[ad_1]

This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. Memory chipmaker Micron put an exclamation point on the end of the first half when it reported earnings yesterday afternoon. The guidance, as always, was the important bit. Wall Street analysts expected that in the August quarter Micron would have revenue of $9bn or so. The midpoint of the company’s guidance was $7.2bn. Big miss — fitting with the inventory and goods demand worries we have been rattling on about here.

Interestingly, though, the stock (already off 40 per cent this year) only fell 3 per cent in late trading. Perhaps, unlike the analysts, investors have priced in a slowdown already. Good news, if so.

Were taking an extra long July 4th weekend. We’ll be back with you on Wednesday. In the meantime, email us: robert.armstrong@ft.com and ethan.wu@ft.com.

Halftime!

We’re halfway through the year. Let’s take a step back and assess where we are. The scoreboard:

In risk assets, there was nowhere to hide other than commodities. The reason (at least at first) was inflation forcing interest rates higher. Here is what happened to the yield curve in the first half:

Notice that the 3-month/10-year curve (the most accurate recession indicator historically) is not even close to inversion. The 2-year/10-year (less accurate, but not useless) is within a hair’s breadth. That may be the difference between the rough market we have now and a properly panicked one we have managed to avoid so far.

Turning to the internal performance of the stock market, the most talked about themes this year have been the poor performance of technology (which had clearly overshot over this cycle) and the great performance of energy. But there is a broader theme with more explanatory power: investors playing defence. The S&P is down 20 per cent. Leaving energy returns a side, as the result of an exogenous shock, the sector performance falls into three groups. Defensive stocks (utilities, staples, healthcare) have outperformed. Risky/speculative stocks (tech, discretionary) have underperformed. The rest have moved with the index:

The first six months of the year have been all of a piece, though. There was a shift in the last month or two, where we went from worrying primarily about inflation to worrying primarily about recession. One way to look at this is through the relative performance of growth and value:

It was value’s half, as expensive tech stocks sold off and cheap energy stocks surged. But about a month ago value’s outperformance stopped. This is consistent with recession fear. Value — that is, cheap — stocks tend to be cyclical, highly leveraged, in highly competitive industries, or all three. Historically, stocks like this do poorly heading into a recession and well in the ensuring recovery. They will look less appealing now than they did a month or so ago, when the Fed looked less fierce and indicators or economic momentum looked better.

As usual, the bond market got the memo before the stock market did. The yield on the 10-year bond has been headed sideways, with some peaks and valleys, since early May, suggesting those foreseeing years of high inflation were too pessimistic. Two-year break-even inflation expectations have been falling since late March, and have fallen particularly sharply lately, suggesting that the Fed will cool inflation quite quickly:

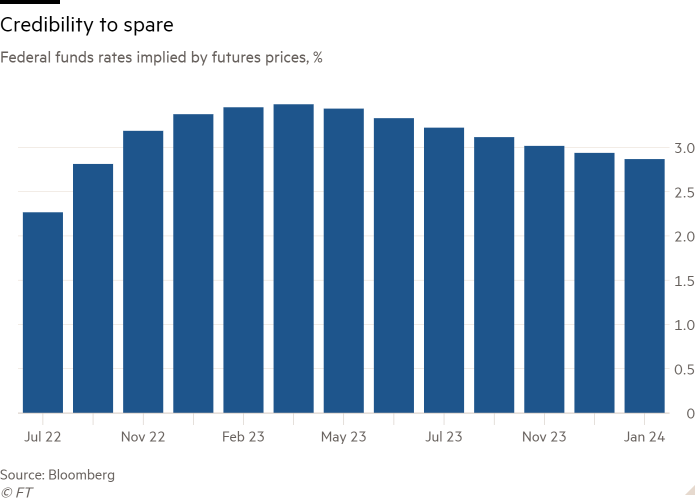

The futures market confirms the picture. It now prices rate cuts starting (slowly) in the middle of next year:

To sum up. First inflation fears then recession fears have whacked risk assets in the first half. The market now appears confident that the economy will slow rapidly, and a year from now inflation will be a secondary worry. Investors are beat up, and increasingly defensively positioned, but not panicked.

What’s happens in the second half? Several points we have made before are worth repeating. Global central banks are withdrawing liquidity from the financial system. Valuations (though there are attractive pockets) are still not particularly cheap. In equities, if not in bonds, there are few signs of capitulation or bottomed-out sentiment. And leading indicators of economic activity are worsening. All of this lends itself to volatility.

Yes, the Fed has gone far in convincing markets that it will get inflation under control soon. But we still expect the second half in markets to be as turbulent as the first, and probably more so.

More slowdown data

The Fed is getting the demand slowdown it wants, bit by bit. That much was clear in Thursday’s personal consumption expenditure data. Real consumption fell 0.4 per cent in May, thanks to a big 3.5 (!) per cent decline in real durable goods spending. No surprise, but still good to see. The chart below smooths the data over three months and focuses on the quantity of durable goods bought each month, ignoring prices:

Between rising inventories and slowing goods demand, manufacturing is also slowing down. Omair Sharif of Inflation Insights has pulled together regional Fed indicators of factory activity. Averaging across the five measured regions, new orders contracted in June. Odds are the nationwide ISM manufacturing index, set to be published today, will fall too:

Consumption remains strong, though. Real services spending grew 0.3 per cent in May, only a tiny deceleration from April. May’s core PCE inflation reading came in at 4 per cent annualised — just as it did in February, March and April. Not spinning higher, but not coming down easy either.

After yesterday’s PCE report, the Atlanta Fed’s GDPNow forecast slipped into the red:

By the common rule of thumb, negative real GDP growth for a second quarter in a row puts us into recession territory. Fixating on this misses the point. What ultimately matters is whether slower growth brings inflation down (as the market expects).

To be confident in that, we need convincing evidence that services inflation is coming down. But the labour market remains stubbornly hot. There has been a small uptick in jobless claims, but current levels are on par with the booming labour market of 2019. Falling goods consumption helps, but not enough. (Ethan Wu)

One good question

A few readers pointed out that Tuesday’s letter on durable goods gluts didn’t adjust for inflation, suggesting new orders for durable goods could be falling in real terms (as domestic consumption of those goods already is; see above). Are they? A good question, but a hard one to answer. The data I used, from a Census Bureau survey of manufacturers, doesn’t have an exact price deflator to convert nominal values to real ones.

I had a look anyway, using the closest deflator I could find, the producer price index for durable consumer goods. After adjusting for inflation, durable goods new orders are still growing, though modestly:

June data will probably change this picture (see previous section). But so far US manufacturing has held up better than the dismal survey data might suggest. (Wu)

One good read

Sure, there’s a nearly perfect inflation hedge out there. Good luck buying it.

[ad_2]

Source link

Comments are closed.