[ad_1]

British pubgoers have been put on notice that they face sharp increases in the price of a pint as mounting inflationary pressures in the brewing industry combine with rising staff and utility costs and the looming end of coronavirus tax relief.

Beer industry executives and analysts warned that drinkers had yet to feel the full impact of brewers’ rising costs, which Dolf van den Brink, Heineken’s chief executive, this week described as “off the charts”.

Prices of malting barley, the most important ingredient for lager, have more than doubled in the past year, while the industry also has to contend with the shipping logjams that are clogging other global supply chains.

The situation reflects the unrelenting broader inflationary pressures in the UK economy. Prices rose at an annual rate of 5.5 per cent in January, the fastest in 30 years, according to official statistics published on Wednesday, and the Bank of England has forecast that inflation will peak above 7 per cent in April.

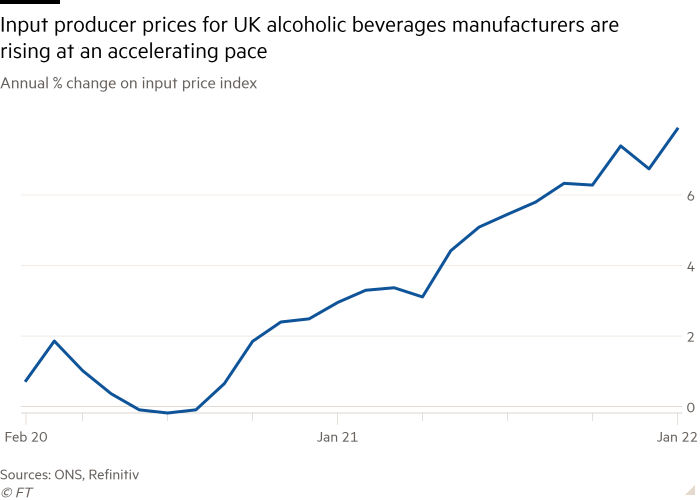

Office for National Statistics figures show that input prices for UK makers of alcoholic drinks rose at an annual rate of 7.9 per cent in January, the fastest pace in a decade.

Given that contracts between British pubs and brewers tend to last a year or more, however, producers are only just beginning to pass on surging costs to consumers.

Tim Martin, founder of pub chain JD Wetherspoon, said: “Those costs are going to come through. They’re only part of the cost borne by the pub, but they will be extremely painful on top of everything else.”

Pubs nevertheless face a dilemma in how much of the additional expenses to pass on at the bar, given that more expensive drinks threaten to deter customers from visiting just as the industry tries to move on from the pandemic.

Emma McClarkin, chief executive of the British Beer and Pub Association, said price increases in pubs would give consumers who were still nervous about Covid another reason to avoid going out again. “It’s difficult when you want to win back consumers,” she said.

Household budgets are being squeezed by more expensive food and other essentials, reducing their discretionary spending.

Martin noted how much cheaper alcohol was in supermarkets. “With real incomes falling, people have to be careful,” he said.

Pub groups said that, although price rises were inevitable, they would vary from region to region and site to site.

Clive Watson, executive chair of City Pub Group, said: “We need to encourage customers to come back so will probably only put up prices by 3 per cent — which will hit our margins.” So far, he added, brewers had increased the price of beer for pubs by about 7 per cent.

The chief executive of one national chain said that determining with any accuracy how much a pint will cost in the months ahead was “nigh on impossible”.

Most operators have been talking about 5 per cent price rises, the executive said. This would add 25p to the price of a £5 pint. Yet many are waiting to see how competitors respond to the pressures before setting a firm pricing strategy.

“We don’t want to be first mover,” said Phil Urban, chief executive of pub and restaurant group Mitchells & Butlers, whose brands include Harvester and All Bar One.

For now, he said, the company was “holding its nerve and not taking price” [an industry term for putting up prices] even though “all the cost headwinds are challenging”.

Andrew Andrea, chief executive of pub chain Marston’s, said the company had so far increased prices “just above mid-single digits” this year. “We haven’t pushed it too far thus far,” he said.

Several executives said a crunch point on pricing was less than two months away. Value added tax, which the government had reduced for hospitality businesses to 12.5 per cent to give them much needed relief during the pandemic, is due to return to the full 20 per cent rate in April. Marston’s might be compelled to increase prices in response, Andrea said.

Ultimately it would be difficult for pubs to avoid passing on a “triple whammy” from “rampantly rising” utility bills, labour inflation and the rising cost of raw materials, said Greg Johnson, leisure analyst at Shore Capital.

The industry would be “looking to pass on what I assume will be pretty high rises”, he added. “We’re all going to have to pay more for a steak and chips and a pint of ale down the Dog & Duck.”

[ad_2]

Source link

Comments are closed.