[ad_1]

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. Global spending across iOS, Google Play and third-party Android app stores in China grew 19% in 2021 to reach $170 billion. Downloads of apps also grew by 5%, reaching 230 billion in 2021, and mobile ad spend grew 23% year over year to reach $295 billion.

Today’s consumers now spend more time in apps than ever before — even topping the time they spend watching TV, in some cases. The average American watches 3.1 hours of TV per day, for example, but in 2021, they spent 4.1 hours on their mobile device. And they’re not even the world’s heaviest mobile users. In markets like Brazil, Indonesia and South Korea, users surpassed five hours per day in mobile apps in 2021.

Apps aren’t just a way to pass idle hours, either. They can grow to become huge businesses. In 2021, 233 apps and games generated over $100 million in consumer spend, and 13 topped $1 billion in revenue. This was up 20% from 2020, when 193 apps and games topped $100 million in annual consumer spend, and just eight apps topped $1 billion.

This Week in Apps offers a way to keep up with this fast-moving industry in one place, with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps to try, too.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Google I/O Wrap-Up

Image Credits: Google

We came, we saw, we I/O’d. But did we have fun?

It’s a shame Google’s big developer event was still largely hybrid — save for select invitees (Google’s partners), the event was only streamed. The keynotes are held at an outdoor amphitheater so the COVID-era rule is starting to not make sense. Concerts are open and tech employees are being shuffled back to the office, but outdoor tech events are still closed, I guess? Unfortunately, this decision impacts those not fortunate enough to make the guest list at these real-world happenings that offer networking opportunities and chances to engage directly with Google employees. At least Apple turned WWDC into a random lottery, or so it says. After all, the keynotes are not the main reason developers go to these things.

In any event, Google’s event sort of felt like an off-year, where some of the biggest hardware announcements had no exact ship dates, beyond “fall” or “next year” or “who knows?!” During the keynote, Google unveiled a lower-cost Pixel 6a phone and new Pixel Buds, both coming this summer, and the big news of its first smartwatch, arriving this fall. But other announcements were just teased, like the Tensor-powered Pixel 7, due this fall; a new Android tablet (the Pixel tablet) for 2023; and Google’s concept for AR glasses, with a ship date of IDK MAYBE ONE DAY.

In terms of Android developer news, there was still quite a bit:

Plus Google announced other updates, including a new Google Wallet app, new AI models (e.g. LaMDA 2), a new “immersive” mode on Google Maps, ad personalization tools, Google Cloud updates, security tools, Assistant features and more.

ARCore Geospatial API

A couple of interesting things at I/O did hint toward Google’s longer-term vision for AR, starting with its latest mulitsearch advances. Announced earlier this year, multisearch lets users combine images and text into a single Google Search query to tackle the sorts of searches that a text search alone could struggle with, or to aid with shopping purchases. But the tech could one day serve to help users scan items in the real world. For starters, Google said users can now scan real-world items and then add “near me” to their query to find a nearby retail store that carries the item in question.

But more interestingly, Google said one day users will be able to pan their camera around to learn about multiple objects within that wider scene. The company suggested the feature could be used to scan the shelves at a bookstore, then see helpful several insights overlaid in front of you.

Image Credits: Google

Of course, this technology would make sense for an AR glasses interface — though the Google exec presenting didn’t directly come out and say that.

“There are 8 billion visual searches on Google with Lens every single month now and that number is three times the size that it was just a year ago,” said Nick Bell, senior director, Google Search. “What we’re definitely seeing from people is that the appetite and the desire to search visually is there. And what we’re trying to do now is lean into the use cases and identify where this is most useful,” he said. “I think as we think about the future of search, visual search is definitely a key part of that.”

Today, many developers are trying out AR experiences in their smartphone apps wondering how consumers will react to the new features. At I/O, Google shared how it sees use cases for AR. These ranged from scanning the world in front of you and augmenting it with information to indoor navigation to playing games. Google presented several experiences built by the new ARCore Geospatial API’s early adopters, which included AR gaming, navigation aids that helped concert-goers find their seats, as well as new tools offered by Bird and Lime to help people geolocate where to park their scooters and e-bikes with “less than a meter accuracy.”

These tools are in the hands of Android and iOS app developers, but one day, the screen developers are building for may no longer be only the rectangular smartphone — but eyewear. (On that note, Meta tried to steal the spotlight with a tease of its mixed reality glasses, but what’s there to say about a pixelated Zuck video?)

But AR glasses are still a bet that the future generation wants a world with ever more personal tech, where tech becomes a further part of the human condition and experience, rather than the handheld tool it is today. That vision also implies the Big Tech backlash we’re experiencing today will come to an end, and people will agree to put Google or Facebook on their face. I mean, even in “Star Trek” they still used tablets, you know?

Elon pauses Twitter deal…well, not really…Oh, who knows!!

Image Credits: Bryce Durbin / TechCrunch

Elon’s trolling. Or aiming to renegotiate the share price. Or looking for an exit. Who knows? But the would-be Twitter acquirer tweeted on Friday the deal was paused while he looked into details related to the percentage of spam and fake accounts on the app. Of course, he can’t really pause the deal over spambots. He declined due diligence. And Twitter discloses the percentage of spam and bots in its SEC filings. And even if it was more than the 5% Twitter says it is, it can’t possibly be SO MUCH MORE that it would actually threaten the deal going through. (Unless Musk just found out almost all Twitter users are bots! Ha! I mean…sometimes it feels like that when you tweet about crypto…)

In any event, if Musk wants out, he’ll find a way — no matter what the contract or SEC has to say about it.

But in a subsequent tweet, Musk wrote he was “still committed” to the acquisition. Okay then??

Regardless of what happens to Twitter, the real damage to the company goes beyond this financial mess. People saw their work demeaned. Advertisers thought about cutting Twitter from their buys. Top execs left. This week, more were fired. Staff’s ability to focus on their work is, arguably, impacted by the ongoing drama. Maybe Jack Dorsey did want to take Twitter private, but why would he have supported doing it this way?

Meanwhile, CEO Parag Agrawal said on Friday the deal wasn’t stopping him from making the “hard decisions as needed,” a reference to the firings, cost-cutting and hiring freeze announced this week.

Platforms: Apple

- Apple is restructuring its services team to refocus on more streaming and advertising work, per Insider. Apple VP of Services, Peter Stern, now focuses on video, books, news, iCloud, Fitness+ and Apple One, but no longer handles advertising. Instead, Todd Teresi, an advertising vice president at Apple, will do so and report directly to SVP of Services, Eddy Cue.

- Following Apple’s plan to clean up the App Store, a report revealed that there are some 1.5 million abandoned apps across both iOS and Android stores as of Q1 2022, which have gone more than two years without an update.

Platforms: Google

E-commerce

- Amazon’s Alexa app is taking on Ibotta, Checkou51, Fetch Rewards and others with a new feature that allows customers to earn cash-back rewards for snapping photos of their receipts and sharing that data back to Amazon.

- ByteDance, TikTok’s parent company, said it aims to double the amount of shopping taking place on Douyin (China’s version of TikTok) to nearly $240 billion, per The Information.

- Apple is reportedly considering a nutrition-focused food delivery service to rival Instacart, offered through the Apple Health app, per Bloomberg’s Power On.

- The top 10 U.S. package tracking apps’ MAUs grew 152% in Q1 2022 compared to Q1 2020, and 20% YoY compared to Q1 2021, per Sensor Tower. Breaking this down further, the top grocery delivery apps’ usage grew 50% compared to 1Q20, and up 9% when compared to 1Q21, while shopping apps grew 9% compared to 1Q20, and declined 5% Y/Y compared to 1Q21.

Augmented Reality

- Niantic’s Lightship Summit is coming up May 24-25 to talk AR across keynotes, workshops and panels.

Fintech

- Robinhood began offering an attractive 1% APY rate in its revamped brokerage cash sweep program rolled out this week. The rate is higher than average, compared with what a U.S. investor would earn on cash in a savings account — around 0.06%.

- A crypto meltdown this week triggered by algorithmic stablecoin TerraUSD falling below $1 drove aggressive panic selling and saw Bitcoin tanking to its lowest point since 2020, as stablecoins struggled to survive. Crypto apps are all feeling the impacts and Binance announced it was indefinitely halting trading of Terraform Labs’ Terra (Luna) and TerraUSD (UST) tokens.

- Coinbase’s decline has mirrored the drop in Bitcoin prices, with its market cap falling to $12.98 billion from a $75 billion+ peak in 2021 per Bloomberg. Its stock closed at $58.50, well below its first-day closing price of $328.28 in April 2021, it said.

Social

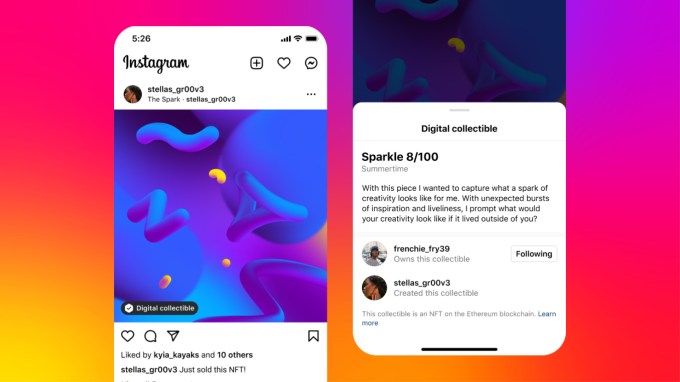

Image Credits: Instagram

- Instagram began rolling out NFTs, initially to select creators. At launch, supported blockchains include Ethereum and Polygon, with support for Flow and Solana coming soon. Third-party wallets compatible for use at launch include Rainbow, MetaMask and Trust Wallet, with Coinbase, Dapper and Phantom coming soon.

- TikTok rolled out a Friends tab for watching videos from people you know, replacing the Discover tab in the app. Who said we wanted to hang out with friends on TikTok?! The app had been pushing people to upload their contacts to the app for weeks prior to the move.

- TikTok and Foursquare expanded a partnership to include Foursquare Attribution. The deal gives advertisers access to conversion insights from the measurement product Foursquare Attribution, which helps track how ads drive people into brick-and-mortar stores.

- Facebook said it’s shuttering its Nearby Friends service after eight years. The closure will come on May 31, along with Weather Alerts, location history and background location, all of which are also being discontinued.

- Four U.S. representatives sent letters to the CEOs of Meta, TikTok, YouTube and Twitter asking them to archive any content uploaded to their platforms that could be used as evidence of Russian war crimes.

- A parent is suing TikTok alleging her child died after repeating the blackout challenge she saw on the app.

Dating

- Tinder parent Match Group sued Google saying its move to force developers to shift to the Google billing system is an abuse of power. Google dismissed the claim saying Match just wanted to avoid paying its fair share.

- Bumble beat on its Q1 earnings estimates with revenue of $211.2 million up 24% year-over-year, and paying users up 7% year-over-year to 3 million. The stock jumped 17% in extended trading on the news.

- Grindr agreed to go public via a SPAC merger at a $2.1 billion valuation including debt. The move will raise ~$384 million. The dating app had $147 million revenue in 2021, up 30% year-over-year.

Messaging

- WhatsApp rolled out Message Reactions, support for sharing files up to 2GB in size, and the ability to add up to 512 people to a group.

Streaming & Entertainment

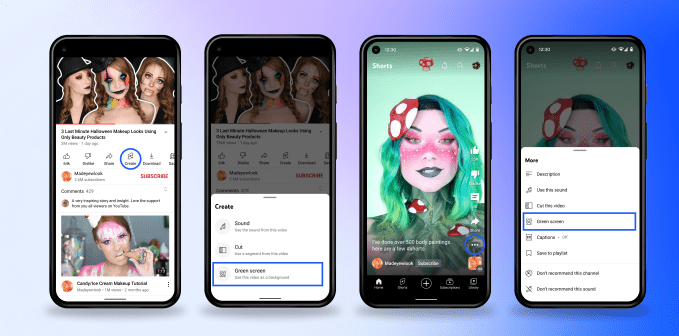

Image Credits: YouTube

- YouTube Shorts, the video service’s TikTok-like product, gained a TikTok-like feature with the addition of the new “Green Screen” effect that lets you clip a 60-second video from any eligible YouTube VOD or upload from your phone’s Camera Roll.

- YouTube also began testing a new membership gifting feature with a small number of creators that would allow users to gift Channel membership subscribers to others.

- Billboard Music Awards teamed up with TikTok to launch an in-app hub, Sound to Song, that highlights the top songs that started out as sounds on TikTok videos then ended up topping the Billboard charts.

- Podcast ad revenue is expected to top $2.13 billion in the U.S. in 2022, a 47% year-over-year increase.

- Wattpad’s Webtoon Studios, the makers of the user-gen fiction app Wattpad, partnered with Italy’s Leone Film Group to co-develop films for both Italian and international audiences based on original stories in Wattpad.

Gaming

- Roblox delivered an earnings miss in Q1 2022, with earnings of $631.2 million versus $645 million expected, and saw a loss of 27 cents instead of the 21 cents expected. The company cited the COVID recovery as contributing to the decline, but said it still believes it’s gaining share relative to other social and gaming apps competing for users’ time.

- Riot Games sued another mobile games developer in China, alleging its game “Mobile Legends: Bang Bang” is ripping off Riot’s popular MOBA, “League of Legends: Wild Riff.” Riot previously sued Moonton over its game “Mobile Legends: 5v5 MOBA,” which Riot said was a copy of “League of Legends.” Riot Games parent Tencent stepped into that case and won a judgment of $2.9 million against Moonton.

- EA is developing a “Lord of the Rings” mobile role-playing game based on J.R.R. Tolkien’s books.

Health & Fitness

- Connected fitness platform Peloton released its latest, a new rowing machine, as well as several updates to its app, including a collaborative workout feature called “Invite Friends” and tools to track non-Peloton workouts, like running, biking and walking.

Travel & Transportation

- Israeli trip-planning app Moovit is integrating with Orlando-based autonomous shuttle startup Beep to allow riders to view options for taking Beep shuttles alongside other forms of transit, like buses or trains.

Government & Policy

- Apple formally responded to an antitrust inquiry by Australian authorities (Australian Competition and Consumer Commission, or ACCC) related to draft antitrust legislation. In its filing, Apple expressed serious concerns, saying it would have to redesign the iPhone to benefit the developers who wanted to remove the App Store’s consumer protection features.

- U.S. Senator Michael Bennet introduced the Digital Platform Commission Act, in an effort to establish a federal watchdog specifically for overseeing Big Tech companies. He argues that the government doesn’t have the tech expertise to make some of the decisions, and suggests the federal body should be staffed with experts in digital fields. The legislation would still have to pass in the 50/50 Senate, however.

Security & Privacy

? Snap acquired the open source, high-performance database KeyDB to improve its caching technology and its sizable engineering workloads. Deal terms were not disclosed, but the full six-person team will now join Snap and remain in Toronto.

? Travel insurance startup Faye raised $8 million in a seed funding round led by Viola Ventures and F2 Venture Capital. The startup covers trips, health, belongings and pets via an app that sends alerts, offers 24/7customer support and enables digital claims filing, as well as electronic transfers of reimbursements to its Faye Wallet.

? Creator app Fanhouse raised $20 million in Series A funding from Andreessen Horowitz for its platform that allows creators to connect directly with their community and generate revenue. Each fan views content that’s watermarked uniquely for them, to help prevent leaks. The app is nearing $10 million-plus in creator payouts after two years, it said.

? Payments infrastructure provider Paddle, which wants to offer a third-party solution to app developers if stores open up, raised $200 million in Series D funding led by KKR. The deal values the business, which now has 3,000 software customers, at $1.4 billion.

? Altro, an app that helps you build credit through everyday recurring payments and subscriptions, raised $18 million in a Series A funding round led by Pendulum. The startup plans to further invest in its credit and financial literacy catalog and marketing, and will expand to include rent payments.

[ad_2]

Source link

Comments are closed.