderate further, having more than halved since late August.

The other crucial factor will be chancellor Jeremy Hunt’s autumn statement on November 17. If the government proceeds with immediate public spending cuts and tax increases to fill a gaping hole in the public finances, it will depress the economy further and ease the pressure on the BoE to raise interest rates.

Ben Broadbent, BoE deputy governor, suggested any fiscal action by the government would need to happen “in the relatively near term” to influence the central bank’s interest rate decisions.

[ad_2]

Source link

Comments are closed.