[ad_1]

This article is an onsite version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Good evening,

Data released by the Bureau of Labor Statistics today shows the US added 428,000 jobs in April, matching the revised figure in March. The unemployment rate was steady at 3.6 per cent, similar to the level in February 2020 before the first coronavirus wave hit the country.

However, the persistence of a tight labour market and high inflation pose concerns for the Biden administration and the Federal Reserve. This week, the US central bank raised its benchmark interest rate by 0.5 percentage points for the first time since 2000 — to a target range of between 0.75 and 1 per cent — to curb rising prices. Inflation in the US is currently running at a 40-year high.

Meanwhile, US stocks fell on Friday, extending sharp losses from the previous session, as signs of a tightening jobs market compounded inflation worries. European shares also declined, with the regional Stoxx 600 index losing almost 2 per cent, putting it on track to end the week more than 4 per cent down. London’s FTSE 100 lost 1.3 per cent and Germany’s Xetra Dax also fell 1.3 per cent.

The Nasdaq Composite, comprised of many of the largest US technology companies, closed down 5 per cent yesterday, in its biggest one-day decline since 2020. The blue-chip S&P 500 index also declined on Thursday with a 3.5 per cent loss.

As the world continues to deal with the economic impact of the pandemic, the war in Ukraine is exacerbating inflationary problems. Central banks are faced with the risk that controlling rising prices could lead to economic decline.

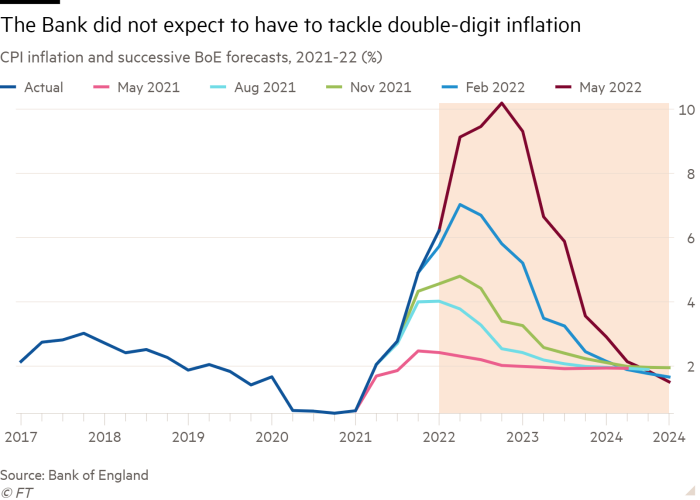

The Bank of England warned yesterday that the UK economy was heading towards a recession and inflation would hit 10 per cent this year, as it lifted the interest rate to 1 per cent, the country’s highest level since 2009.

With UK prices likely to rise at their fastest rate in more than 40 years as sustained double-digit inflation becomes possible for the first time since the 1970s, the BoE — which is celebrating 25 years of independence this week — faces challenges that it has not encountered in the past quarter of a century, writes economics editor Chris Giles.

Latest news

For up-to-the-minute news updates, visit our live blog.

Need to know: the economy

China’s president Xi Jinping has reaffirmed his commitment to the country’s controversial zero-Covid strategy, warning against “any slackening” in the effort and vowing to crack down on criticism of the policy despite signs of damage to the economy.

US homebuyers are stretching their budgets to buy new homes and rushing to strike deals to avoid higher mortgage financing costs, according to the latest industry data. Mortgage rates have reached their highest levels in more than a decade, according to the recent Freddie Mac survey.

Latest for the UK/Europe

Momentum is building for the European Central Bank to raise interest rates in July to fight soaring inflation, after dovish policymakers indicated they were ready to accept an end to almost eight years of negative borrowing costs.

The EU is considering providing more time and money to Hungary to adapt to an embargo on Russian oil after talks on Brussels’ plans for imposing sanctions became “stuck”.

Vodafone, the UK telecoms group under pressure from an activist investor, has strengthened its board with two appointments. They are Simon Segars, former chief executive of Arm, the UK-based chip business, and Delphine Cunci, an industry heavyweight in France. Europe’s largest activist fund Cevian Capital has been pushing the mobile group to refresh its management, which it believes has insufficient experience.

Help us compile our ranking of Europe’s Diversity Leaders. Employees and workplace experts are invited to complete a short survey to assess companies’ progress on inclusivity by June 12.

UK prime minister Boris Johnson faces renewed pressure on his leadership after the Conservatives suffered significant defeats in yesterday’s local elections, including big losses in London.

Coronavirus infections in England have fallen to their lowest level since the start of the year, according to official data published today, as the spread of the disease slows across the UK.

Global latest

US regulators have travelled to mainland China to discuss a potential compromise over audit disclosures that could stop around 270 Chinese companies from being delisted by New York exchanges, according to two people close to the matter.

Tomorrow you can hear Henry Kissinger, Chimamanda Ngozi Adichie and more at our inaugural US FTWeekend Festival in Washington, DC. As a newsletter subscriber, you can claim an exclusive limited-time offer of 50 per cent off your pass using promo code: FTNewslettersxFTWF22.

Need to know: business

German sportswear group Adidas has warned that its operating profit this year would be lower than previously expected, as the company struggles with disrupted supply chains, closed shops in China and rising costs. Operating profit tumbled 38 per cent to €437mn in the first quarter as the company was hit by the economic fallout from China’s strict Covid policies.

Australia’s biggest investment bank Macquarie Group profited from volatility on global commodity markets and record dealmaking, driving full-year net profit up 56 per cent from the previous year to a record high of A$4.7bn ($3.3bn).

British Airways has been forced to cut flight schedules further as it struggles to hire staff quickly enough to meet renewed demand for travel after culling nearly 10,000 jobs during the pandemic, raising concerns that the carrier could miss out on a bumper summer for European airlines.

France has warmly welcomed Binance’s bid to put down roots in one of Europe’s top financial centres, drawing a deep divide with watchdogs in the UK that rejected the crypto giant. Binance this week received a nod from French financial regulators, a move that clears the way for the crypto exchange to establish a significant presence in the G7 nation that could also help the company unlock access to other jurisdictions across Europe.

Boeing will move its headquarters to the Washington, DC area from Chicago, bringing the company closer to federal lawmakers and rival defence contractors. The move comes during a tumultuous period for the company, which has been subject to greater regulatory scrutiny following two fatal crashes of its 737 Max jet in 2018 and 2019 as well as the discovery of flaws in its 787 Dreamliner.

Science round-up

The true total global pandemic death toll was about 15mn by the end of 2021, based on an analysis of excess mortality, said the World Health Organization. Ten countries, including India, the US and Russia, accounted for about two-thirds of the total excess deaths in a two-year period.

“We have found that the global death toll is higher for men than for women”, splitting 57 per cent to 43 per cent, said Dr William Msemburi, an official in the WHO’s department of data and analytics. The excess deaths were also concentrated in older people, with 82 per cent of deaths estimated to have occurred in the over-60s. The data highlights the need for better health systems and continued development of treatments and vaccines.

US drugmaker Moderna is developing an Omicron jab to be released in the autumn, aiming for those in the northern hemisphere to get boosted in October. The bivalent booster stimulates an immune response against two antigens, including mutations in the Omicron variant.

Meanwhile, US regulators are limiting the use of Johnson & Johnson’s Covid vaccine for adults because of the potential risk posed by a rare and life-threatening blood clotting disorder.

Covid cases and vaccinations

Total global cases: 510.8mn

Total doses given: 11.7bn

Get the latest worldwide picture with our vaccine tracker

And finally . . .

Whether you like it or not, face-to-face gatherings are back as Covid-19 restrictions ease and hybrid working becomes more common. After two years of online meetings, networking at an in-person event can be daunting. If this applies to you, one tip from this article on networking in a hybrid era is to pace yourself and attend fewer events as you gradually ease yourself back into real life — and get used to talking about the weather with strangers again.

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at disruptedtimes@ft.com. Thank you

[ad_2]

Source link

Comments are closed.