[ad_1]

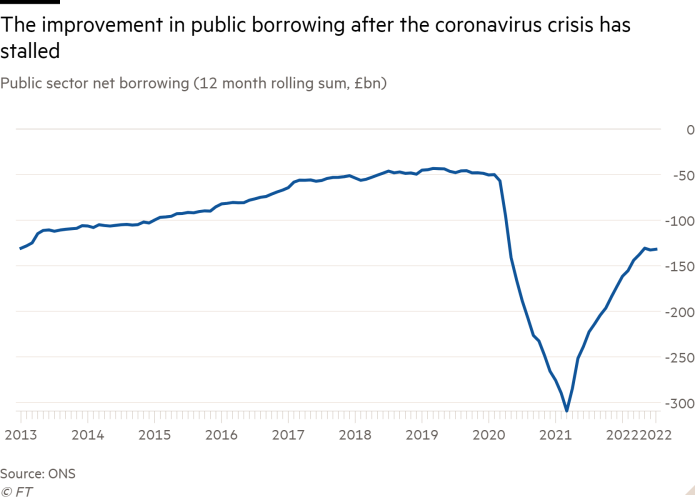

High levels of inflation will ensure a large overshoot in government borrowing this year, economists said on Friday, as the deficit was again higher than expected in July

Although the UK public finances improved in July from a particularly weak reading in June, the data from the Office for National Statistics was still significantly worse than the fiscal watchdog had expected for the month.

The figures will put further pressure on the Conservative party leadership candidates, Liz Truss and Rishi Sunak, to explain how they will finance their plans for large tax cuts when the public finances are deteriorating.

Public sector net borrowing came to £4.9bn last month, an improvement of £800mn compared with July 2021 and far better than the £20.9bn deficit in June, according to the ONS.

But the decline between June and July was expected because the government did not have big debt interest bills to pay last month, and the level of borrowing was still £4.7bn higher than the Office for Budget Responsibility, the spending watchdog, had forecast for the month.

Martin Beck, chief economic adviser to the EY Item Club, said the government was set to continue missing OBR forecasts for the rest of the financial year, which ends next March. “This is likely to reflect the slowdown in economic activity in the first half of 2022, while on the expenditure side the impact of much higher-than-expected inflation on debt interest payments has been key,” he said.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the OBR’s forecast of £99bn public borrowing in 2022-23 was likely to be revised higher to £150bn, mostly reflecting the higher cost of inflation-linked debt.

He also noted that the current bout of inflation would not help to boost government coffers much because it was the “wrong type” for the public finances because food is zero rated for VAT, and electricity and natural gas consumption incurs only a 5 per cent rate of VAT.

“As a result, the reallocation of households’ expenditure from other goods and services towards food and energy will act as a drag on overall tax receipts,” Tombs said.

Ministers will be relieved that tax receipts held up well in July, with the government collecting £78.2bn in revenues over the month — £6.1bn more than a year earlier. But Chancellor Nadhim Zahawi acknowledged that high inflation was “putting pressure on the public finances by pushing up the amount we spend on debt interest”.

The Treasury cautioned that there was not much comfort to be taken from July’s figures being stronger than June’s because at a time of elevated inflation there would be significant volatility in the monthly data.

Alison Ring, public sector and taxation director for the Institute of Chartered Accountants in England and Wales, said: “The UK’s deteriorating fiscal situation will make it hard for the new prime minister to deliver on promised tax cuts, invest in energy resilience and support struggling families and businesses over the winter without breaching fiscal rules intended to ensure the long-term health of the public finances.”

Both Truss and Sunak have promised an emergency Budget to flesh out the energy price support and tax cuts they will offer soon after one of them is elected to be the new UK prime minister.

Sunak’s leadership campaign said the public finance figures highlighted “why gripping inflation must be the priority.

“The figures show that inflation is causing the economy to slow and the deficit to increase. Permanent and unfunded tax cuts now would make both of these problems a lot worse,” a spokesperson said.

Officials at the Treasury and the OBR have indicated that they will be ready to provide new medium-term forecasts to inform any emergency Budget, which will prove uncomfortable reading if independent economists’ predictions for the public finances are an accurate guide to the fiscal watchdog’s thinking.

Additional reporting by Sebastian Payne

[ad_2]

Source link

Comments are closed.