[ad_1]

The European Central Bank is using its pandemic-era bond-buying programme to shield highly indebted eurozone countries from the effects of its decision to unwind stimulus programmes in its bid to fight inflation.

The central bank concluded net purchases under its pandemic emergency purchase programme in March, but is focusing reinvestments of maturing bonds on the bloc’s more financially fragile members.

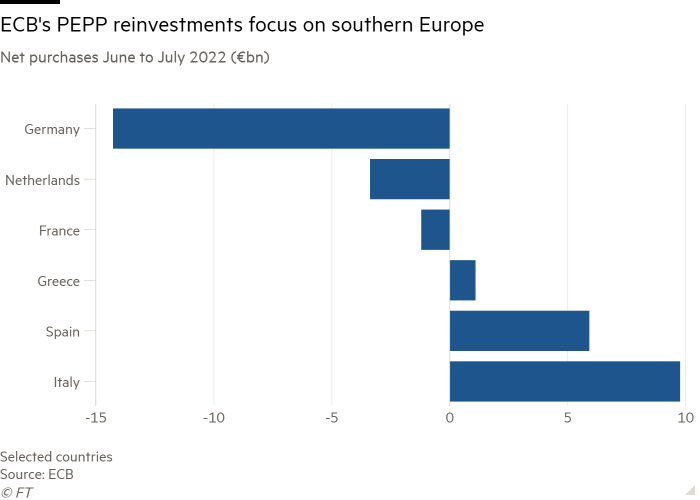

Between June and July, the ECB injected €17bn into Italian, Spanish and Greek markets, while allowing its portfolio of German, Dutch and French debt to fall by €18bn, according to Financial Times calculations based on the central bank’s data.

“The deviation now is very large,” said Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management, about the ECB’s reinvestments. “It looks like the ECB has been very active by reinvesting almost all the proceeds from core countries into peripheral countries.”

The reinvestments highlight the ECB’s eagerness to keep a lid on borrowing costs for countries such as Italy and prevent a eurozone debt meltdown as it pulls back from the accommodative monetary policy that has supported the bloc since the debt crisis a decade ago.

It comes after the ECB last month raised interest rates for the first time since 2011 after making the decision to conclude the PEPP programme, and a longer-running bond-buying scheme called the asset purchase programme.

Sven Jari Stehn, chief European economist at Goldman Sachs, said the “extent of the flexibility that has been utilised” in reinvesting proceeds of bonds that were part of the PEPP programme was “somewhat more than people had expected”.

ECB policymakers and investors are worried that tighter monetary policy will widen the gulf between the region’s strongest and weakest economies — so-called fragmentation risk. These fears pushed wider the difference between Italian and benchmark German 10-year bond yields to as much as 2.4 percentage points in June, a level last seen during the market tumult in the early days of the pandemic in 2020.

The spread has since narrowed to about 2.1 percentage points after the ECB committed to pushing back against fragmentation. The ECB last month said flexibility in deploying PEPP reinvestments would be the “first line of defence” in its attempt to keep a lid on so-called spreads.

“I think it’s a good thing for them to be bold . . . it’s good for markets to see they’re putting their money where their mouth is,” said Ducrozet, adding that “the clear message is that they’re using this flexibility almost to the max that they could”.

The central bank also last month put in place a new transmission protection instrument that can be used in case PEPP reinvestments fail to keep spreads under control. The tool allows the ECB to buy the bonds of any country it deems as facing market pressures outside the economic outlook, at unlimited scale. Investors have been watching Italian spreads cautiously to see when the ECB may step in, with many deeming 2.5 percentage points an important mark.

While the ECB is yet to use the new tool, its use of PEPP reinvestments shows how eager policymakers are to keep spreads under control.

Jari Stehn said this was “an activation of the first line of defence against fragmentation risk but still means that it’s an open question whether and when the TPI is activated”.

[ad_2]

Source link

Comments are closed.