[ad_1]

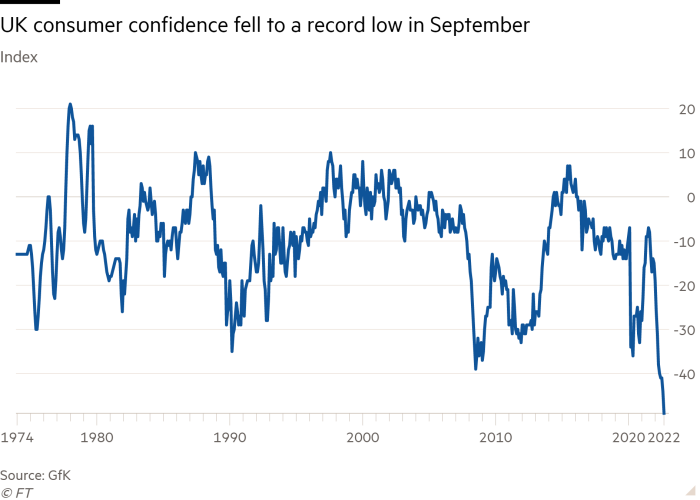

UK consumer confidence has defied expectations of an improvement and fallen to a new all-time low, as households struggle under the pressure of the cost of living crisis.

The consumer confidence index, a closely watched measure of how people view their personal finances and wider economic prospects, dropped 5 percentage points to minus 49 in September, research group GfK said on Friday. That was the lowest since records began in 1974.

Joe Staton, GfK client strategy director, said confidence had “tumbled” in September to a new low as households “buckl[ed] under the pressure of the UK’s growing cost of living crisis driven by rapidly rising food prices, domestic fuel bills and mortgage payments”.

The fall defied expectations of a small rise to minus 42 forecast by economists polled by Reuters, who thought there would be some improvement following the government’s £150bn package aimed at freezing household energy bills.

The data come the day after the Bank of England lifted interest rates by 50 basis points to 2.25 per cent, the highest since 2008, meaning borrowing will become more expensive for businesses and households.

“For consumers already struggling to keep their household finances in check, the increased cost of borrowing as a result of the rate rise . . . may signify the breaking point, leading to the acceleration of decrease in demand,” said James Brown, managing partner at global consultancy Simon-Kucher & Partners.

Incorporating the energy bills freeze, the BoE expects UK inflation to peak at 11 per cent in October from its current 9.9 per cent, a near 40-year high, further eroding households’ real incomes.

The data also follow confirmation, ahead of Friday’s mini-Budget, that the government will from November reverse the 1.25 per cent rise in national insurance contributions that was introduced in April.

Staton said the “mini-Budget, and the longer-term agenda to drive the economy and help rebalance household finances, will be a major test for the popularity of Liz Truss’s new government”.

The GfK index, based on interviews collected in the first two weeks of the month, showed scores in relation to four of the five questions posed, which touch on personal finances and the wider economic picture, at record lows.

Forward-looking indicators, which track expectations for the next 12 months, registered the largest fall, dropping 9 percentage points for personal finances and 8 percentage points for the economy.

Economists expect record-low consumer confidence to result in falling spending, a trend registered by the BoE in its agents survey published on Thursday.

It showed that food retailers reported customers opting for cheaper goods and cutting back on non-essential items, such as confectionery. Discount chains gained market share, while sales of household items, such as furniture, electrical goods and home-improvement products, fell.

Clothing sales were supported by the return to the office, but in hospitality, sales were down on pre-pandemic levels. Holiday booking also weakened and domestic tourism was limited by higher petrol prices.

Demand was strong, however, for financial services and legal advice, such as tax planning, equity release, debt consolidation and early repayment. Third sector organisations also reported a large rise in people seeking debt advice.

[ad_2]

Source link

Comments are closed.